6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

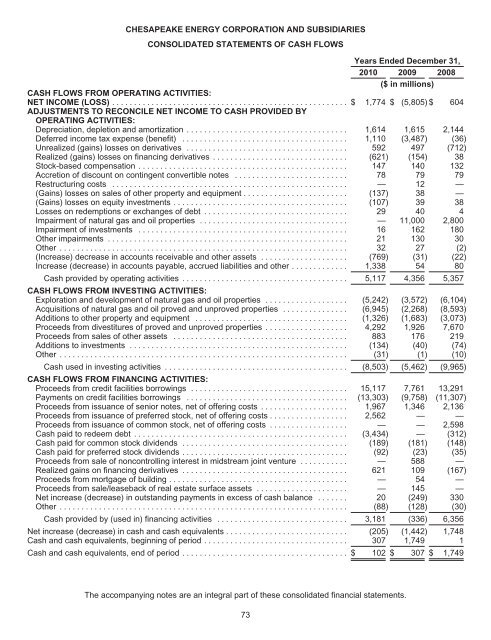

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES<br />

CONSOLIDATED STATEMENTS OF CASH FLOWS<br />

Years Ended December 31,<br />

2010 2009<br />

($ in millions)<br />

2008<br />

CASH FLOWS FROM OPERATING ACTIVITIES:<br />

NET INCOME (LOSS) ...................................................... $<br />

ADJUSTMENTS TO RECONCILE NET INCOME TO CASH PROVIDED BY<br />

OPERATING ACTIVITIES:<br />

1,774 $ (5,805) $ 604<br />

Depreciation, depletion and amortization ..................................... 1,614 1,615 2,144<br />

Deferred income tax expense (benefit) ...................................... 1,110 (3,487) (36)<br />

Unrealized (gains) losses on derivatives ..................................... 592 497 (712)<br />

Realized (gains) losses on financing derivatives ............................... (621) (154) 38<br />

Stock-based compensation ................................................ 147 140 132<br />

Accretion of discount on contingent convertible notes .......................... 78 79 79<br />

Restructuring costs ...................................................... — 12 —<br />

(Gains) losses on sales of other property and equipment ........................ (137) 38 —<br />

(Gains) losses on equity investments ........................................ (107) 39 38<br />

Losses on redemptions or exchanges of debt ................................. 29 40 4<br />

Impairment of natural gas and oil properties .................................. — 11,000 2,800<br />

Impairment of investments ................................................ 16 162 180<br />

Other impairments ....................................................... 21 130 30<br />

Other .................................................................. 32 27 (2)<br />

(Increase) decrease in accounts receivable and other assets .................... (769) (31) (22)<br />

Increase (decrease) in accounts payable, accrued liabilities and other ............. 1,338 54 80<br />

Cash provided by operating activities ...................................... 5,117 4,356 5,357<br />

CASH FLOWS FROM INVESTING ACTIVITIES:<br />

Exploration and development of natural gas and oil properties ................... (5,242) (3,572) (6,104)<br />

Acquisitions of natural gas and oil proved and unproved properties ............... (6,945) (2,268) (8,593)<br />

Additions to other property and equipment ................................... (1,326) (1,683) (3,073)<br />

Proceeds from divestitures of proved and unproved properties ................... 4,292 1,926 7,670<br />

Proceeds from sales of other assets ........................................ 883 176 219<br />

Additions to investments .................................................. (134) (40) (74)<br />

Other .................................................................. (31) (1) (10)<br />

Cash used in investing activities .......................................... (8,503) (5,462) (9,965)<br />

CASH FLOWS FROM FINANCING ACTIVITIES:<br />

Proceeds from credit facilities borrowings .................................... 15,117 7,761 13,291<br />

Payments on credit facilities borrowings ..................................... (13,303) (9,758) (11,307)<br />

Proceeds from issuance of senior notes, net of offering costs .................... 1,967 1,346 2,136<br />

Proceeds from issuance of preferred stock, net of offering costs .................. 2,562 — —<br />

Proceeds from issuance of common stock, net of offering costs .................. — — 2,598<br />

Cash paid to redeem debt ................................................. (3,434) — (312)<br />

Cash paid for common stock dividends ...................................... (189) (181) (148)<br />

Cash paid for preferred stock dividends ...................................... (92) (23) (35)<br />

Proceeds from sale of noncontrolling interest in midstream joint venture ........... — 588 —<br />

Realized gains on financing derivatives ...................................... 621 109 (167)<br />

Proceeds from mortgage of building ......................................... — 54 —<br />

Proceeds from sale/leaseback of real estate surface assets ..................... — 145 —<br />

Net increase (decrease) in outstanding payments in excess of cash balance ....... 20 (249) 330<br />

Other .................................................................. (88) (128) (30)<br />

Cash provided by (used in) financing activities .............................. 3,181 (336) 6,356<br />

Net increase (decrease) in cash and cash equivalents ............................ (205) (1,442) 1,748<br />

Cash and cash equivalents, beginning of period ................................. 307 1,749 1<br />

Cash and cash equivalents, end of period ...................................... $ 102 $ 307 $ 1,749<br />

The accompanying notes are an integral part of these consolidated financial statements.<br />

73