EDC PR 2016 (FS section)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statement<br />

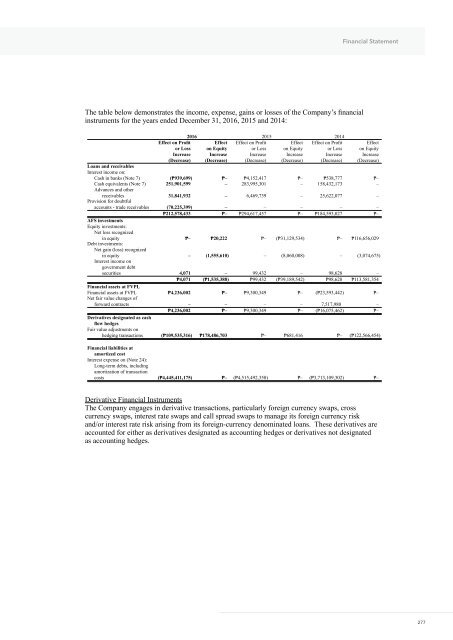

The table below demonstrates the income, expense, gains or losses of the Company’s financial<br />

instruments for the years ended December 31, <strong>2016</strong>, 2015 and 2014:<br />

<strong>2016</strong> 2015 2014<br />

Effect on Profit<br />

or Loss<br />

Increase<br />

(Decrease)<br />

Effect<br />

on Equity<br />

Increase<br />

(Decrease)<br />

Effect on Profit<br />

or Loss<br />

Increase<br />

(Decrease)<br />

Effect<br />

on Equity<br />

Increase<br />

(Decrease)<br />

Effect on Profit<br />

or Loss<br />

Increase<br />

(Decrease)<br />

Effect<br />

on Equity<br />

Increase<br />

(Decrease)<br />

Loans and receivables<br />

Interest income on:<br />

Cash in banks (Note 7) (₱939,699) ₱– ₱4,152,417 ₱– ₱538,777 ₱–<br />

Cash equivalents (Note 7) 251,901,599 – 283,995,301 – 158,432,173 –<br />

Advances and other<br />

receivables 31,841,932 – 6,469,739 – 25,622,077 –<br />

Provision for doubtful<br />

accounts - trade receivables (70,225,399) – – – – –<br />

₱212,578,433 ₱– ₱294,617,457 ₱– ₱184,593,027 ₱–<br />

A<strong>FS</strong> investments<br />

Equity investments:<br />

Net loss recognized<br />

in equity ₱– ₱20,222 ₱– (₱31,129,534) ₱– ₱116,656,029<br />

Debt investments:<br />

Net gain (loss) recognized<br />

in equity – (1,555,610) – (8,060,008) – (3,074,675)<br />

Interest income on<br />

government debt<br />

securities 4,071 – 99,432 – 98,628 –<br />

₱4,071 (₱1,535,388) ₱99,432 (₱39,189,542) ₱98,628 ₱113,581,354<br />

Financial assets at FVPL<br />

Financial assets at FVPL ₱4,236,002 ₱– ₱9,300,349 ₱– (₱23,593,442) ₱–<br />

Net fair value changes of<br />

forward contracts – – – – 7,517,980 –<br />

₱4,236,002 ₱– ₱9,300,349 ₱– (₱16,075,462) ₱–<br />

Derivatives designated as cash<br />

flow hedges<br />

Fair value adjustments on<br />

hedging transactions (₱109,535,316) ₱178,486,703 ₱– ₱681,416 ₱– (₱122,566,454)<br />

Financial liabilities at<br />

amortized cost<br />

Interest expense on (Note 24):<br />

Long-term debts, including<br />

amortization of transaction<br />

costs (₱4,445,411,175) ₱– (₱4,515,492,350) ₱– (₱3,713,109,302) ₱–<br />

Derivative Financial Instruments<br />

The Company engages in derivative transactions, particularly foreign currency swaps, cross<br />

currency swaps, interest rate swaps and call spread swaps to manage its foreign currency risk<br />

and/or interest rate risk arising from its foreign-currency denominated loans. These derivatives are<br />

accounted for either as derivatives designated as accounting hedges or derivatives not designated<br />

as accounting hedges.<br />

277