EDC PR 2016 (FS section)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

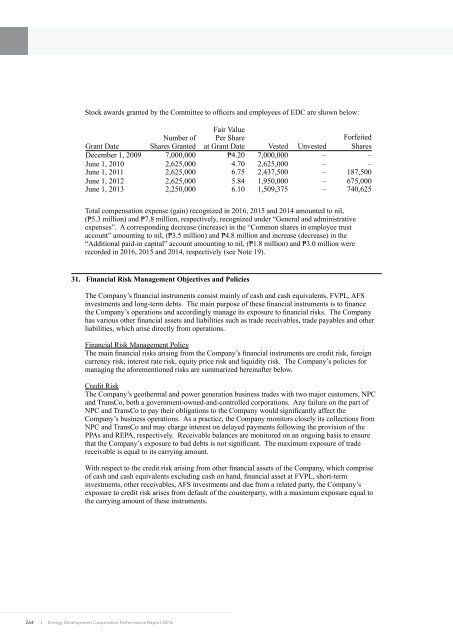

Stock awards granted by the Committee to officers and employees of <strong>EDC</strong> are shown below:<br />

Grant Date<br />

Number of<br />

Shares Granted<br />

Fair Value<br />

Per Share<br />

at Grant Date Vested Unvested<br />

Forfeited<br />

Shares<br />

December 1, 2009 7,000,000 ₱4.20 7,000,000 – –<br />

June 1, 2010 2,625,000 4.70 2,625,000 – –<br />

June 1, 2011 2,625,000 6.75 2,437,500 – 187,500<br />

June 1, 2012 2,625,000 5.84 1,950,000 – 675,000<br />

June 1, 2013 2,250,000 6.10 1,509,375 – 740,625<br />

Total compensation expense (gain) recognized in <strong>2016</strong>, 2015 and 2014 amounted to nil,<br />

(₱5.3 million) and ₱7.8 million, respectively, recognized under “General and administrative<br />

expenses”. A corresponding decrease (increase) in the “Common shares in employee trust<br />

account” amounting to nil, (₱3.5 million) and ₱4.8 million and increase (decrease) in the<br />

“Additional paid-in capital” account amounting to nil, (₱1.8 million) and ₱3.0 million were<br />

recorded in <strong>2016</strong>, 2015 and 2014, respectively (see Note 19).<br />

31. Financial Risk Management Objectives and Policies<br />

The Company’s financial instruments consist mainly of cash and cash equivalents, FVPL, A<strong>FS</strong><br />

investments and long-term debts. The main purpose of these financial instruments is to finance<br />

the Company’s operations and accordingly manage its exposure to financial risks. The Company<br />

has various other financial assets and liabilities such as trade receivables, trade payables and other<br />

liabilities, which arise directly from operations.<br />

Financial Risk Management Policy<br />

The main financial risks arising from the Company’s financial instruments are credit risk, foreign<br />

currency risk, interest rate risk, equity price risk and liquidity risk. The Company’s policies for<br />

managing the aforementioned risks are summarized hereinafter below.<br />

Credit Risk<br />

The Company’s geothermal and power generation business trades with two major customers, NPC<br />

and TransCo, both a government-owned-and-controlled corporations. Any failure on the part of<br />

NPC and TransCo to pay their obligations to the Company would significantly affect the<br />

Company’s business operations. As a practice, the Company monitors closely its collections from<br />

NPC and TransCo and may charge interest on delayed payments following the provision of the<br />

PPAs and REPA, respectively. Receivable balances are monitored on an ongoing basis to ensure<br />

that the Company’s exposure to bad debts is not significant. The maximum exposure of trade<br />

receivable is equal to its carrying amount.<br />

With respect to the credit risk arising from other financial assets of the Company, which comprise<br />

of cash and cash equivalents excluding cash on hand, financial asset at FVPL, short-term<br />

investments, other receivables, A<strong>FS</strong> investments and due from a related party, the Company’s<br />

exposure to credit risk arises from default of the counterparty, with a maximum exposure equal to<br />

the carrying amount of these instruments.<br />

264<br />

I Energy Development Corporation Performance Report <strong>2016</strong>