EDC PR 2016 (FS section)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statement<br />

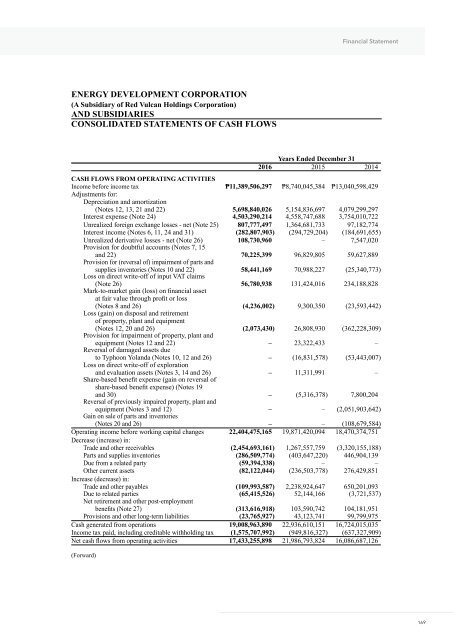

ENERGY DEVELOPMENT CORPORATION<br />

(A Subsidiary of Red Vulcan Holdings Corporation)<br />

AND SUBSIDIARIES<br />

CONSOLIDATED STATEMENTS OF CASH FLOWS<br />

Years Ended December 31<br />

<strong>2016</strong> 2015 2014<br />

CASH FLOWS FROM OPERATING ACTIVITIES<br />

Income before income tax ₱11,389,506,297 ₱8,740,045,384 ₱13,040,598,429<br />

Adjustments for:<br />

Depreciation and amortization<br />

(Notes 12, 13, 21 and 22) 5,698,840,026 5,154,836,697 4,079,299,297<br />

Interest expense (Note 24) 4,503,290,214 4,558,747,688 3,754,010,722<br />

Unrealized foreign exchange losses - net (Note 25) 807,777,497 1,364,681,733 97,182,774<br />

Interest income (Notes 6, 11, 24 and 31) (282,807,903) (294,729,204) (184,691,655)<br />

Unrealized derivative losses - net (Note 26) 108,730,960 – 7,547,020<br />

Provision for doubtful accounts (Notes 7, 15<br />

and 22) 70,225,399 96,829,805 59,627,889<br />

Provision for (reversal of) impairment of parts and<br />

supplies inventories (Notes 10 and 22)<br />

Loss on direct write-off of input VAT claims<br />

58,441,169 70,988,227 (25,340,773)<br />

(Note 26) 56,780,938 131,424,016 234,188,828<br />

Mark-to-market gain (loss) on financial asset<br />

at fair value through profit or loss<br />

(Notes 8 and 26) (4,236,002) 9,300,350 (23,593,442)<br />

Loss (gain) on disposal and retirement<br />

of property, plant and equipment<br />

(Notes 12, 20 and 26) (2,073,430) 26,808,930 (362,228,309)<br />

Provision for impairment of property, plant and<br />

equipment (Notes 12 and 22) – 23,322,433 –<br />

Reversal of damaged assets due<br />

to Typhoon Yolanda (Notes 10, 12 and 26) – (16,831,578) (53,443,007)<br />

Loss on direct write-off of exploration<br />

and evaluation assets (Notes 3, 14 and 26) – 11,311,991 –<br />

Share-based benefit expense (gain on reversal of<br />

share-based benefit expense) (Notes 19<br />

and 30) – (5,316,378) 7,800,204<br />

Reversal of previously impaired property, plant and<br />

equipment (Notes 3 and 12) – – (2,051,903,642)<br />

Gain on sale of parts and inventories<br />

(Notes 20 and 26) – – (108,679,584)<br />

Operating income before working capital changes 22,404,475,165 19,871,420,094 18,470,374,751<br />

Decrease (increase) in:<br />

Trade and other receivables (2,454,693,161) 1,267,557,759 (3,320,155,188)<br />

Parts and supplies inventories (286,509,774) (403,647,220) 446,904,139<br />

Due from a related party (59,394,338) – –<br />

Other current assets (82,122,044) (236,503,778) 276,429,851<br />

Increase (decrease) in:<br />

Trade and other payables (109,993,587) 2,238,924,647 650,201,093<br />

Due to related parties (65,415,526) 52,144,166 (3,721,537)<br />

Net retirement and other post-employment<br />

benefits (Note 27) (313,616,918) 103,590,742 104,181,951<br />

Provisions and other long-term liabilities (23,765,927) 43,123,741 99,799,975<br />

Cash generated from operations 19,008,963,890 22,936,610,151 16,724,015,035<br />

Income tax paid, including creditable withholding tax (1,575,707,992) (949,816,327) (637,327,909)<br />

Net cash flows from operating activities 17,433,255,898 21,986,793,824 16,086,687,126<br />

(Forward)<br />

169