6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Acreage<br />

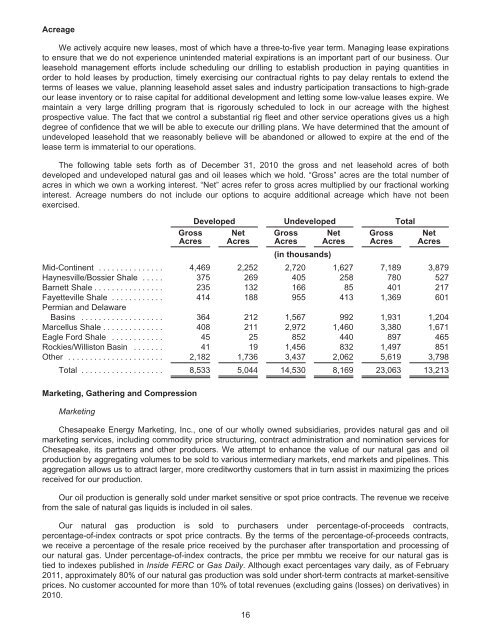

We actively acquire new leases, most of which have a three-to-five year term. Managing lease expirations<br />

to ensure that we do not experience unintended material expirations is an important part of our business. Our<br />

leasehold management efforts include scheduling our drilling to establish production in paying quantities in<br />

order to hold leases by production, timely exercising our contractual rights to pay delay rentals to extend the<br />

terms of leases we value, planning leasehold asset sales and industry participation transactions to high-grade<br />

our lease inventory or to raise capital for additional development and letting some low-value leases expire. We<br />

maintain a very large drilling program that is rigorously scheduled to lock in our acreage with the highest<br />

prospective value. The fact that we control a substantial rig fleet and other service operations gives us a high<br />

degree of confidence that we will be able to execute our drilling plans. We have determined that the amount of<br />

undeveloped leasehold that we reasonably believe will be abandoned or allowed to expire at the end of the<br />

lease term is immaterial to our operations.<br />

The following table sets forth as of December 31, 2010 the gross and net leasehold acres of both<br />

developed and undeveloped natural gas and oil leases which we hold. “Gross” acres are the total number of<br />

acres in which we own a working interest. “Net” acres refer to gross acres multiplied by our fractional working<br />

interest. Acreage numbers do not include our options to acquire additional acreage which have not been<br />

exercised.<br />

Gross<br />

Acres<br />

Developed Undeveloped Total<br />

Net<br />

Acres<br />

Gross<br />

Acres<br />

Net<br />

Acres<br />

Gross<br />

Acres<br />

Net<br />

Acres<br />

Mid-Continent ............... 4,469 2,252<br />

(in thousands)<br />

2,720 1,627 7,189 3,879<br />

Haynesville/Bossier Shale ..... 375 269 405 258 780 527<br />

Barnett Shale ................ 235 132 166 85 401 217<br />

Fayetteville Shale ............<br />

Permian and Delaware<br />

414 188 955 413 1,369 601<br />

Basins ................... 364 212 1,567 992 1,931 1,204<br />

Marcellus Shale .............. 408 211 2,972 1,460 3,380 1,671<br />

Eagle Ford Shale ............ 45 25 852 440 897 465<br />

Rockies/Williston Basin ....... 41 19 1,456 832 1,497 851<br />

Other ...................... 2,182 1,736 3,437 2,062 5,619 3,798<br />

Total ................... 8,533 5,044 14,530 8,169 23,063 13,213<br />

Marketing, Gathering and Compression<br />

Marketing<br />

Chesapeake Energy Marketing, Inc., one of our wholly owned subsidiaries, provides natural gas and oil<br />

marketing services, including commodity price structuring, contract administration and nomination services for<br />

Chesapeake, its partners and other producers. We attempt to enhance the value of our natural gas and oil<br />

production by aggregating volumes to be sold to various intermediary markets, end markets and pipelines. This<br />

aggregation allows us to attract larger, more creditworthy customers that in turn assist in maximizing the prices<br />

received for our production.<br />

Our oil production is generally sold under market sensitive or spot price contracts. The revenue we receive<br />

from the sale of natural gas liquids is included in oil sales.<br />

Our natural gas production is sold to purchasers under percentage-of-proceeds contracts,<br />

percentage-of-index contracts or spot price contracts. By the terms of the percentage-of-proceeds contracts,<br />

we receive a percentage of the resale price received by the purchaser after transportation and processing of<br />

our natural gas. Under percentage-of-index contracts, the price per mmbtu we receive for our natural gas is<br />

tied to indexes published in Inside FERC or Gas Daily. Although exact percentages vary daily, as of February<br />

2011, approximately 80% of our natural gas production was sold under short-term contracts at market-sensitive<br />

prices. No customer accounted for more than 10% of total revenues (excluding gains (losses) on derivatives) in<br />

2010.<br />

16