EDC PR 2016 (FS section)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

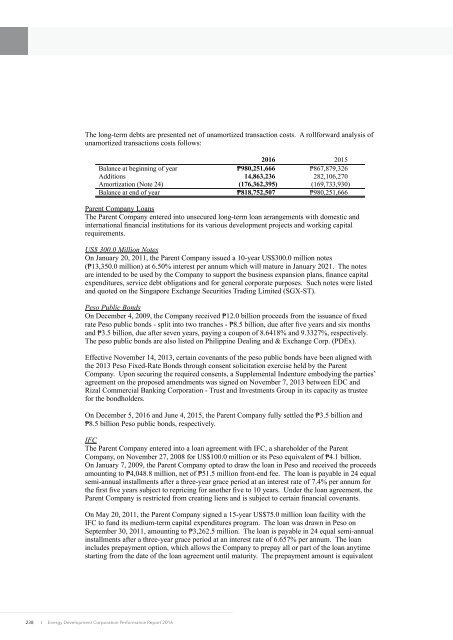

The long-term debts are presented net of unamortized transaction costs. A rollforward analysis of<br />

unamortized transactions costs follows:<br />

<strong>2016</strong> 2015<br />

Balance at beginning of year ₱980,251,666 ₱867,879,326<br />

Additions 14,863,236 282,106,270<br />

Amortization (Note 24) (176,362,395) (169,733,930)<br />

Balance at end of year ₱818,752,507 ₱980,251,666<br />

Parent Company Loans<br />

The Parent Company entered into unsecured long-term loan arrangements with domestic and<br />

international financial institutions for its various development projects and working capital<br />

requirements.<br />

US$ 300.0 Million Notes<br />

On January 20, 2011, the Parent Company issued a 10-year US$300.0 million notes<br />

(₱13,350.0 million) at 6.50% interest per annum which will mature in January 2021. The notes<br />

are intended to be used by the Company to support the business expansion plans, finance capital<br />

expenditures, service debt obligations and for general corporate purposes. Such notes were listed<br />

and quoted on the Singapore Exchange Securities Trading Limited (SGX-ST).<br />

Peso Public Bonds<br />

On December 4, 2009, the Company received ₱12.0 billion proceeds from the issuance of fixed<br />

rate Peso public bonds - split into two tranches - ₱8.5 billion, due after five years and six months<br />

and ₱3.5 billion, due after seven years, paying a coupon of 8.6418% and 9.3327%, respectively.<br />

The peso public bonds are also listed on Philippine Dealing and & Exchange Corp. (PDEx).<br />

Effective November 14, 2013, certain covenants of the peso public bonds have been aligned with<br />

the 2013 Peso Fixed-Rate Bonds through consent solicitation exercise held by the Parent<br />

Company. Upon securing the required consents, a Supplemental Indenture embodying the parties’<br />

agreement on the proposed amendments was signed on November 7, 2013 between <strong>EDC</strong> and<br />

Rizal Commercial Banking Corporation - Trust and Investments Group in its capacity as trustee<br />

for the bondholders.<br />

On December 5, <strong>2016</strong> and June 4, 2015, the Parent Company fully settled the ₱3.5 billion and<br />

₱8.5 billion Peso public bonds, respectively.<br />

IFC<br />

The Parent Company entered into a loan agreement with IFC, a shareholder of the Parent<br />

Company, on November 27, 2008 for US$100.0 million or its Peso equivalent of ₱4.1 billion.<br />

On January 7, 2009, the Parent Company opted to draw the loan in Peso and received the proceeds<br />

amounting to ₱4,048.8 million, net of ₱51.5 million front-end fee. The loan is payable in 24 equal<br />

semi-annual installments after a three-year grace period at an interest rate of 7.4% per annum for<br />

the first five years subject to repricing for another five to 10 years. Under the loan agreement, the<br />

Parent Company is restricted from creating liens and is subject to certain financial covenants.<br />

On May 20, 2011, the Parent Company signed a 15-year US$75.0 million loan facility with the<br />

IFC to fund its medium-term capital expenditures program. The loan was drawn in Peso on<br />

September 30, 2011, amounting to ₱3,262.5 million. The loan is payable in 24 equal semi-annual<br />

installments after a three-year grace period at an interest rate of 6.657% per annum. The loan<br />

includes prepayment option, which allows the Company to prepay all or part of the loan anytime<br />

starting from the date of the loan agreement until maturity. The prepayment amount is equivalent<br />

238<br />

I Energy Development Corporation Performance Report <strong>2016</strong>