EDC PR 2016 (FS section)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statement<br />

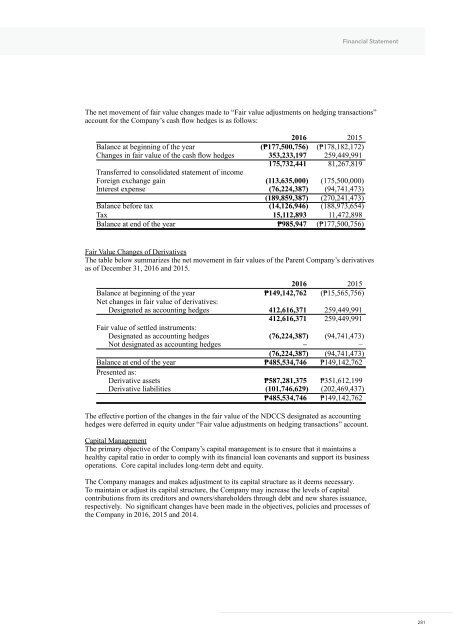

The net movement of fair value changes made to “Fair value adjustments on hedging transactions”<br />

account for the Company’s cash flow hedges is as follows:<br />

<strong>2016</strong> 2015<br />

Balance at beginning of the year (₱177,500,756) (₱178,182,172)<br />

Changes in fair value of the cash flow hedges 353,233,197 259,449,991<br />

175,732,441 81,267,819<br />

Transferred to consolidated statement of income<br />

Foreign exchange gain (113,635,000) (175,500,000)<br />

Interest expense (76,224,387) (94,741,473)<br />

(189,859,387) (270,241,473)<br />

Balance before tax (14,126,946) (188,973,654)<br />

Tax 15,112,893 11,472,898<br />

Balance at end of the year ₱985,947 (₱177,500,756)<br />

Fair Value Changes of Derivatives<br />

The table below summarizes the net movement in fair values of the Parent Company’s derivatives<br />

as of December 31, <strong>2016</strong> and 2015.<br />

<strong>2016</strong> 2015<br />

Balance at beginning of the year ₱149,142,762 (₱15,565,756)<br />

Net changes in fair value of derivatives:<br />

Designated as accounting hedges 412,616,371 259,449,991<br />

412,616,371 259,449,991<br />

Fair value of settled instruments:<br />

Designated as accounting hedges (76,224,387) (94,741,473)<br />

Not designated as accounting hedges – –<br />

(76,224,387) (94,741,473)<br />

Balance at end of the year ₱485,534,746 ₱149,142,762<br />

Presented as:<br />

Derivative assets ₱587,281,375 ₱351,612,199<br />

Derivative liabilities (101,746,629) (202,469,437)<br />

₱485,534,746 ₱149,142,762<br />

The effective portion of the changes in the fair value of the NDCCS designated as accounting<br />

hedges were deferred in equity under “Fair value adjustments on hedging transactions” account.<br />

Capital Management<br />

The primary objective of the Company’s capital management is to ensure that it maintains a<br />

healthy capital ratio in order to comply with its financial loan covenants and support its business<br />

operations. Core capital includes long-term debt and equity.<br />

The Company manages and makes adjustment to its capital structure as it deems necessary.<br />

To maintain or adjust its capital structure, the Company may increase the levels of capital<br />

contributions from its creditors and owners/shareholders through debt and new shares issuance,<br />

respectively. No significant changes have been made in the objectives, policies and processes of<br />

the Company in <strong>2016</strong>, 2015 and 2014.<br />

281