EDC PR 2016 (FS section)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statement<br />

various risk of the Plan. The Company’s current investment strategy is suited for an investor with<br />

a conservative investment risk profile.<br />

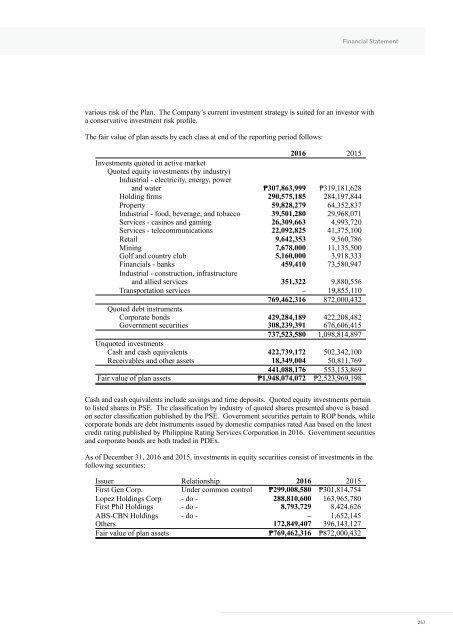

The fair value of plan assets by each class at end of the reporting period follows:<br />

<strong>2016</strong> 2015<br />

Investments quoted in active market<br />

Quoted equity investments (by industry)<br />

Industrial - electricity, energy, power<br />

and water ₱307,863,999 ₱319,181,628<br />

Holding firms 290,575,185 284,197,844<br />

Property 59,828,279 64,352,837<br />

Industrial - food, beverage, and tobacco 39,501,280 29,968,071<br />

Services - casinos and gaming 26,309,663 4,993,720<br />

Services - telecommunications 22,092,825 41,375,100<br />

Retail 9,642,353 9,560,786<br />

Mining 7,678,000 11,135,500<br />

Golf and country club 5,160,000 3,918,333<br />

Financials - banks 459,410 73,580,947<br />

Industrial - construction, infrastructure<br />

and allied services 351,322 9,880,556<br />

Transportation services – 19,855,110<br />

769,462,316 872,000,432<br />

Quoted debt instruments<br />

Corporate bonds 429,284,189 422,208,482<br />

Government securities 308,239,391 676,606,415<br />

737,523,580 1,098,814,897<br />

Unquoted investments<br />

Cash and cash equivalents 422,739,172 502,342,100<br />

Receivables and other assets 18,349,004 50,811,769<br />

441,088,176 553,153,869<br />

Fair value of plan assets ₱1,948,074,072 ₱2,523,969,198<br />

Cash and cash equivalents include savings and time deposits. Quoted equity investments pertain<br />

to listed shares in PSE. The classification by industry of quoted shares presented above is based<br />

on sector classification published by the PSE. Government securities pertain to ROP bonds, while<br />

corporate bonds are debt instruments issued by domestic companies rated Aaa based on the latest<br />

credit rating published by Philippine Rating Services Corporation in <strong>2016</strong>. Government securities<br />

and corporate bonds are both traded in PDEx.<br />

As of December 31, <strong>2016</strong> and 2015, investments in equity securities consist of investments in the<br />

following securities:<br />

Issuer Relationship <strong>2016</strong> 2015<br />

First Gen Corp. Under common control ₱299,008,580 ₱301,814,754<br />

Lopez Holdings Corp - do - 288,810,600 163,965,780<br />

First Phil Holdings - do - 8,793,729 8,424,626<br />

ABS-CBN Holdings - do - – 1,652,145<br />

Others 172,849,407 396,143,127<br />

Fair value of plan assets ₱769,462,316 ₱872,000,432<br />

257