6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

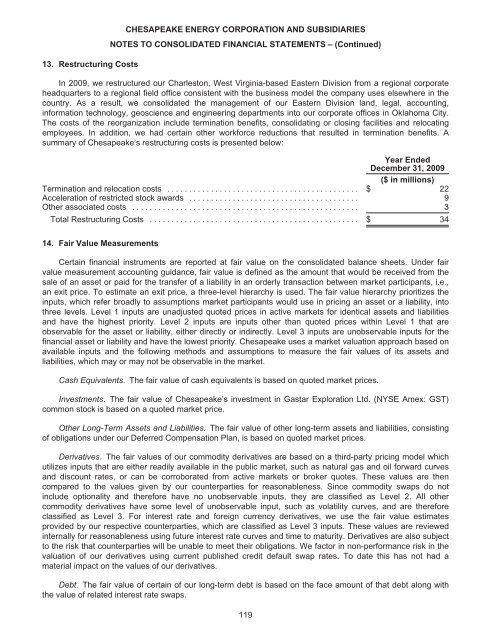

13. Restructuring Costs<br />

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED <strong>FINANCIAL</strong> STATEMENTS – (Continued)<br />

In 2009, we restructured our Charleston, West Virginia-based Eastern Division from a regional corporate<br />

headquarters to a regional field office consistent with the business model the company uses elsewhere in the<br />

country. As a result, we consolidated the management of our Eastern Division land, legal, accounting,<br />

information technology, geoscience and engineering departments into our corporate offices in Oklahoma City.<br />

The costs of the reorganization include termination benefits, consolidating or closing facilities and relocating<br />

employees. In addition, we had certain other workforce reductions that resulted in termination benefits. A<br />

summary of Chesapeake’s restructuring costs is presented below:<br />

Year Ended<br />

December 31, 2009<br />

($ in millions)<br />

Termination and relocation costs ............................................ $ 22<br />

Acceleration of restricted stock awards ....................................... 9<br />

Other associated costs .................................................... 3<br />

Total Restructuring Costs ................................................ $ 34<br />

14. Fair Value Measurements<br />

Certain financial instruments are reported at fair value on the consolidated balance sheets. Under fair<br />

value measurement accounting guidance, fair value is defined as the amount that would be received from the<br />

sale of an asset or paid for the transfer of a liability in an orderly transaction between market participants, i.e.,<br />

an exit price. To estimate an exit price, a three-level hierarchy is used. The fair value hierarchy prioritizes the<br />

inputs, which refer broadly to assumptions market participants would use in pricing an asset or a liability, into<br />

three levels. Level 1 inputs are unadjusted quoted prices in active markets for identical assets and liabilities<br />

and have the highest priority. Level 2 inputs are inputs other than quoted prices within Level 1 that are<br />

observable for the asset or liability, either directly or indirectly. Level 3 inputs are unobservable inputs for the<br />

financial asset or liability and have the lowest priority. Chesapeake uses a market valuation approach based on<br />

available inputs and the following methods and assumptions to measure the fair values of its assets and<br />

liabilities, which may or may not be observable in the market.<br />

Cash Equivalents. The fair value of cash equivalents is based on quoted market prices.<br />

Investments. The fair value of Chesapeake’s investment in Gastar Exploration Ltd. (NYSE Amex: GST)<br />

common stock is based on a quoted market price.<br />

Other Long-Term Assets and Liabilities. The fair value of other long-term assets and liabilities, consisting<br />

of obligations under our Deferred Compensation Plan, is based on quoted market prices.<br />

Derivatives. The fair values of our commodity derivatives are based on a third-party pricing model which<br />

utilizes inputs that are either readily available in the public market, such as natural gas and oil forward curves<br />

and discount rates, or can be corroborated from active markets or broker quotes. These values are then<br />

compared to the values given by our counterparties for reasonableness. Since commodity swaps do not<br />

include optionality and therefore have no unobservable inputs, they are classified as Level 2. All other<br />

commodity derivatives have some level of unobservable input, such as volatility curves, and are therefore<br />

classified as Level 3. For interest rate and foreign currency derivatives, we use the fair value estimates<br />

provided by our respective counterparties, which are classified as Level 3 inputs. These values are reviewed<br />

internally for reasonableness using future interest rate curves and time to maturity. Derivatives are also subject<br />

to the risk that counterparties will be unable to meet their obligations. We factor in non-performance risk in the<br />

valuation of our derivatives using current published credit default swap rates. To date this has not had a<br />

material impact on the values of our derivatives.<br />

Debt. The fair value of certain of our long-term debt is based on the face amount of that debt along with<br />

the value of related interest rate swaps.<br />

119