6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

6 5 - RR DONNELLEY FINANCIAL - External Home Login

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

CHESAPEAKE ENERGY CORPORATION AND SUBSIDIARIES<br />

NOTES TO CONSOLIDATED <strong>FINANCIAL</strong> STATEMENTS – (Continued)<br />

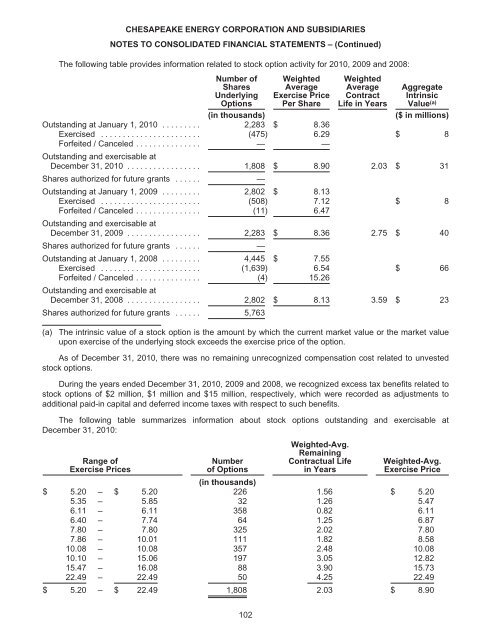

The following table provides information related to stock option activity for 2010, 2009 and 2008:<br />

Number of<br />

Shares<br />

Underlying<br />

Options<br />

Weighted<br />

Average<br />

Exercise Price<br />

Per Share<br />

Weighted<br />

Average<br />

Contract<br />

Life in Years<br />

Aggregate<br />

Intrinsic<br />

Value (a)<br />

(in thousands) ($ in millions)<br />

Outstanding at January 1, 2010 ......... 2,283 $ 8.36<br />

Exercised ....................... (475) 6.29 $ 8<br />

Forfeited / Canceled ............... — —<br />

Outstanding and exercisable at<br />

December 31, 2010 ................. 1,808 $ 8.90 2.03 $ 31<br />

Shares authorized for future grants ...... —<br />

Outstanding at January 1, 2009 ......... 2,802 $ 8.13<br />

Exercised ....................... (508) 7.12 $ 8<br />

Forfeited / Canceled ............... (11) 6.47<br />

Outstanding and exercisable at<br />

December 31, 2009 ................. 2,283 $ 8.36 2.75 $ 40<br />

Shares authorized for future grants ...... —<br />

Outstanding at January 1, 2008 ......... 4,445 $ 7.55<br />

Exercised ....................... (1,639) 6.54 $ 66<br />

Forfeited / Canceled ............... (4) 15.26<br />

Outstanding and exercisable at<br />

December 31, 2008 ................. 2,802 $ 8.13 3.59 $ 23<br />

Shares authorized for future grants ...... 5,763<br />

(a) The intrinsic value of a stock option is the amount by which the current market value or the market value<br />

upon exercise of the underlying stock exceeds the exercise price of the option.<br />

As of December 31, 2010, there was no remaining unrecognized compensation cost related to unvested<br />

stock options.<br />

During the years ended December 31, 2010, 2009 and 2008, we recognized excess tax benefits related to<br />

stock options of $2 million, $1 million and $15 million, respectively, which were recorded as adjustments to<br />

additional paid-in capital and deferred income taxes with respect to such benefits.<br />

The following table summarizes information about stock options outstanding and exercisable at<br />

December 31, 2010:<br />

Range of<br />

Exercise Prices<br />

Number<br />

of Options<br />

Weighted-Avg.<br />

Remaining<br />

Contractual Life<br />

in Years<br />

Weighted-Avg.<br />

Exercise Price<br />

$ 5.20 – $ 5.20<br />

(in thousands)<br />

226 1.56 $ 5.20<br />

5.35 – 5.85 32 1.26 5.47<br />

6.11 – 6.11 358 0.82 6.11<br />

6.40 – 7.74 64 1.25 6.87<br />

7.80 – 7.80 325 2.02 7.80<br />

7.86 – 10.01 111 1.82 8.58<br />

10.08 – 10.08 357 2.48 10.08<br />

10.10 – 15.06 197 3.05 12.82<br />

15.47 – 16.08 88 3.90 15.73<br />

22.49 – 22.49 50 4.25 22.49<br />

$ 5.20 – $ 22.49 1,808 2.03 $ 8.90<br />

102