EDC PR 2016 (FS section)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Statement<br />

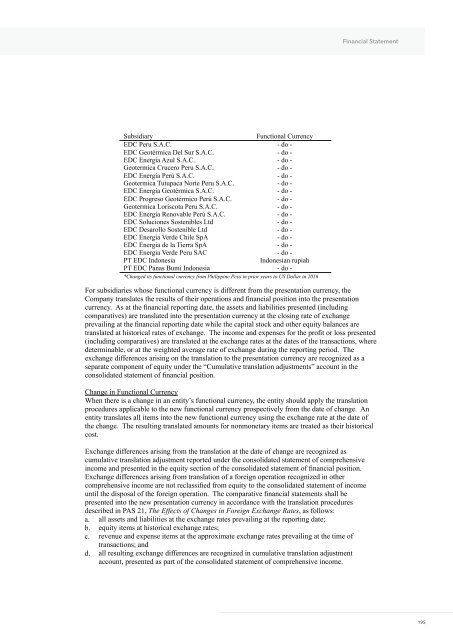

Subsidiary<br />

Functional Currency<br />

<strong>EDC</strong> Peru S.A.C. - do -<br />

<strong>EDC</strong> Geotérmica Del Sur S.A.C. - do -<br />

<strong>EDC</strong> Energía Azul S.A.C. - do -<br />

Geotermica Crucero Peru S.A.C. - do -<br />

<strong>EDC</strong> Energía Perú S.A.C. - do -<br />

Geotermica Tutupaca Norte Peru S.A.C. - do -<br />

<strong>EDC</strong> Energía Geotérmica S.A.C. - do -<br />

<strong>EDC</strong> Progreso Geotérmico Perú S.A.C. - do -<br />

Geotermica Loriscota Peru S.A.C. - do -<br />

<strong>EDC</strong> Energía Renovable Perú S.A.C. - do -<br />

<strong>EDC</strong> Soluciones Sostenibles Ltd - do -<br />

<strong>EDC</strong> Desarollo Sostenible Ltd - do -<br />

<strong>EDC</strong> Energia Verde Chile SpA - do -<br />

<strong>EDC</strong> Energia de la Tierra SpA - do -<br />

<strong>EDC</strong> Energia Verde Peru SAC - do -<br />

PT <strong>EDC</strong> Indonesia<br />

Indonesian rupiah<br />

PT <strong>EDC</strong> Panas Bumi Indonesia - do -<br />

*Changed its functional currency from Philippine Peso in prior years to US Dollar in <strong>2016</strong><br />

For subsidiaries whose functional currency is different from the presentation currency, the<br />

Company translates the results of their operations and financial position into the presentation<br />

currency. As at the financial reporting date, the assets and liabilities presented (including<br />

comparatives) are translated into the presentation currency at the closing rate of exchange<br />

prevailing at the financial reporting date while the capital stock and other equity balances are<br />

translated at historical rates of exchange. The income and expenses for the profit or loss presented<br />

(including comparatives) are translated at the exchange rates at the dates of the transactions, where<br />

determinable, or at the weighted average rate of exchange during the reporting period. The<br />

exchange differences arising on the translation to the presentation currency are recognized as a<br />

separate component of equity under the “Cumulative translation adjustments” account in the<br />

consolidated statement of financial position.<br />

Change in Functional Currency<br />

When there is a change in an entity’s functional currency, the entity should apply the translation<br />

procedures applicable to the new functional currency prospectively from the date of change. An<br />

entity translates all items into the new functional currency using the exchange rate at the date of<br />

the change. The resulting translated amounts for nonmonetary items are treated as their historical<br />

cost.<br />

Exchange differences arising from the translation at the date of change are recognized as<br />

cumulative translation adjustment reported under the consolidated statement of comprehensive<br />

income and presented in the equity <strong>section</strong> of the consolidated statement of financial position.<br />

Exchange differences arising from translation of a foreign operation recognized in other<br />

comprehensive income are not reclassified from equity to the consolidated statement of income<br />

until the disposal of the foreign operation. The comparative financial statements shall be<br />

presented into the new presentation currency in accordance with the translation procedures<br />

described in PAS 21, The Effects of Changes in Foreign Exchange Rates, as follows:<br />

a.<br />

b.<br />

c.<br />

d.<br />

all assets and liabilities at the exchange rates prevailing at the reporting date;<br />

equity items at historical exchange rates;<br />

revenue and expense items at the approximate exchange rates prevailing at the time of<br />

transactions; and<br />

all resulting exchange differences are recognized in cumulative translation adjustment<br />

account, presented as part of the consolidated statement of comprehensive income.<br />

195