EDC PR 2016 (FS section)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

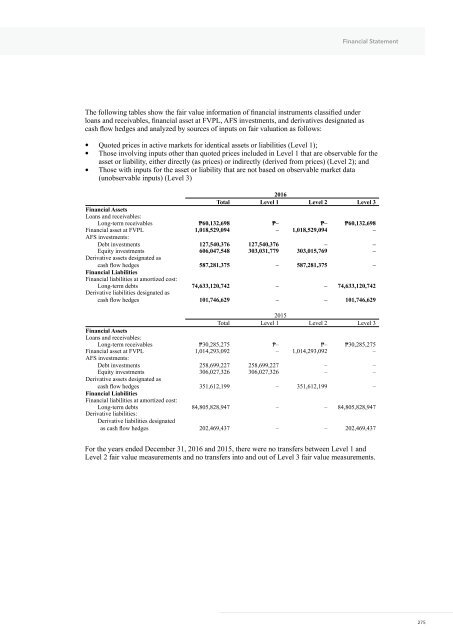

Financial Statement<br />

The following tables show the fair value information of financial instruments classified under<br />

loans and receivables, financial asset at FVPL, A<strong>FS</strong> investments, and derivatives designated as<br />

cash flow hedges and analyzed by sources of inputs on fair valuation as follows:<br />

Quoted prices in active markets for identical assets or liabilities (Level 1);<br />

Those involving inputs other than quoted prices included in Level 1 that are observable for the<br />

asset or liability, either directly (as prices) or indirectly (derived from prices) (Level 2); and<br />

Those with inputs for the asset or liability that are not based on observable market data<br />

(unobservable inputs) (Level 3)<br />

<strong>2016</strong><br />

Total Level 1 Level 2 Level 3<br />

Financial Assets<br />

Loans and receivables:<br />

Long-term receivables ₱60,132,698 ₱– ₱– ₱60,132,698<br />

Financial asset at FVPL 1,018,529,094 – 1,018,529,094 –<br />

A<strong>FS</strong> investments:<br />

Debt investments 127,540,376 127,540,376 – –<br />

Equity investments 606,047,548 303,031,779 303,015,769 –<br />

Derivative assets designated as<br />

cash flow hedges 587,281,375 – 587,281,375 –<br />

Financial Liabilities<br />

Financial liabilities at amortized cost:<br />

Long-term debts 74,633,120,742 – – 74,633,120,742<br />

Derivative liabilities designated as<br />

cash flow hedges 101,746,629 – – 101,746,629<br />

2015<br />

Total Level 1 Level 2 Level 3<br />

Financial Assets<br />

Loans and receivables:<br />

Long-term receivables ₱30,285,275 ₱– ₱– ₱30,285,275<br />

Financial asset at FVPL 1,014,293,092 – 1,014,293,092 –<br />

A<strong>FS</strong> investments:<br />

Debt investments 258,699,227 258,699,227 – –<br />

Equity investments 306,027,326 306,027,326 – –<br />

Derivative assets designated as<br />

cash flow hedges 351,612,199 – 351,612,199 –<br />

Financial Liabilities<br />

Financial liabilities at amortized cost:<br />

Long-term debts 84,805,828,947 – – 84,805,828,947<br />

Derivative liabilities:<br />

Derivative liabilities designated<br />

as cash flow hedges 202,469,437 – – 202,469,437<br />

For the years ended December 31, <strong>2016</strong> and 2015, there were no transfers between Level 1 and<br />

Level 2 fair value measurements and no transfers into and out of Level 3 fair value measurements.<br />

275