EDC PR 2016 (FS section)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

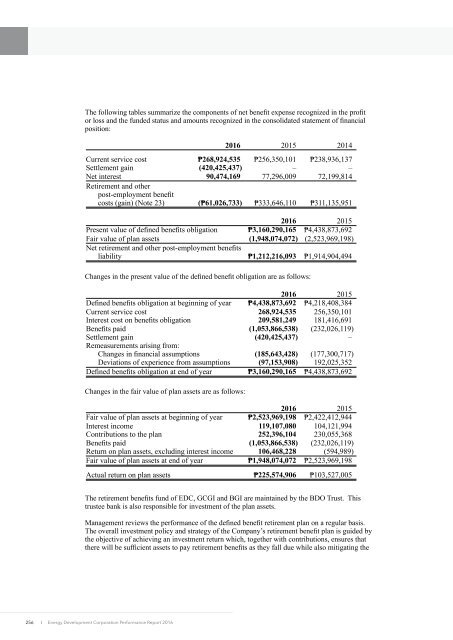

The following tables summarize the components of net benefit expense recognized in the profit<br />

or loss and the funded status and amounts recognized in the consolidated statement of financial<br />

position:<br />

Changes in the present value of the defined benefit obligation are as follows:<br />

Changes in the fair value of plan assets are as follows:<br />

<strong>2016</strong> 2015 2014<br />

Current service cost ₱268,924,535 ₱256,350,101 ₱238,936,137<br />

Settlement gain (420,425,437) – –<br />

Net interest 90,474,169 77,296,009 72,199,814<br />

Retirement and other<br />

post-employment benefit<br />

costs (gain) (Note 23) (₱61,026,733) ₱333,646,110 ₱311,135,951<br />

<strong>2016</strong> 2015<br />

Present value of defined benefits obligation ₱3,160,290,165 ₱4,438,873,692<br />

Fair value of plan assets (1,948,074,072) (2,523,969,198)<br />

Net retirement and other post-employment benefits<br />

liability ₱1,212,216,093 ₱1,914,904,494<br />

<strong>2016</strong> 2015<br />

Defined benefits obligation at beginning of year ₱4,438,873,692 ₱4,218,408,384<br />

Current service cost 268,924,535 256,350,101<br />

Interest cost on benefits obligation 209,581,249 181,416,691<br />

Benefits paid (1,053,866,538) (232,026,119)<br />

Settlement gain (420,425,437) –<br />

Remeasurements arising from:<br />

Changes in financial assumptions (185,643,428) (177,300,717)<br />

Deviations of experience from assumptions (97,153,908) 192,025,352<br />

Defined benefits obligation at end of year ₱3,160,290,165 ₱4,438,873,692<br />

<strong>2016</strong> 2015<br />

Fair value of plan assets at beginning of year ₱2,523,969,198 ₱2,422,412,944<br />

Interest income 119,107,080 104,121,994<br />

Contributions to the plan 252,396,104 230,055,368<br />

Benefits paid (1,053,866,538) (232,026,119)<br />

Return on plan assets, excluding interest income 106,468,228 (594,989)<br />

Fair value of plan assets at end of year ₱1,948,074,072 ₱2,523,969,198<br />

Actual return on plan assets ₱225,574,906 ₱103,527,005<br />

The retirement benefits fund of <strong>EDC</strong>, GCGI and BGI are maintained by the BDO Trust. This<br />

trustee bank is also responsible for investment of the plan assets.<br />

Management reviews the performance of the defined benefit retirement plan on a regular basis.<br />

The overall investment policy and strategy of the Company’s retirement benefit plan is guided by<br />

the objective of achieving an investment return which, together with contributions, ensures that<br />

there will be sufficient assets to pay retirement benefits as they fall due while also mitigating the<br />

256<br />

I Energy Development Corporation Performance Report <strong>2016</strong>