Financial Statement 20. Related Party Transactions Parties are considered to be related if one party has the ability, directly or indirectly, to control the other party or exercise significant influence over the other party in making financial and operating decisions. Parties are also considered to be related if they are subject to common control. Following are the amounts of transactions and outstanding balances as of and for the years ended December 31, <strong>2016</strong> and 2015 with entities under common control: Transactions for the years ended December 31 Outstanding balance as of December 31 Related Party Nature of Transaction Terms <strong>2016</strong> 2015 2014 <strong>2016</strong> 2015 Due to related parties First Gen Consultancy fee Unsecured and will ₱388,912,941 ₱388,912,941 ₱175,284,706 ₱32,409,349 ₱97,228,235 be settled in cash Dividend 257,863,502 – – – – Interest-free advances - do - 25,560,873 22,288,499 28,769,152 3,679,173 4,490,831 Lopez Holding Interest-free advances - do - 13,028,235 6,734,500 – – – Eugenio Lopez Foundation Interest-free advances - do - 2,425,000 – – – – Red Vulcan Dividend - do - 1,957,500,000 2,407,500,000 – – – Lopez Foundation Interest-free advances - do - 27,950,425 56,500 – – – First Gas Power Interest-free advances - do - 376,737 91,734 579,088 133,127 48,435 Corporation FGP Corp Interest-free advances - do - 130,325 63,013 408,775 132,458 2,133 First Gas Holdings Corp. Interest-free advances - do - – – 51,480 – – First Gen Puyo Interest-free advances - do - – – 173,000 – – ₱2,673,748,038 ₱2,825,647,187 ₱205,266,201 ₱36,354,107 ₱101,769,634 Due from a related party First GES Other services - do - ₱59,394,338 ₱– ₱– ₱59,394,338 ₱– Trade and other receivables (Note 7) First GES Sale of electricity Unsecured and will ₱479,598,311 ₱354,941,012 ₱342,258,797 ₱70,688,394 ₱40,330,538 be settled in cash Thermaprime Sale of rigs and - do - – – 1,650,000,000 – – inventories ₱479,598,311 ₱354,941,012 ₱1,992,258,797 ₱70,688,394 ₱40,330,538 Entities under common control Trade and other payables (Note 16) Thermaprime Drilling and other Unsecured and will ₱1,646,993,965 ₱1,800,321,705 ₱1,441,980,032 ₱371,413,825 ₱602,471,776 related services be settled in cash First Balfour Inc. Civil Works and other - do - 1,487,206,197 2,654,609,480 2,368,911,626 938,446,981 1,356,167,441 services First GES Purchase of services - do - 95,297,541 12,983,759 – 4,315,931 – and utilities Rockwell Land Purchase of services - do - 32,118,700 80,810 125,104 32,118,700 – Corporation and utilities Bayantel Purchase of services - do - 15,249,877 18,918,189 14,254,689 12,673,166 1,687,740 and utilities ABS-CBN Foundation Purchase of services - do - – 5,215,400 965,000 63,000 63,000 and utilities First Philippine Realty Purchase of services - do - 779,034 2,186,874 2,390,863 8,050 27,693 Corporation and utilities Adtel Purchase of services - do - 4,114,015 2,020,132 1,857,576 806,382 1,900,142 and utilities First Philec Manufacturing Purchase of services - do - 44,196 351,830 6,996,360 9,117,293 9,117,293 Technologies Corp and utilities ABS-CBN Publishing, Inc. Purchase of services - do - 826,636 150,311 – 3,600 841,600 and utilities Securities Transfer Purchase of services - do - 628,350 140,187 – 34,011 289,200 Services, inc. and utilities ABS-CBN Corporation Purchase of services - do - 1,371,257 26,518 434,456 – 26,518 and utilities First Philippine Industrial Purchase of services - do - 3,654 3,654 – 3,654 3,654 Corporation First Philec Inc. (formerly First Electro Dynamics Corp.) Skycable and utilities Purchase of services and utilities Purchase of services and utilities - do - – – – 358,000 358,000 - do - 735,268 660,807 – 1,325,893 186,830 ₱3,285,368,690 ₱4,497,669,656 ₱3,837,915,706 ₱1,370,688,486 ₱1,973,140,887 249

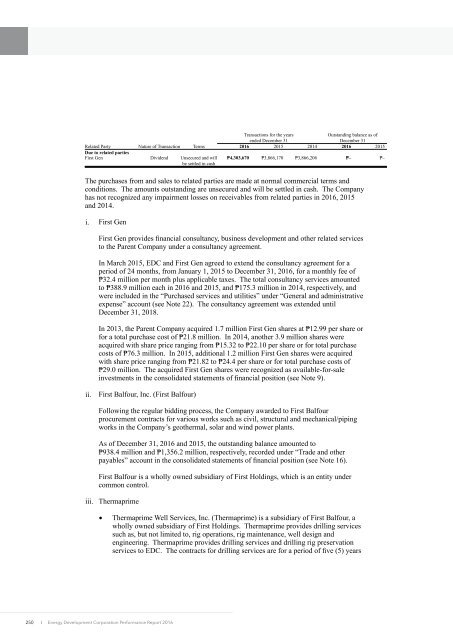

Transactions for the years ended December 31 Outstanding balance as of December 31 Related Party Nature of Transaction Terms <strong>2016</strong> 2015 2014 <strong>2016</strong> 2015 Due to related parties First Gen Dividend Unsecured and will ₱4,303,670 ₱3,866,170 ₱3,866,206 ₱– ₱– be settled in cash The purchases from and sales to related parties are made at normal commercial terms and conditions. The amounts outstanding are unsecured and will be settled in cash. The Company has not recognized any impairment losses on receivables from related parties in <strong>2016</strong>, 2015 and 2014. i. First Gen First Gen provides financial consultancy, business development and other related services to the Parent Company under a consultancy agreement. In March 2015, <strong>EDC</strong> and First Gen agreed to extend the consultancy agreement for a period of 24 months, from January 1, 2015 to December 31, <strong>2016</strong>, for a monthly fee of ₱32.4 million per month plus applicable taxes. The total consultancy services amounted to ₱388.9 million each in <strong>2016</strong> and 2015, and ₱175.3 million in 2014, respectively, and were included in the “Purchased services and utilities” under “General and administrative expense” account (see Note 22). The consultancy agreement was extended until December 31, 2018. In 2013, the Parent Company acquired 1.7 million First Gen shares at ₱12.99 per share or for a total purchase cost of ₱21.8 million. In 2014, another 3.9 million shares were acquired with share price ranging from ₱15.32 to ₱22.10 per share or for total purchase costs of ₱76.3 million. In 2015, additional 1.2 million First Gen shares were acquired with share price ranging from ₱21.82 to ₱24.4 per share or for total purchase costs of ₱29.0 million. The acquired First Gen shares were recognized as available-for-sale investments in the consolidated statements of financial position (see Note 9). ii. First Balfour, Inc. (First Balfour) Following the regular bidding process, the Company awarded to First Balfour procurement contracts for various works such as civil, structural and mechanical/piping works in the Company’s geothermal, solar and wind power plants. As of December 31, <strong>2016</strong> and 2015, the outstanding balance amounted to ₱938.4 million and ₱1,356.2 million, respectively, recorded under “Trade and other payables” account in the consolidated statements of financial position (see Note 16). First Balfour is a wholly owned subsidiary of First Holdings, which is an entity under common control. iii. Thermaprime Thermaprime Well Services, Inc. (Thermaprime) is a subsidiary of First Balfour, a wholly owned subsidiary of First Holdings. Thermaprime provides drilling services such as, but not limited to, rig operations, rig maintenance, well design and engineering. Thermaprime provides drilling services and drilling rig preservation services to <strong>EDC</strong>. The contracts for drilling services are for a period of five (5) years 250 I Energy Development Corporation Performance Report <strong>2016</strong>

- Page 1 and 2:

2016 Audited Consolidated Financial

- Page 3 and 4:

Compliance • We have monitored th

- Page 5 and 6:

156 I Energy Development Corporatio

- Page 7 and 8:

We have fulfilled the responsibilit

- Page 9 and 10:

Those charged with governance are r

- Page 11 and 12:

ENERGY DEVELOPMENT CORPORATION (A S

- Page 13 and 14:

ENERGY DEVELOPMENT CORPORATION (A S

- Page 15 and 16:

ENERGY DEVELOPMENT CORPORATION (A S

- Page 17 and 18:

Preferred Stock (Note 19) Common St

- Page 19 and 20:

Years Ended December 31 2016 2015 2

- Page 21 and 22:

Southern Negros, Valencia, Negros O

- Page 23 and 24:

EDC Drillco EDC Drillco is a compan

- Page 25 and 26:

Geotermica Chile SPA also incorpora

- Page 27 and 28:

Authorization for Issuance of the C

- Page 29 and 30:

These amendments are applied prospe

- Page 31 and 32:

Applicability of IFRIC 12, Service

- Page 33 and 34:

In August 2013, EDC Geotermica SpA

- Page 35 and 36:

Fair Value Measurement of Financial

- Page 37 and 38:

In 2011, EDC recognized full impair

- Page 39 and 40:

The factors that the Company consid

- Page 41 and 42:

Recognition of Deferred Income Tax

- Page 43 and 44:

Current versus Non-current Classifi

- Page 45 and 46:

In 2015, the functional currency of

- Page 47 and 48: Construction in progress represents

- Page 49 and 50: would have been determined, net of

- Page 51 and 52: Classified under loans and receivab

- Page 53 and 54: Derivative financial instruments ar

- Page 55 and 56: the allowance account. Any subseque

- Page 57 and 58: maturity or expected disposal date

- Page 59 and 60: has expired, as well as the Parent

- Page 61 and 62: Proceeds from Insurance Claims Proc

- Page 63 and 64: Future Changes in Accounting Polici

- Page 65 and 66: The Company is currently assessing

- Page 67 and 68: oader review of the research projec

- Page 69 and 70: LGBU NIGBU BGBU MAGBU Pantabangan/

- Page 71 and 72: 7. Trade and Other Receivables 2016

- Page 73 and 74: The movements of the net accumulate

- Page 75 and 76: 12. Property, Plant and Equipment L

- Page 77 and 78: Total borrowing costs capitalized t

- Page 79 and 80: Bac-Man 3 Engineering Procurement a

- Page 81 and 82: 13. Goodwill and Intangible Assets

- Page 83 and 84: Carrying amount of exploration and

- Page 85 and 86: 2015 Long term receivables Input VA

- Page 87 and 88: The long-term debts are presented n

- Page 89 and 90: The Parent Company capitalized in i

- Page 91 and 92: ₱8.5 billion GCGI Term Loan On Ma

- Page 93 and 94: 19. Equity Capital Stock As require

- Page 95 and 96: On March 6, 2015, the BOD approved

- Page 97: US$14.0 million thereafter up to 20

- Page 101 and 102: Remuneration of Key Management Pers

- Page 103 and 104: Net retirement and other post-emplo

- Page 105 and 106: The following tables summarize the

- Page 107 and 108: The Company expects to contribute

- Page 109 and 110: Beginning of Year Charged to Income

- Page 111 and 112: f. g. h. i. j. k. On June 29, 2011,

- Page 113 and 114: Stock awards granted by the Committ

- Page 115 and 116: Foreign Currency Risk Foreign curre

- Page 117 and 118: US$ Japanese yen (JP¥) Sweden kron

- Page 119 and 120: 2015 Foreign Currency Appreciates (

- Page 121 and 122: The following tables demonstrate th

- Page 123 and 124: Financial Assets and Financial Liab

- Page 125 and 126: The Company classifies its financia

- Page 127 and 128: The table below shows the derivativ

- Page 129 and 130: Pertinent details of the IRS are as

- Page 131 and 132: The Company monitors capital using

- Page 133 and 134: Legal Claims The Company is conting

- Page 135 and 136: EDC also holds geothermal resource

- Page 137 and 138: As of December 31, 2016, the Compan

- Page 139 and 140: As of December 31, 2016, the Compan

- Page 141 and 142: Ancillary Services Procurement Agre

- Page 143 and 144: 41. ULGEI Power Supply Agreements A