EDC PR 2016 (FS section)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

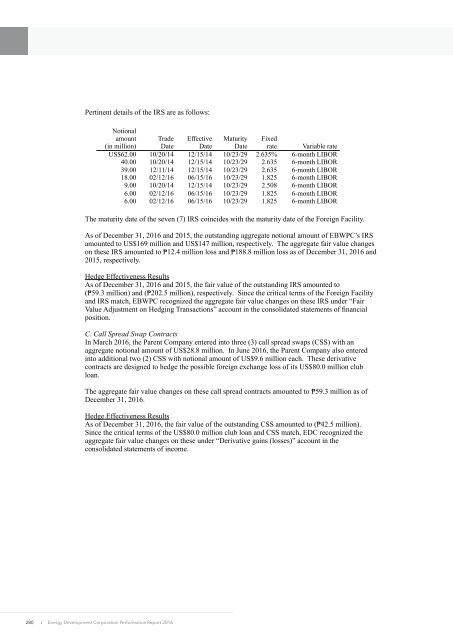

Pertinent details of the IRS are as follows:<br />

Notional<br />

amount<br />

(in million)<br />

Trade<br />

Date<br />

Effective<br />

Date<br />

Maturity<br />

Date<br />

Fixed<br />

rate Variable rate<br />

US$62.00 10/20/14 12/15/14 10/23/29 2.635% 6-month LIBOR<br />

40.00 10/20/14 12/15/14 10/23/29 2.635 6-month LIBOR<br />

39.00 12/11/14 12/15/14 10/23/29 2.635 6-month LIBOR<br />

18.00 02/12/16 06/15/16 10/23/29 1.825 6-month LIBOR<br />

9.00 10/20/14 12/15/14 10/23/29 2.508 6-month LIBOR<br />

6.00 02/12/16 06/15/16 10/23/29 1.825 6-month LIBOR<br />

6.00 02/12/16 06/15/16 10/23/29 1.825 6-month LIBOR<br />

The maturity date of the seven (7) IRS coincides with the maturity date of the Foreign Facility.<br />

As of December 31, <strong>2016</strong> and 2015, the outstanding aggregate notional amount of EBWPC’s IRS<br />

amounted to US$169 million and US$147 million, respectively. The aggregate fair value changes<br />

on these IRS amounted to ₱12.4 million loss and ₱188.8 million loss as of December 31, <strong>2016</strong> and<br />

2015, respectively.<br />

Hedge Effectiveness Results<br />

As of December 31, <strong>2016</strong> and 2015, the fair value of the outstanding IRS amounted to<br />

(₱59.3 million) and (₱202.5 million), respectively. Since the critical terms of the Foreign Facility<br />

and IRS match, EBWPC recognized the aggregate fair value changes on these IRS under “Fair<br />

Value Adjustment on Hedging Transactions” account in the consolidated statements of financial<br />

position.<br />

C. Call Spread Swap Contracts<br />

In March <strong>2016</strong>, the Parent Company entered into three (3) call spread swaps (CSS) with an<br />

aggregate notional amount of US$28.8 million. In June <strong>2016</strong>, the Parent Company also entered<br />

into additional two (2) CSS with notional amount of US$9.6 million each. These derivative<br />

contracts are designed to hedge the possible foreign exchange loss of its US$80.0 million club<br />

loan.<br />

The aggregate fair value changes on these call spread contracts amounted to ₱59.3 million as of<br />

December 31, <strong>2016</strong>.<br />

Hedge Effectiveness Results<br />

As of December 31, <strong>2016</strong>, the fair value of the outstanding CSS amounted to (₱42.5 million).<br />

Since the critical terms of the US$80.0 million club loan and CSS match, <strong>EDC</strong> recognized the<br />

aggregate fair value changes on these under “Derivative gains (losses)” account in the<br />

consolidated statements of income.<br />

280<br />

I Energy Development Corporation Performance Report <strong>2016</strong>