6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED <strong>FINANCIAL</strong> STATEMENTS – (Continued)<br />

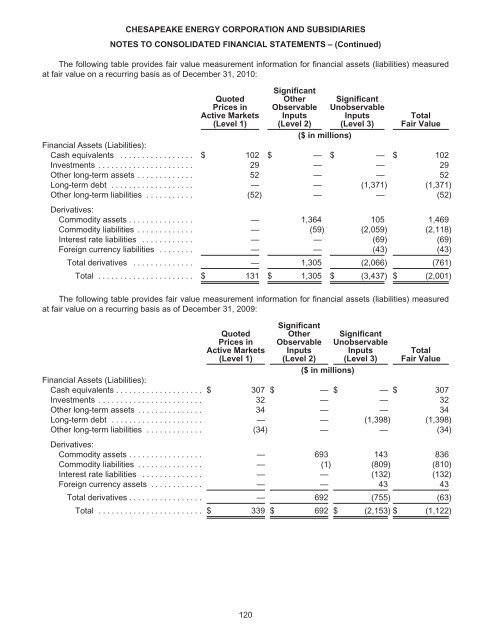

The following table provides fair value measurement information for financial assets (liabilities) measured<br />

at fair value on a recurring basis as of December 31, 2010:<br />

Quoted<br />

Prices in<br />

Active Markets<br />

(Level 1)<br />

Significant<br />

Other<br />

Observable<br />

Inputs<br />

(Level 2)<br />

Significant<br />

Unobservable<br />

Inputs<br />

(Level 3)<br />

Total<br />

Fair Value<br />

($ in millions)<br />

Financial Assets (Liabilities):<br />

Cash equivalents ................. $ 102 $ — $ — $ 102<br />

Investments ...................... 29 — — 29<br />

Other long-term assets ............. 52 — — 52<br />

Long-term debt ................... — — (1,371) (1,371)<br />

Other long-term liabilities ...........<br />

Derivatives:<br />

(52) — — (52)<br />

Commodity assets ............... — 1,364 105 1,469<br />

Commodity liabilities ............. — (59) (2,059) (2,118)<br />

Interest rate liabilities ............ — — (69) (69)<br />

Foreign currency liabilities ........ — — (43) (43)<br />

Total derivatives .............. — 1,305 (2,066) (761)<br />

Total ...................... $ 131 $ 1,305 $ (3,437) $ (2,001)<br />

The following table provides fair value measurement information for financial assets (liabilities) measured<br />

at fair value on a recurring basis as of December 31, 2009:<br />

Quoted<br />

Prices in<br />

Active Markets<br />

(Level 1)<br />

Significant<br />

Other<br />

Observable<br />

Inputs<br />

(Level 2)<br />

Significant<br />

Unobservable<br />

Inputs<br />

(Level 3)<br />

Total<br />

Fair Value<br />

($ in millions)<br />

Financial Assets (Liabilities):<br />

Cash equivalents .................... $ 307 $ — $ — $ 307<br />

Investments ........................ 32 — — 32<br />

Other long-term assets ............... 34 — — 34<br />

Long-term debt ..................... — — (1,398) (1,398)<br />

Other long-term liabilities .............<br />

Derivatives:<br />

(34) — — (34)<br />

Commodity assets ................. — 693 143 836<br />

Commodity liabilities ............... — (1) (809) (810)<br />

Interest rate liabilities .............. — — (132) (132)<br />

Foreign currency assets ............ — — 43 43<br />

Total derivatives ................. — 692 (755) (63)<br />

Total ........................ $ 339 $ 692 $ (2,153) $ (1,122)<br />

120