6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

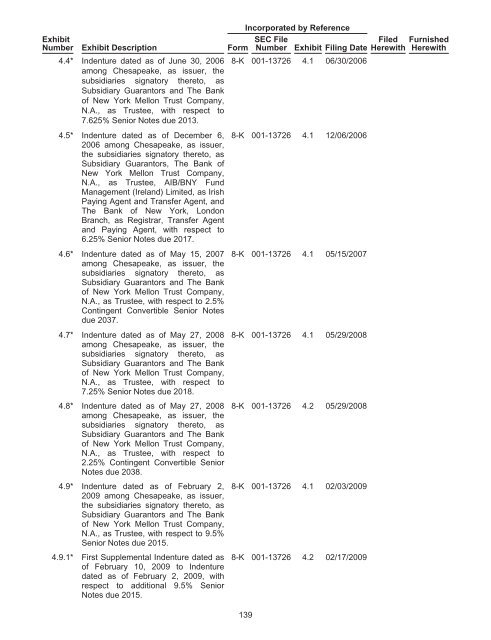

Exhibit<br />

Number Exhibit Description Form<br />

4.4* Indenture dated as of June 30, 2006<br />

among Chesapeake, as issuer, the<br />

subsidiaries signatory thereto, as<br />

Subsidiary Guarantors and The Bank<br />

of New York Mellon Trust Company,<br />

N.A., as Trustee, with respect to<br />

7.625% Senior Notes due 2013.<br />

4.5* Indenture dated as of December 6,<br />

2006 among Chesapeake, as issuer,<br />

the subsidiaries signatory thereto, as<br />

Subsidiary Guarantors, The Bank of<br />

New York Mellon Trust Company,<br />

N.A., as Trustee, AIB/BNY Fund<br />

Management (Ireland) Limited, as Irish<br />

Paying Agent and Transfer Agent, and<br />

The Bank of New York, London<br />

Branch, as Registrar, Transfer Agent<br />

and Paying Agent, with respect to<br />

6.25% Senior Notes due 2017.<br />

4.6* Indenture dated as of May 15, 2007<br />

among Chesapeake, as issuer, the<br />

subsidiaries signatory thereto, as<br />

Subsidiary Guarantors and The Bank<br />

of New York Mellon Trust Company,<br />

N.A., as Trustee, with respect to 2.5%<br />

Contingent Convertible Senior Notes<br />

due 2037.<br />

4.7* Indenture dated as of May 27, 2008<br />

among Chesapeake, as issuer, the<br />

subsidiaries signatory thereto, as<br />

Subsidiary Guarantors and The Bank<br />

of New York Mellon Trust Company,<br />

N.A., as Trustee, with respect to<br />

7.25% Senior Notes due 2018.<br />

4.8* Indenture dated as of May 27, 2008<br />

among Chesapeake, as issuer, the<br />

subsidiaries signatory thereto, as<br />

Subsidiary Guarantors and The Bank<br />

of New York Mellon Trust Company,<br />

N.A., as Trustee, with respect to<br />

2.25% Contingent Convertible Senior<br />

Notes due 2038.<br />

4.9* Indenture dated as of February 2,<br />

2009 among Chesapeake, as issuer,<br />

the subsidiaries signatory thereto, as<br />

Subsidiary Guarantors and The Bank<br />

of New York Mellon Trust Company,<br />

N.A., as Trustee, with respect to 9.5%<br />

Senior Notes due 2015.<br />

4.9.1* First Supplemental Indenture dated as<br />

of February 10, 2009 to Indenture<br />

dated as of February 2, 2009, with<br />

respect to additional 9.5% Senior<br />

Notes due 2015.<br />

Incorporated by Reference<br />

SEC File<br />

Filed<br />

Number Exhibit Filing Date Herewith Furnished<br />

Herewith<br />

8-K 001-13726 4.1 06/30/2006<br />

8-K 001-13726 4.1 12/06/2006<br />

8-K 001-13726 4.1 05/15/2007<br />

8-K 001-13726 4.1 05/29/2008<br />

8-K 001-13726 4.2 05/29/2008<br />

8-K 001-13726 4.1 02/03/2009<br />

8-K 001-13726 4.2 02/17/2009<br />

139