EDC PR 2016 (FS section)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

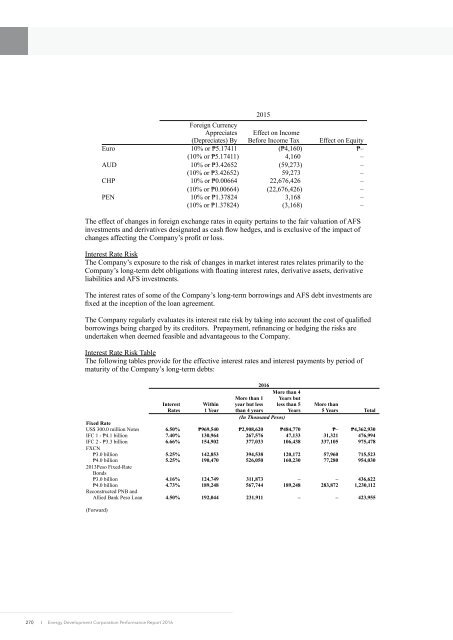

2015<br />

Foreign Currency<br />

Appreciates<br />

(Depreciates) By<br />

Effect on Income<br />

Before Income Tax Effect on Equity<br />

Euro 10% or ₱5.17411 (₱4,160) ₱–<br />

(10% or ₱5.17411) 4,160 –<br />

AUD 10% or ₱3.42652 (59,273) –<br />

(10% or ₱3.42652) 59,273 –<br />

CHP 10% or ₱0.00664 22,676,426 –<br />

(10% or ₱0.00664) (22,676,426) –<br />

PEN 10% or ₱1.37824 3,168 –<br />

(10% or ₱1.37824) (3,168) –<br />

The effect of changes in foreign exchange rates in equity pertains to the fair valuation of A<strong>FS</strong><br />

investments and derivatives designated as cash flow hedges, and is exclusive of the impact of<br />

changes affecting the Company’s profit or loss.<br />

Interest Rate Risk<br />

The Company’s exposure to the risk of changes in market interest rates relates primarily to the<br />

Company’s long-term debt obligations with floating interest rates, derivative assets, derivative<br />

liabilities and A<strong>FS</strong> investments.<br />

The interest rates of some of the Company’s long-term borrowings and A<strong>FS</strong> debt investments are<br />

fixed at the inception of the loan agreement.<br />

The Company regularly evaluates its interest rate risk by taking into account the cost of qualified<br />

borrowings being charged by its creditors. Prepayment, refinancing or hedging the risks are<br />

undertaken when deemed feasible and advantageous to the Company.<br />

Interest Rate Risk Table<br />

The following tables provide for the effective interest rates and interest payments by period of<br />

maturity of the Company’s long-term debts:<br />

Interest<br />

Rates<br />

Within<br />

1 Year<br />

<strong>2016</strong><br />

More than 1<br />

year but less<br />

than 4 years<br />

More than 4<br />

Years but<br />

less than 5<br />

Years<br />

More than<br />

5 Years Total<br />

(In Thousand Pesos)<br />

Fixed Rate<br />

US$ 300.0 million Notes 6.50% ₱969,540 ₱2,908,620 ₱484,770 ₱– ₱4,362,930<br />

IFC 1 - ₱4.1 billion 7.40% 130,964 267,576 47,133 31,321 476,994<br />

IFC 2 - ₱3.3 billion 6.66% 154,902 377,033 106,438 337,105 975,478<br />

FXCN<br />

₱3.0 billion 5.25% 142,853 394,538 120,172 57,960 715,523<br />

₱4.0 billion 5.25% 190,470 526,050 160,230 77,280 954,030<br />

2013Peso Fixed-Rate<br />

Bonds<br />

₱3.0 billion 4.16% 124,749 311,873 – – 436,622<br />

₱4.0 billion 4.73% 189,248 567,744 189,248 283,872 1,230,112<br />

Reconstructed PNB and<br />

Allied Bank Peso Loan 4.50% 192,044 231,911 – – 423,955<br />

(Forward)<br />

270<br />

I Energy Development Corporation Performance Report <strong>2016</strong>