EDC PR 2016 (FS section)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

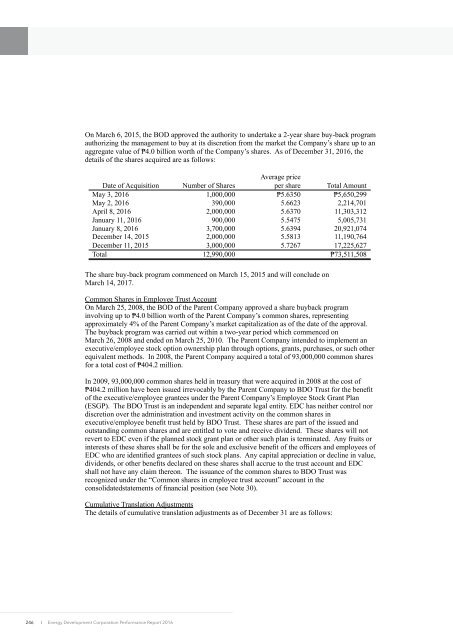

On March 6, 2015, the BOD approved the authority to undertake a 2-year share buy-back program<br />

authorizing the management to buy at its discretion from the market the Company’s share up to an<br />

aggregate value of ₱4.0 billion worth of the Company’s shares. As of December 31, <strong>2016</strong>, the<br />

details of the shares acquired are as follows:<br />

Date of Acquisition Number of Shares<br />

Average price<br />

per share Total Amount<br />

May 3, <strong>2016</strong> 1,000,000 ₱5.6350 ₱5,650,299<br />

May 2, <strong>2016</strong> 390,000 5.6623 2,214,701<br />

April 8, <strong>2016</strong> 2,000,000 5.6370 11,303,312<br />

January 11, <strong>2016</strong> 900,000 5.5475 5,005,731<br />

January 8, <strong>2016</strong> 3,700,000 5.6394 20,921,074<br />

December 14, 2015 2,000,000 5.5813 11,190,764<br />

December 11, 2015 3,000,000 5.7267 17,225,627<br />

Total 12,990,000 ₱73,511,508<br />

The share buy-back program commenced on March 15, 2015 and will conclude on<br />

March 14, 2017.<br />

Common Shares in Employee Trust Account<br />

On March 25, 2008, the BOD of the Parent Company approved a share buyback program<br />

involving up to ₱4.0 billion worth of the Parent Company’s common shares, representing<br />

approximately 4% of the Parent Company’s market capitalization as of the date of the approval.<br />

The buyback program was carried out within a two-year period which commenced on<br />

March 26, 2008 and ended on March 25, 2010. The Parent Company intended to implement an<br />

executive/employee stock option ownership plan through options, grants, purchases, or such other<br />

equivalent methods. In 2008, the Parent Company acquired a total of 93,000,000 common shares<br />

for a total cost of ₱404.2 million.<br />

In 2009, 93,000,000 common shares held in treasury that were acquired in 2008 at the cost of<br />

₱404.2 million have been issued irrevocably by the Parent Company to BDO Trust for the benefit<br />

of the executive/employee grantees under the Parent Company’s Employee Stock Grant Plan<br />

(ESGP). The BDO Trust is an independent and separate legal entity. <strong>EDC</strong> has neither control nor<br />

discretion over the administration and investment activity on the common shares in<br />

executive/employee benefit trust held by BDO Trust. These shares are part of the issued and<br />

outstanding common shares and are entitled to vote and receive dividend. These shares will not<br />

revert to <strong>EDC</strong> even if the planned stock grant plan or other such plan is terminated. Any fruits or<br />

interests of these shares shall be for the sole and exclusive benefit of the officers and employees of<br />

<strong>EDC</strong> who are identified grantees of such stock plans. Any capital appreciation or decline in value,<br />

dividends, or other benefits declared on these shares shall accrue to the trust account and <strong>EDC</strong><br />

shall not have any claim thereon. The issuance of the common shares to BDO Trust was<br />

recognized under the “Common shares in employee trust account” account in the<br />

consolidatedstatements of financial position (see Note 30).<br />

Cumulative Translation Adjustments<br />

The details of cumulative translation adjustments as of December 31 are as follows:<br />

246<br />

I Energy Development Corporation Performance Report <strong>2016</strong>