EDC PR 2016 (FS section)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Financial Statement<br />

Government share are allocated between the DOE and Local Government Units (LGUs) where<br />

the geothermal resources are located and payable within 60 days after the end of each quarter.<br />

Government share amounted to ₱253.0 million, ₱260.2 million and ₱269.1 million in <strong>2016</strong>, 2015<br />

and 2014, respectively (see Note 21).<br />

“Other payables” account includes provision for shortfall generation amounting to<br />

₱396.0 million and ₱441.5 million in <strong>2016</strong> and 2015, respectively (see Note 3), and deferred<br />

output VAT.<br />

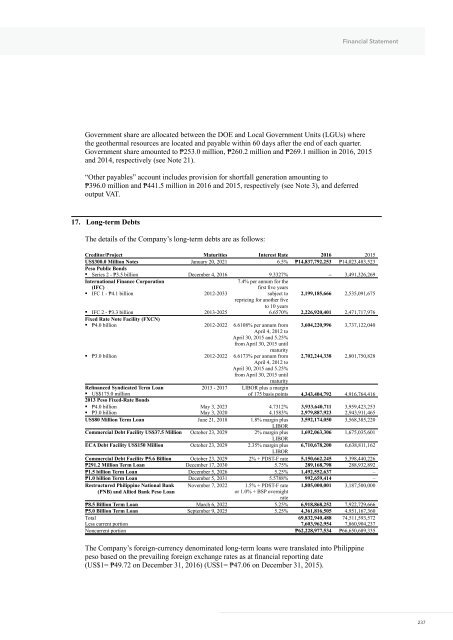

17. Long-term Debts<br />

The details of the Company’s long-term debts are as follows:<br />

Creditor/Project Maturities Interest Rate <strong>2016</strong> 2015<br />

US$300.0 Million Notes January 20, 2021 6.5% ₱14,837,792,253 ₱14,023,483,523<br />

Peso Public Bonds<br />

Series 2 - ₱3.5 billion December 4, <strong>2016</strong> 9.3327% – 3,491,326,269<br />

International Finance Corporation<br />

7.4% per annum for the<br />

(IFC)<br />

first five years<br />

IFC 1 - ₱4.1 billion 2012-2033 subject to 2,199,185,666 2,535,091,675<br />

repricing for another five<br />

to 10 years<br />

IFC 2 - ₱3.3 billion 2013-2025 6.6570% 2,226,920,401 2,471,717,976<br />

Fixed Rate Note Facility (FXCN)<br />

₱4.0 billion 2012-2022 6.6108% per annum from 3,604,220,996 3,737,122,040<br />

April 4, 2012 to<br />

April 30, 2015 and 5.25%<br />

from April 30, 2015 until<br />

maturity<br />

₱3.0 billion 2012-2022 6.6173% per annum from 2,702,244,338 2,801,750,828<br />

April 4, 2012 to<br />

April 30, 2015 and 5.25%<br />

from April 30, 2015 until<br />

maturity<br />

Refinanced Syndicated Term Loan<br />

US$175.0 million<br />

2013 - 2017 LIBOR plus a margin<br />

of 175 basis points 4,343,404,792 4,916,764,416<br />

2013 Peso Fixed-Rate Bonds<br />

₱4.0 billion May 3, 2023 4.7312% 3,933,640,711 3,959,423,253<br />

₱3.0 billion May 3, 2020 4.1583% 2,979,887,923 2,943,911,465<br />

US$80 Million Term Loan June 21, 2018 1.8% margin plus 3,592,174,050 3,568,385,220<br />

LIBOR<br />

Commercial Debt Facility US$37.5 Million October 23, 2029 2% margin plus 1,692,063,306 1,675,035,601<br />

LIBOR<br />

ECA Debt Facility US$150 Million October 23, 2029 2.35% margin plus 6,710,678,200 6,638,811,162<br />

LIBOR<br />

Commercial Debt Facility ₱5.6 Billion October 23, 2029 2% + PDST-F rate 5,150,662,245 5,398,440,226<br />

₱291.2 Million Term Loan December 17, 2030 5.75% 289,168,798 288,932,892<br />

₱1.5 billion Term Loan December 5, 2026 5.25% 1,492,552,637 –<br />

₱1.0 billion Term Loan December 5, 2031 5.5788% 992,659,414 –<br />

Restructured Philippine National Bank<br />

(PNB) and Allied Bank Peso Loan<br />

November 7, 2022<br />

1.5% + PDST-F rate<br />

or 1.0% + BSP overnight<br />

rate<br />

1,805,000,001 3,187,500,000<br />

₱8.5 Billion Term Loan March 6, 2022 5.25% 6,918,868,252 7,922,729,666<br />

₱5.0 Billion Term Loan September 9, 2025 5.25% 4,361,816,505 4,951,167,360<br />

Total 69,832,940,488 74,511,593,572<br />

Less current portion 7,603,962,954 7,860,904,237<br />

Noncurrent portion ₱62,228,977,534 ₱66,650,689,335<br />

The Company’s foreign-currency denominated long-term loans were translated into Philippine<br />

peso based on the prevailing foreign exchange rates as at financial reporting date<br />

(US$1= ₱49.72 on December 31, <strong>2016</strong>) (US$1= ₱47.06 on December 31, 2015).<br />

237