EDC PR 2016 (FS section)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

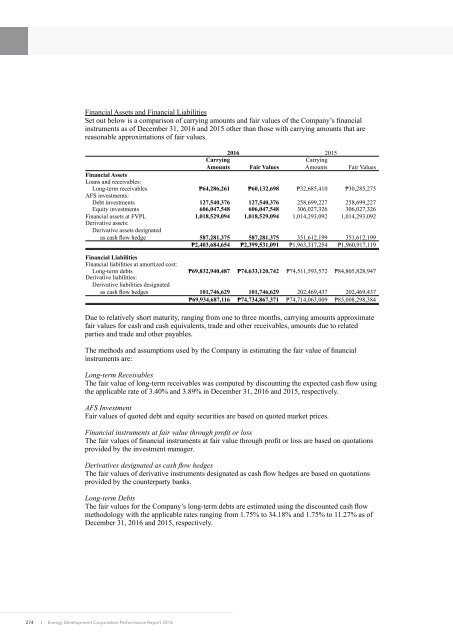

Financial Assets and Financial Liabilities<br />

Set out below is a comparison of carrying amounts and fair values of the Company’s financial<br />

instruments as of December 31, <strong>2016</strong> and 2015 other than those with carrying amounts that are<br />

reasonable approximations of fair values.<br />

<strong>2016</strong> 2015<br />

Carrying<br />

Amounts Fair Values<br />

Carrying<br />

Amounts Fair Values<br />

Financial Assets<br />

Loans and receivables:<br />

Long-term receivables ₱64,286,261 ₱60,132,698 ₱32,685,410 ₱30,285,275<br />

A<strong>FS</strong> investments:<br />

Debt investments 127,540,376 127,540,376 258,699,227 258,699,227<br />

Equity investments 606,047,548 606,047,548 306,027,326 306,027,326<br />

Financial assets at FVPL 1,018,529,094 1,018,529,094 1,014,293,092 1,014,293,092<br />

Derivative assets:<br />

Derivative assets designated<br />

as cash flow hedge 587,281,375 587,281,375 351,612,199 351,612,199<br />

₱2,403,684,654 ₱2,399,531,091 ₱1,963,317,254 ₱1,960,917,119<br />

Financial Liabilities<br />

Financial liabilities at amortized cost:<br />

Long-term debts ₱69,832,940,487 ₱74,633,120,742 ₱74,511,593,572 ₱84,805,828,947<br />

Derivative liabilities:<br />

Derivative liabilities designated<br />

as cash flow hedges 101,746,629 101,746,629 202,469,437 202,469,437<br />

₱69,934,687,116 ₱74,734,867,371 ₱74,714,063,009 ₱85,008,298,384<br />

Due to relatively short maturity, ranging from one to three months, carrying amounts approximate<br />

fair values for cash and cash equivalents, trade and other receivables, amounts due to related<br />

parties and trade and other payables.<br />

The methods and assumptions used by the Company in estimating the fair value of financial<br />

instruments are:<br />

Long-term Receivables<br />

The fair value of long-term receivables was computed by discounting the expected cash flow using<br />

the applicable rate of 3.40% and 3.89% in December 31, <strong>2016</strong> and 2015, respectively.<br />

A<strong>FS</strong> Investment<br />

Fair values of quoted debt and equity securities are based on quoted market prices.<br />

Financial instruments at fair value through profit or loss<br />

The fair values of financial instruments at fair value through profit or loss are based on quotations<br />

provided by the investment manager.<br />

Derivatives designated as cash flow hedges<br />

The fair values of derivative instruments designated as cash flow hedges are based on quotations<br />

provided by the counterparty banks.<br />

Long-term Debts<br />

The fair values for the Company’s long-term debts are estimated using the discounted cash flow<br />

methodology with the applicable rates ranging from 1.75% to 34.18% and 1.75% to 11.27% as of<br />

December 31, <strong>2016</strong> and 2015, respectively.<br />

274<br />

I Energy Development Corporation Performance Report <strong>2016</strong>