Financial Statement 28. Income Tax a. The components of the Company’s recognized deferred tax assets and liabilities follow: <strong>2016</strong> Beginning of Year Charged to Income Charged to OCI End of Year Deferred tax assets on: Impairment loss on property, plant and equipment ₱630,668,477 (₱2,551,650) ₱– ₱628,116,827 Unrealized foreign exchange losses - BOT power plants 597,504,286 (105,320,740) – 492,183,546 Revenue generated during testing period of BGI power plants 153,831,583 – – 153,831,583 Accrued retirement benefits 91,157,367 74,154,343 (37,719,810) 127,591,900 Differences in fair value versus cost of Tongonan and Palinpinon property, plant and equipment 136,260,947 (18,130,887) – 118,130,060 Provision for rehabilitation and restoration costs 90,767,250 7,549,374 98,316,624 Allowance for doubtful accounts 158,045,674 1,116,658 – 159,162,332 Provision for impairment of parts and supplies inventories 32,836,367 91,963 – 32,928,330 Fair value changes on hedging transactions 12,411,484 – 15,112,893 27,524,377 Unrealized foreign exchange losses 93,373,667 122,101,243 (513,802) 214,961,108 Others 131,272,696 (3,390,237) (1,770,263) 126,112,196 2,128,129,798 75,620,067 (24,890,982) 2,178,858,883 Deferred income tax liabilities on: Differences in fair value versus cost of property, plant and equipment (864,864,560) 12,574,665 – (852,289,895) Differences between the carrying amount of nonmonetary assets and liabilities and the related tax base – (73,990,301) – (73,990,301) Capitalized rehabilitation and restoration costs (52,065,372) (3,019,872) (47,462) (55,132,706) Unrealized foreign exchange gains (6,727,807) (18,309,308) (324,978) (25,362,093) Difference in fair value versus cost of inventories (14,690,179) 1,024,644 – (13,665,535) Calamity loss (1,997,347) – – (1,997,347) Others (67,692,621) – (67,692,621) (1,008,037,886) (81,720,172) (372,440) (1,090,130,498) ₱1,120,091,912 (₱6,100,105) (₱25,263,422) ₱1,088,728,385 2015 Beginning of Year Charged to Income Charged to OCI End of Year Deferred income tax assets on: Impairment loss on property, plant and equipment ₱658,520,017 (₱27,851,540) ₱– ₱630,668,477 Unrealized foreign exchange losses - BOT power plants 702,825,026 (105,320,740) – 597,504,286 Differences in fair value versus cost of Tongonan and Palinpinon property, plant and equipment 154,438,728 (18,177,781) – 136,260,947 Revenue generated during testing period of BGI power plants 153,831,583 – – 153,831,583 Accrued retirement benefits 83,948,806 5,676,599 1,531,962 91,157,367 Provision for rehabilitation and restoration costs 72,158,362 18,608,888 – 90,767,250 Allowance for doubtful accounts 154,068,080 3,977,594 – 158,045,674 Calamity loss 1,529,978 (3,527,325) – (1,997,347) Provision for impairment of parts and supplies inventories 26,180,856 6,655,511 – 32,836,367 Fair value changes on hedging transactions 938,586 – 11,472,898 12,411,484 Unrealized foreign exchange losses – net (13,972,556) 109,540,529 (2,194,306) 93,373,667 Others 60,273,772 66,945,985 4,052,939 131,272,696 2,054,741,238 56,527,720 14,863,493 2,126,132,451 (Forward) 259

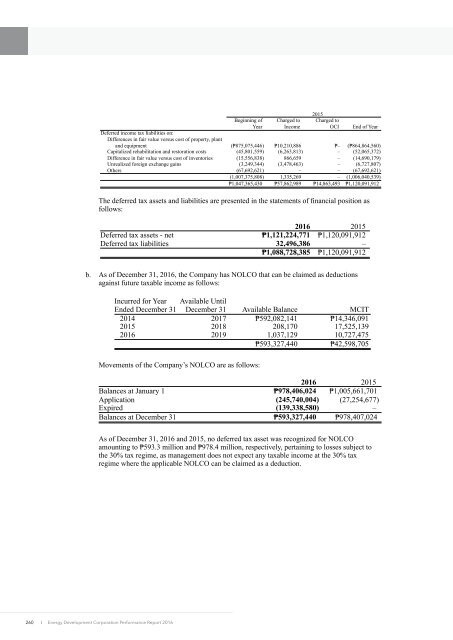

Beginning of Year Charged to Income 2015 Charged to OCI End of Year Deferred income tax liabilities on: Differences in fair value versus cost of property, plant and equipment (₱875,075,446) ₱10,210,886 ₱– (₱864,864,560) Capitalized rehabilitation and restoration costs (45,801,559) (6,263,813) – (52,065,372) Difference in fair value versus cost of inventories (15,556,838) 866,659 – (14,690,179) Unrealized foreign exchange gains (3,249,344) (3,478,463) – (6,727,807) Others (67,692,621) – – (67,692,621) (1,007,375,808) 1,335,269 – (1,006,040,539) ₱1,047,365,430 ₱57,862,989 ₱14,863,493 ₱1,120,091,912 The deferred tax assets and liabilities are presented in the statements of financial position as follows: <strong>2016</strong> 2015 Deferred tax assets - net ₱1,121,224,771 ₱1,120,091,912 Deferred tax liabilities 32,496,386 – ₱1,088,728,385 ₱1,120,091,912 b. As of December 31, <strong>2016</strong>, the Company has NOLCO that can be claimed as deductions against future taxable income as follows: Incurred for Year Ended December 31 Available Until December 31 Available Balance MCIT 2014 2017 ₱592,082,141 ₱14,346,091 2015 2018 208,170 17,525,139 <strong>2016</strong> 2019 1,037,129 10,727,475 ₱593,327,440 ₱42,598,705 Movements of the Company’s NOLCO are as follows: <strong>2016</strong> 2015 Balances at January 1 ₱978,406,024 ₱1,005,661,701 Application (245,740,004) (27,254,677) Expired (139,338,580) – Balances at December 31 ₱593,327,440 ₱978,407,024 As of December 31, <strong>2016</strong> and 2015, no deferred tax asset was recognized for NOLCO amounting to ₱593.3 million and ₱978.4 million, respectively, pertaining to losses subject to the 30% tax regime, as management does not expect any taxable income at the 30% tax regime where the applicable NOLCO can be claimed as a deduction. 260 I Energy Development Corporation Performance Report <strong>2016</strong>

- Page 1 and 2:

2016 Audited Consolidated Financial

- Page 3 and 4:

Compliance • We have monitored th

- Page 5 and 6:

156 I Energy Development Corporatio

- Page 7 and 8:

We have fulfilled the responsibilit

- Page 9 and 10:

Those charged with governance are r

- Page 11 and 12:

ENERGY DEVELOPMENT CORPORATION (A S

- Page 13 and 14:

ENERGY DEVELOPMENT CORPORATION (A S

- Page 15 and 16:

ENERGY DEVELOPMENT CORPORATION (A S

- Page 17 and 18:

Preferred Stock (Note 19) Common St

- Page 19 and 20:

Years Ended December 31 2016 2015 2

- Page 21 and 22:

Southern Negros, Valencia, Negros O

- Page 23 and 24:

EDC Drillco EDC Drillco is a compan

- Page 25 and 26:

Geotermica Chile SPA also incorpora

- Page 27 and 28:

Authorization for Issuance of the C

- Page 29 and 30:

These amendments are applied prospe

- Page 31 and 32:

Applicability of IFRIC 12, Service

- Page 33 and 34:

In August 2013, EDC Geotermica SpA

- Page 35 and 36:

Fair Value Measurement of Financial

- Page 37 and 38:

In 2011, EDC recognized full impair

- Page 39 and 40:

The factors that the Company consid

- Page 41 and 42:

Recognition of Deferred Income Tax

- Page 43 and 44:

Current versus Non-current Classifi

- Page 45 and 46:

In 2015, the functional currency of

- Page 47 and 48:

Construction in progress represents

- Page 49 and 50:

would have been determined, net of

- Page 51 and 52:

Classified under loans and receivab

- Page 53 and 54:

Derivative financial instruments ar

- Page 55 and 56:

the allowance account. Any subseque

- Page 57 and 58: maturity or expected disposal date

- Page 59 and 60: has expired, as well as the Parent

- Page 61 and 62: Proceeds from Insurance Claims Proc

- Page 63 and 64: Future Changes in Accounting Polici

- Page 65 and 66: The Company is currently assessing

- Page 67 and 68: oader review of the research projec

- Page 69 and 70: LGBU NIGBU BGBU MAGBU Pantabangan/

- Page 71 and 72: 7. Trade and Other Receivables 2016

- Page 73 and 74: The movements of the net accumulate

- Page 75 and 76: 12. Property, Plant and Equipment L

- Page 77 and 78: Total borrowing costs capitalized t

- Page 79 and 80: Bac-Man 3 Engineering Procurement a

- Page 81 and 82: 13. Goodwill and Intangible Assets

- Page 83 and 84: Carrying amount of exploration and

- Page 85 and 86: 2015 Long term receivables Input VA

- Page 87 and 88: The long-term debts are presented n

- Page 89 and 90: The Parent Company capitalized in i

- Page 91 and 92: ₱8.5 billion GCGI Term Loan On Ma

- Page 93 and 94: 19. Equity Capital Stock As require

- Page 95 and 96: On March 6, 2015, the BOD approved

- Page 97 and 98: US$14.0 million thereafter up to 20

- Page 99 and 100: Transactions for the years ended De

- Page 101 and 102: Remuneration of Key Management Pers

- Page 103 and 104: Net retirement and other post-emplo

- Page 105 and 106: The following tables summarize the

- Page 107: The Company expects to contribute

- Page 111 and 112: f. g. h. i. j. k. On June 29, 2011,

- Page 113 and 114: Stock awards granted by the Committ

- Page 115 and 116: Foreign Currency Risk Foreign curre

- Page 117 and 118: US$ Japanese yen (JP¥) Sweden kron

- Page 119 and 120: 2015 Foreign Currency Appreciates (

- Page 121 and 122: The following tables demonstrate th

- Page 123 and 124: Financial Assets and Financial Liab

- Page 125 and 126: The Company classifies its financia

- Page 127 and 128: The table below shows the derivativ

- Page 129 and 130: Pertinent details of the IRS are as

- Page 131 and 132: The Company monitors capital using

- Page 133 and 134: Legal Claims The Company is conting

- Page 135 and 136: EDC also holds geothermal resource

- Page 137 and 138: As of December 31, 2016, the Compan

- Page 139 and 140: As of December 31, 2016, the Compan

- Page 141 and 142: Ancillary Services Procurement Agre

- Page 143 and 144: 41. ULGEI Power Supply Agreements A