EDC PR 2016 (FS section)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statement<br />

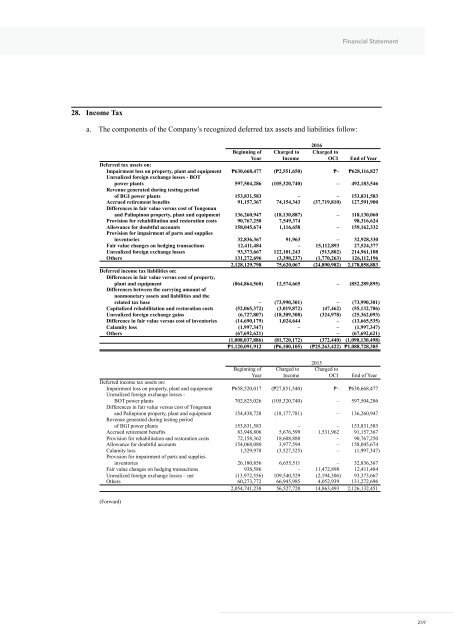

28. Income Tax<br />

a.<br />

The components of the Company’s recognized deferred tax assets and liabilities follow:<br />

<strong>2016</strong><br />

Beginning of<br />

Year<br />

Charged to<br />

Income<br />

Charged to<br />

OCI End of Year<br />

Deferred tax assets on:<br />

Impairment loss on property, plant and equipment ₱630,668,477 (₱2,551,650) ₱– ₱628,116,827<br />

Unrealized foreign exchange losses - BOT<br />

power plants 597,504,286 (105,320,740) – 492,183,546<br />

Revenue generated during testing period<br />

of BGI power plants 153,831,583 – – 153,831,583<br />

Accrued retirement benefits 91,157,367 74,154,343 (37,719,810) 127,591,900<br />

Differences in fair value versus cost of Tongonan<br />

and Palinpinon property, plant and equipment 136,260,947 (18,130,887) – 118,130,060<br />

Provision for rehabilitation and restoration costs 90,767,250 7,549,374 98,316,624<br />

Allowance for doubtful accounts 158,045,674 1,116,658 – 159,162,332<br />

Provision for impairment of parts and supplies<br />

inventories 32,836,367 91,963 – 32,928,330<br />

Fair value changes on hedging transactions 12,411,484 – 15,112,893 27,524,377<br />

Unrealized foreign exchange losses 93,373,667 122,101,243 (513,802) 214,961,108<br />

Others 131,272,696 (3,390,237) (1,770,263) 126,112,196<br />

2,128,129,798 75,620,067 (24,890,982) 2,178,858,883<br />

Deferred income tax liabilities on:<br />

Differences in fair value versus cost of property,<br />

plant and equipment (864,864,560) 12,574,665 – (852,289,895)<br />

Differences between the carrying amount of<br />

nonmonetary assets and liabilities and the<br />

related tax base – (73,990,301) – (73,990,301)<br />

Capitalized rehabilitation and restoration costs (52,065,372) (3,019,872) (47,462) (55,132,706)<br />

Unrealized foreign exchange gains (6,727,807) (18,309,308) (324,978) (25,362,093)<br />

Difference in fair value versus cost of inventories (14,690,179) 1,024,644 – (13,665,535)<br />

Calamity loss (1,997,347) – – (1,997,347)<br />

Others (67,692,621) – (67,692,621)<br />

(1,008,037,886) (81,720,172) (372,440) (1,090,130,498)<br />

₱1,120,091,912 (₱6,100,105) (₱25,263,422) ₱1,088,728,385<br />

2015<br />

Beginning of<br />

Year<br />

Charged to<br />

Income<br />

Charged to<br />

OCI End of Year<br />

Deferred income tax assets on:<br />

Impairment loss on property, plant and equipment ₱658,520,017 (₱27,851,540) ₱– ₱630,668,477<br />

Unrealized foreign exchange losses -<br />

BOT power plants 702,825,026 (105,320,740) – 597,504,286<br />

Differences in fair value versus cost of Tongonan<br />

and Palinpinon property, plant and equipment 154,438,728 (18,177,781) – 136,260,947<br />

Revenue generated during testing period<br />

of BGI power plants 153,831,583 – – 153,831,583<br />

Accrued retirement benefits 83,948,806 5,676,599 1,531,962 91,157,367<br />

Provision for rehabilitation and restoration costs 72,158,362 18,608,888 – 90,767,250<br />

Allowance for doubtful accounts 154,068,080 3,977,594 – 158,045,674<br />

Calamity loss 1,529,978 (3,527,325) – (1,997,347)<br />

Provision for impairment of parts and supplies<br />

inventories 26,180,856 6,655,511 – 32,836,367<br />

Fair value changes on hedging transactions 938,586 – 11,472,898 12,411,484<br />

Unrealized foreign exchange losses – net (13,972,556) 109,540,529 (2,194,306) 93,373,667<br />

Others 60,273,772 66,945,985 4,052,939 131,272,696<br />

2,054,741,238 56,527,720 14,863,493 2,126,132,451<br />

(Forward)<br />

259