EDC PR 2016 (FS section)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

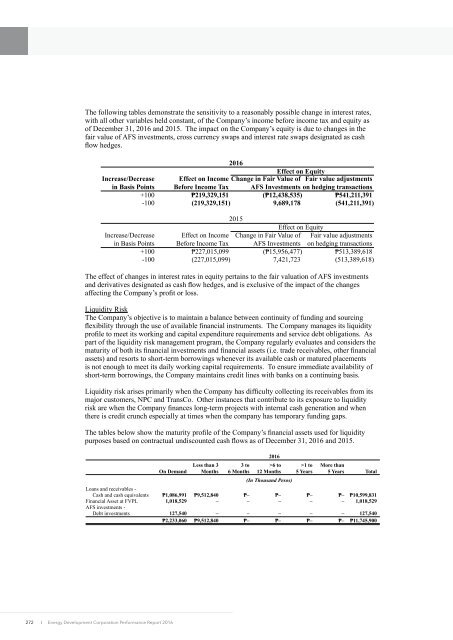

The following tables demonstrate the sensitivity to a reasonably possible change in interest rates,<br />

with all other variables held constant, of the Company’s income before income tax and equity as<br />

of December 31, <strong>2016</strong> and 2015. The impact on the Company’s equity is due to changes in the<br />

fair value of A<strong>FS</strong> investments, cross currency swaps and interest rate swaps designated as cash<br />

flow hedges.<br />

<strong>2016</strong><br />

Effect on Equity<br />

Increase/Decrease Effect on Income Change in Fair Value of Fair value adjustments<br />

in Basis Points Before Income Tax A<strong>FS</strong> Investments on hedging transactions<br />

+100 ₱219,329,151 (₱12,438,535) ₱541,211,391<br />

-100 (219,329,151) 9,689,178 (541,211,391)<br />

2015<br />

Effect on Equity<br />

Increase/Decrease<br />

in Basis Points<br />

Effect on Income<br />

Before Income Tax<br />

Change in Fair Value of<br />

A<strong>FS</strong> Investments<br />

Fair value adjustments<br />

on hedging transactions<br />

+100 ₱227,015,099 (₱15,956,477) ₱513,389,618<br />

-100 (227,015,099) 7,421,723 (513,389,618)<br />

The effect of changes in interest rates in equity pertains to the fair valuation of A<strong>FS</strong> investments<br />

and derivatives designated as cash flow hedges, and is exclusive of the impact of the changes<br />

affecting the Company’s profit or loss.<br />

Liquidity Risk<br />

The Company’s objective is to maintain a balance between continuity of funding and sourcing<br />

flexibility through the use of available financial instruments. The Company manages its liquidity<br />

profile to meet its working and capital expenditure requirements and service debt obligations. As<br />

part of the liquidity risk management program, the Company regularly evaluates and considers the<br />

maturity of both its financial investments and financial assets (i.e. trade receivables, other financial<br />

assets) and resorts to short-term borrowings whenever its available cash or matured placements<br />

is not enough to meet its daily working capital requirements. To ensure immediate availability of<br />

short-term borrowings, the Company maintains credit lines with banks on a continuing basis.<br />

Liquidity risk arises primarily when the Company has difficulty collecting its receivables from its<br />

major customers, NPC and TransCo. Other instances that contribute to its exposure to liquidity<br />

risk are when the Company finances long-term projects with internal cash generation and when<br />

there is credit crunch especially at times when the company has temporary funding gaps.<br />

The tables below show the maturity profile of the Company’s financial assets used for liquidity<br />

purposes based on contractual undiscounted cash flows as of December 31, <strong>2016</strong> and 2015.<br />

On Demand<br />

Less than 3<br />

Months<br />

3 to<br />

6 Months<br />

<strong>2016</strong><br />

>6 to<br />

12 Months<br />

(In Thousand Pesos)<br />

>1 to<br />

5 Years<br />

More than<br />

5 Years Total<br />

Loans and receivables -<br />

Cash and cash equivalents ₱1,086,991 ₱9,512,840 ₱– ₱– ₱– ₱– ₱10,599,831<br />

Financial Asset at FVPL 1,018,529 – – – – – 1,018,529<br />

A<strong>FS</strong> investments -<br />

Debt investments 127,540 – – – – – 127,540<br />

₱2,233,060 ₱9,512,840 ₱– ₱– ₱– ₱– ₱11,745,900<br />

272<br />

I Energy Development Corporation Performance Report <strong>2016</strong>