EDC PR 2016 (FS section)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Statement<br />

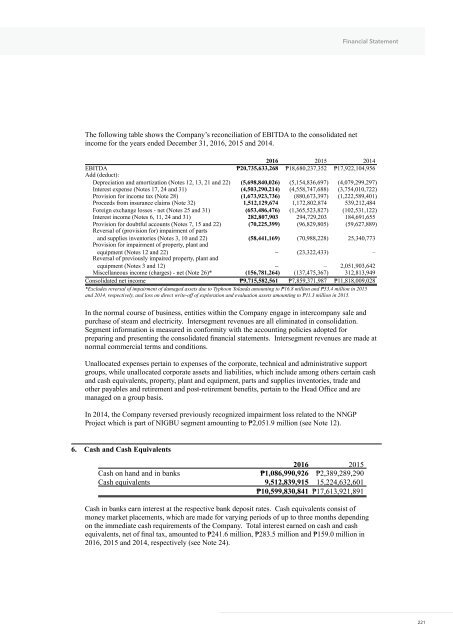

The following table shows the Company’s reconciliation of EBITDA to the consolidated net<br />

income for the years ended December 31, <strong>2016</strong>, 2015 and 2014.<br />

<strong>2016</strong> 2015 2014<br />

EBITDA ₱20,735,633,268 ₱18,680,237,352 ₱17,922,104,956<br />

Add (deduct):<br />

Depreciation and amortization (Notes 12, 13, 21 and 22) (5,698,840,026) (5,154,836,697) (4,079,299,297)<br />

Interest expense (Notes 17, 24 and 31) (4,503,290,214) (4,558,747,688) (3,754,010,722)<br />

Provision for income tax (Note 28) (1,673,923,736) (880,673,397) (1,222,589,401)<br />

Proceeds from insurance claims (Note 32) 1,512,129,674 1,172,802,874 539,212,484<br />

Foreign exchange losses - net (Notes 25 and 31) (653,486,476) (1,365,523,827) (102,531,122)<br />

Interest income (Notes 6, 11, 24 and 31) 282,807,903 294,729,203 184,691,655<br />

Provision for doubtful accounts (Notes 7, 15 and 22) (70,225,399) (96,829,805) (59,627,889)<br />

Reversal of (provision for) impairment of parts<br />

and supplies inventories (Notes 3, 10 and 22) (58,441,169) (70,988,228) 25,340,773<br />

Provision for impairment of property, plant and<br />

equipment (Notes 12 and 22) – (23,322,433) –<br />

Reversal of previously impaired property, plant and<br />

equipment (Notes 3 and 12) – – 2,051,903,642<br />

Miscellaneous income (charges) - net (Note 26)* (156,781,264) (137,475,367) 312,813,949<br />

Consolidated net income ₱9,715,582,561 ₱7,859,371,987 ₱11,818,009,028<br />

*Excludes reversal of impairment of damaged assets due to Typhoon Yolanda amounting to ₱16.8 million and ₱53.4 million in 2015<br />

and 2014, respectively, and loss on direct write-off of exploration and evaluation assets amounting to ₱11.3 million in 2015.<br />

In the normal course of business, entities within the Company engage in intercompany sale and<br />

purchase of steam and electricity. Intersegment revenues are all eliminated in consolidation.<br />

Segment information is measured in conformity with the accounting policies adopted for<br />

preparing and presenting the consolidated financial statements. Intersegment revenues are made at<br />

normal commercial terms and conditions.<br />

Unallocated expenses pertain to expenses of the corporate, technical and administrative support<br />

groups, while unallocated corporate assets and liabilities, which include among others certain cash<br />

and cash equivalents, property, plant and equipment, parts and supplies inventories, trade and<br />

other payables and retirement and post-retirement benefits, pertain to the Head Office and are<br />

managed on a group basis.<br />

In 2014, the Company reversed previously recognized impairment loss related to the NNGP<br />

Project which is part of NIGBU segment amounting to ₱2,051.9 million (see Note 12).<br />

6. Cash and Cash Equivalents<br />

<strong>2016</strong> 2015<br />

Cash on hand and in banks ₱1,086,990,926 ₱2,389,289,290<br />

Cash equivalents 9,512,839,915 15,224,632,601<br />

₱10,599,830,841 ₱17,613,921,891<br />

Cash in banks earn interest at the respective bank deposit rates. Cash equivalents consist of<br />

money market placements, which are made for varying periods of up to three months depending<br />

on the immediate cash requirements of the Company. Total interest earned on cash and cash<br />

equivalents, net of final tax, amounted to ₱241.6 million, ₱283.5 million and ₱159.0 million in<br />

<strong>2016</strong>, 2015 and 2014, respectively (see Note 24).<br />

221