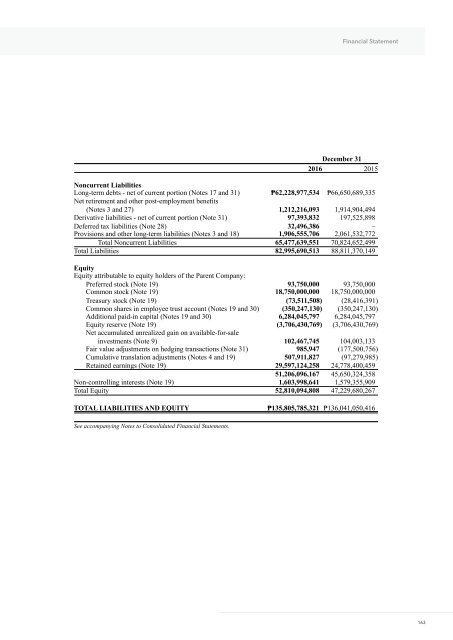

Financial Statement December 31 <strong>2016</strong> 2015 Noncurrent Liabilities Long-term debts - net of current portion (Notes 17 and 31) ₱62,228,977,534 ₱66,650,689,335 Net retirement and other post-employment benefits (Notes 3 and 27) 1,212,216,093 1,914,904,494 Derivative liabilities - net of current portion (Note 31) 97,393,832 197,525,898 Deferred tax liabilities (Note 28) 32,496,386 – Provisions and other long-term liabilities (Notes 3 and 18) 1,906,555,706 2,061,532,772 Total Noncurrent Liabilities 65,477,639,551 70,824,652,499 Total Liabilities 82,995,690,513 88,811,370,149 Equity Equity attributable to equity holders of the Parent Company: Preferred stock (Note 19) 93,750,000 93,750,000 Common stock (Note 19) 18,750,000,000 18,750,000,000 Treasury stock (Note 19) (73,511,508) (28,416,391) Common shares in employee trust account (Notes 19 and 30) (350,247,130) (350,247,130) Additional paid-in capital (Notes 19 and 30) 6,284,045,797 6,284,045,797 Equity reserve (Note 19) (3,706,430,769) (3,706,430,769) Net accumulated unrealized gain on available-for-sale investments (Note 9) 102,467,745 104,003,133 Fair value adjustments on hedging transactions (Note 31) 985,947 (177,500,756) Cumulative translation adjustments (Notes 4 and 19) 507,911,827 (97,279,985) Retained earnings (Note 19) 29,597,124,258 24,778,400,459 51,206,096,167 45,650,324,358 Non-controlling interests (Note 19) 1,603,998,641 1,579,355,909 Total Equity 52,810,094,808 47,229,680,267 TOTAL LIABILITIES AND EQUITY ₱135,805,785,321 ₱136,041,050,416 See accompanying Notes to Consolidated Financial Statements. 163

ENERGY DEVELOPMENT CORPORATION (A Subsidiary of Red Vulcan Holdings Corporation) AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF INCOME Years Ended December 31 <strong>2016</strong> 2015 2014 REVENUE FROM SALE OF ELECTRICITY (Notes 3, 12, 20, 34, 35, 36, 37, 38, 40 and 41) ₱34,235,563,322 ₱34,360,459,794 ₱30,867,199,917 COSTS OF SALE OF ELECTRICITY (Notes 10, 12, 20, 21, 23, 27, 38 and 39) (13,757,233,474) (14,439,512,541) (11,314,332,241) GENERAL AND ADMINISTRATIVE EXPENSES (Notes 10, 12, 15, 22, 23 and 27) (5,570,203,174) (6,586,687,065) (5,744,349,133) FINANCIAL INCOME (EXPENSE) Interest income (Notes 6, 11, 24 and 31) 282,807,903 294,729,204 184,691,655 Interest expense (Notes 17, 18, 24 and 31) (4,503,290,214) (4,558,747,688) (3,754,010,722) (4,220,482,311) (4,264,018,484) (3,569,319,067) OTHER INCOME (CHARGES) Proceeds from insurance claims (Note 32) 1,512,129,674 1,172,802,874 539,212,484 Foreign exchange losses - net (Notes 25 and 31) (653,486,476) (1,365,523,827) (102,531,122) Reversal of previously impaired property, plant and equipment (Notes 3 and 12) Miscellaneous income (charges) - net (Note 26) – (156,781,264) – (137,475,367) 2,051,903,642 312,813,949 701,861,934 (330,196,320) 2,801,398,953 INCOME BEFORE INCOME TAX 11,389,506,297 8,740,045,384 13,040,598,429 <strong>PR</strong>OVISION FOR (BENEFIT FROM) INCOME TAX (Note 28) Current 1,667,823,631 938,536,386 934,128,656 Deferred 6,100,105 (57,862,989) 288,460,745 1,673,923,736 880,673,397 1,222,589,401 NET INCOME ₱9,715,582,561 ₱7,859,371,987 ₱11,818,009,028 Net income attributable to: Equity holders of the Parent Company ₱9,352,420,983 ₱7,642,097,536 ₱11,681,155,539 Non-controlling interests 363,161,578 217,274,451 136,853,489 ₱9,715,582,561 ₱7,859,371,987 ₱11,818,009,028 Basic/Diluted Earnings Per Share for Net Income Attributable to Equity Holders of the Parent Company (Note 29) ₱0.499 ₱0.407 ₱0.623 See accompanying Notes to Consolidated Financial Statements. 164 I Energy Development Corporation Performance Report <strong>2016</strong>

- Page 1 and 2: 2016 Audited Consolidated Financial

- Page 3 and 4: Compliance • We have monitored th

- Page 5 and 6: 156 I Energy Development Corporatio

- Page 7 and 8: We have fulfilled the responsibilit

- Page 9 and 10: Those charged with governance are r

- Page 11: ENERGY DEVELOPMENT CORPORATION (A S

- Page 15 and 16: ENERGY DEVELOPMENT CORPORATION (A S

- Page 17 and 18: Preferred Stock (Note 19) Common St

- Page 19 and 20: Years Ended December 31 2016 2015 2

- Page 21 and 22: Southern Negros, Valencia, Negros O

- Page 23 and 24: EDC Drillco EDC Drillco is a compan

- Page 25 and 26: Geotermica Chile SPA also incorpora

- Page 27 and 28: Authorization for Issuance of the C

- Page 29 and 30: These amendments are applied prospe

- Page 31 and 32: Applicability of IFRIC 12, Service

- Page 33 and 34: In August 2013, EDC Geotermica SpA

- Page 35 and 36: Fair Value Measurement of Financial

- Page 37 and 38: In 2011, EDC recognized full impair

- Page 39 and 40: The factors that the Company consid

- Page 41 and 42: Recognition of Deferred Income Tax

- Page 43 and 44: Current versus Non-current Classifi

- Page 45 and 46: In 2015, the functional currency of

- Page 47 and 48: Construction in progress represents

- Page 49 and 50: would have been determined, net of

- Page 51 and 52: Classified under loans and receivab

- Page 53 and 54: Derivative financial instruments ar

- Page 55 and 56: the allowance account. Any subseque

- Page 57 and 58: maturity or expected disposal date

- Page 59 and 60: has expired, as well as the Parent

- Page 61 and 62: Proceeds from Insurance Claims Proc

- Page 63 and 64:

Future Changes in Accounting Polici

- Page 65 and 66:

The Company is currently assessing

- Page 67 and 68:

oader review of the research projec

- Page 69 and 70:

LGBU NIGBU BGBU MAGBU Pantabangan/

- Page 71 and 72:

7. Trade and Other Receivables 2016

- Page 73 and 74:

The movements of the net accumulate

- Page 75 and 76:

12. Property, Plant and Equipment L

- Page 77 and 78:

Total borrowing costs capitalized t

- Page 79 and 80:

Bac-Man 3 Engineering Procurement a

- Page 81 and 82:

13. Goodwill and Intangible Assets

- Page 83 and 84:

Carrying amount of exploration and

- Page 85 and 86:

2015 Long term receivables Input VA

- Page 87 and 88:

The long-term debts are presented n

- Page 89 and 90:

The Parent Company capitalized in i

- Page 91 and 92:

₱8.5 billion GCGI Term Loan On Ma

- Page 93 and 94:

19. Equity Capital Stock As require

- Page 95 and 96:

On March 6, 2015, the BOD approved

- Page 97 and 98:

US$14.0 million thereafter up to 20

- Page 99 and 100:

Transactions for the years ended De

- Page 101 and 102:

Remuneration of Key Management Pers

- Page 103 and 104:

Net retirement and other post-emplo

- Page 105 and 106:

The following tables summarize the

- Page 107 and 108:

The Company expects to contribute

- Page 109 and 110:

Beginning of Year Charged to Income

- Page 111 and 112:

f. g. h. i. j. k. On June 29, 2011,

- Page 113 and 114:

Stock awards granted by the Committ

- Page 115 and 116:

Foreign Currency Risk Foreign curre

- Page 117 and 118:

US$ Japanese yen (JP¥) Sweden kron

- Page 119 and 120:

2015 Foreign Currency Appreciates (

- Page 121 and 122:

The following tables demonstrate th

- Page 123 and 124:

Financial Assets and Financial Liab

- Page 125 and 126:

The Company classifies its financia

- Page 127 and 128:

The table below shows the derivativ

- Page 129 and 130:

Pertinent details of the IRS are as

- Page 131 and 132:

The Company monitors capital using

- Page 133 and 134:

Legal Claims The Company is conting

- Page 135 and 136:

EDC also holds geothermal resource

- Page 137 and 138:

As of December 31, 2016, the Compan

- Page 139 and 140:

As of December 31, 2016, the Compan

- Page 141 and 142:

Ancillary Services Procurement Agre

- Page 143 and 144:

41. ULGEI Power Supply Agreements A