EDC PR 2016 (FS section)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

In 2011, <strong>EDC</strong> recognized full impairment on its Northern Negros Geothermal Power Plant<br />

(NNGP) assets amounting to ₱8,737.6 million due to steam supply limitations. To utilize the<br />

remaining facilities and fixed assets of NNGP to the extent possible, the BOD approved the<br />

transfer of selected NNGP assets to Nasulo Power Plant located in Southern Negros. In light of<br />

the completion of the Nasulo Power Plant in July 2014, the Company has determined that the<br />

impairment loss previously recognized on assets transferred to and installed in Nasulo<br />

(from NNGP) must be reversed as the service potential of those assets has now been established<br />

(see Note 12). Accordingly, reversal of impairment loss amounting to ₱2,051.9 million was<br />

recognized in 2014 representing the net book value of assets installed in Nasulo Power Plant had<br />

there been no impairment loss previously recognized on these assets. The corresponding deferred<br />

tax asset amounting to ₱205.2 million has likewise been reversed. No similar reversal was<br />

recognized in <strong>2016</strong> and 2015.<br />

From originally being part of the NNGP CGU, the related assets have become part of the CGU<br />

consisting of Nasulo/Nasuji steam field and power plants in 2014. The amount of reversal of<br />

impairment was presented under the Negros Island Geothermal Business Unit (NIGBU) operating<br />

segment since the CGU is located in Negros Island (see Note 5). Based on a discounted cash flow<br />

projection using 8.7% as pre-tax discount rate, the recoverable amount of the relevant CGU is<br />

estimated to be at ₱15,673.6 million as of July 31, 2014, the effective date of the reversal. The<br />

period covered by the cash flow projection is consistent with the estimated useful life of major<br />

component of the Nasulo Power Plant.<br />

The carrying amount of property, plant and equipment as of December 31, <strong>2016</strong> and 2015<br />

amounted to ₱91,932.0 million and ₱88,567.7 million, respectively (see Note 12). The carrying<br />

amount of water rights as of December 31, <strong>2016</strong> and 2015 amounted to ₱1,430.8 million and<br />

₱1,527.0 million, respectively (see Note 13). The carrying amount of other intangible assets as of<br />

December 31, <strong>2016</strong> and 2015 amounted to ₱40.4 million and ₱111.0 million, respectively<br />

(see Note 13).<br />

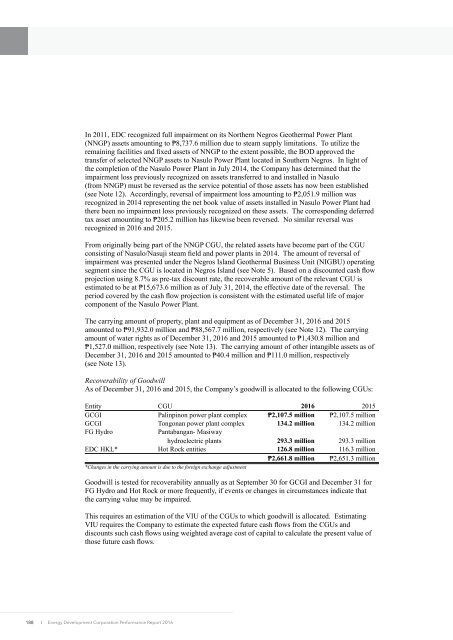

Recoverability of Goodwill<br />

As of December 31, <strong>2016</strong> and 2015, the Company’s goodwill is allocated to the following CGUs:<br />

Entity CGU <strong>2016</strong> 2015<br />

GCGI Palinpinon power plant complex ₱2,107.5 million ₱2,107.5 million<br />

GCGI Tongonan power plant complex 134.2 million 134.2 million<br />

FG Hydro<br />

Pantabangan- Masiway<br />

hydroelectric plants 293.3 million 293.3 million<br />

<strong>EDC</strong> HKL* Hot Rock entities 126.8 million 116.3 million<br />

₱2,661.8 million ₱2,651.3 million<br />

*Changes in the carrying amount is due to the foreign exchange adjustment<br />

Goodwill is tested for recoverability annually as at September 30 for GCGI and December 31 for<br />

FG Hydro and Hot Rock or more frequently, if events or changes in circumstances indicate that<br />

the carrying value may be impaired.<br />

This requires an estimation of the VIU of the CGUs to which goodwill is allocated. Estimating<br />

VIU requires the Company to estimate the expected future cash flows from the CGUs and<br />

discounts such cash flows using weighted average cost of capital to calculate the present value of<br />

those future cash flows.<br />

188<br />

I Energy Development Corporation Performance Report <strong>2016</strong>