EDC PR 2016 (FS section)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Current versus Non-current Classification<br />

The Company presents assets and liabilities in statement of financial position based on<br />

current/non-current classification. An asset as current when it is:<br />

Expected to be realized or intended to be sold or consumed in normal operating cycle;<br />

Held primarily for the purpose of trading;<br />

Expected to be realized within twelve months after the reporting period; or<br />

Cash or cash equivalent unless restricted from being exchanged or used to settle a liability for<br />

at least twelve months after the reporting period.<br />

All other assets are classified as non-current.<br />

A liability is current when:<br />

It is expected to be settled in normal operating cycle;<br />

It is held primarily for the purpose of trading;<br />

It is due to be settled within twelve months after the reporting period; or<br />

There is no unconditional right to defer the settlement of the liability for at least twelve<br />

months after the reporting period.<br />

The Company classifies all other liabilities as non-current. Deferred tax assets and liabilities are<br />

classified as non-current assets and liabilities.<br />

Foreign Currency Translations<br />

The consolidated financial statements are presented in Philippine Peso, which is also the Parent<br />

Company’s functional currency. Each entity within the Company determines its own functional<br />

currency and measures items included in their financial statements using that functional currency.<br />

Transactions in foreign currencies are initially recorded at the functional currency exchange rate<br />

prevailing at the date of transaction. Monetary assets and monetary liabilities denominated in<br />

foreign currencies are translated at the closing rate of exchange prevailing at financial reporting<br />

date. Non-monetary items that are measured in terms of historical cost in a foreign currency are<br />

translated using the exchange rates as at the dates of the initial transactions.<br />

Non-monetary items measured at fair value in a foreign currency are translated using the exchange<br />

rates at the date when the fair value was determined. Foreign exchange differences between the<br />

rate at transaction date and the rate at settlement date or financial reporting date are recognized in<br />

the profit or loss.<br />

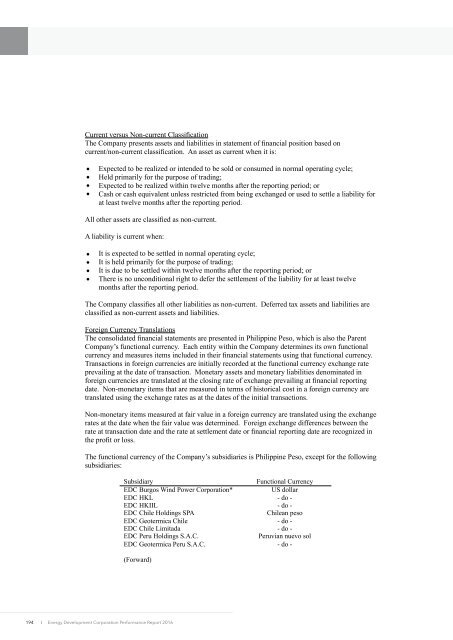

The functional currency of the Company’s subsidiaries is Philippine Peso, except for the following<br />

subsidiaries:<br />

Subsidiary<br />

Functional Currency<br />

<strong>EDC</strong> Burgos Wind Power Corporation*<br />

US dollar<br />

<strong>EDC</strong> HKL - do -<br />

<strong>EDC</strong> HKIIL - do -<br />

<strong>EDC</strong> Chile Holdings SPA<br />

Chilean peso<br />

<strong>EDC</strong> Geotermica Chile - do -<br />

<strong>EDC</strong> Chile Limitada - do -<br />

<strong>EDC</strong> Peru Holdings S.A.C.<br />

Peruvian nuevo sol<br />

<strong>EDC</strong> Geotermica Peru S.A.C. - do -<br />

(Forward)<br />

194<br />

I Energy Development Corporation Performance Report <strong>2016</strong>