EDC PR 2016 (FS section)

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Statement<br />

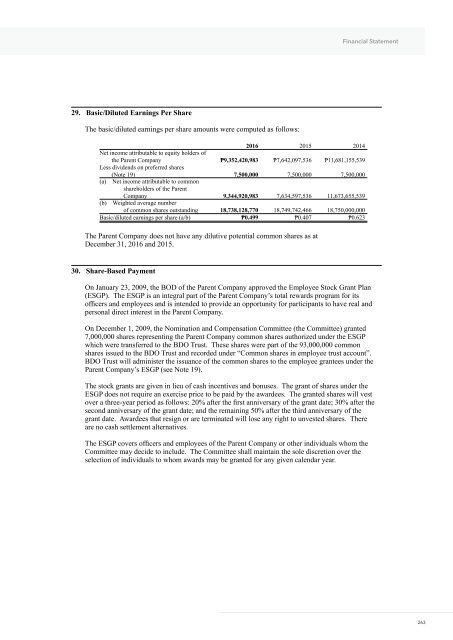

29. Basic/Diluted Earnings Per Share<br />

The basic/diluted earnings per share amounts were computed as follows:<br />

<strong>2016</strong> 2015 2014<br />

Net income attributable to equity holders of<br />

the Parent Company ₱9,352,420,983 ₱7,642,097,536 ₱11,681,155,539<br />

Less dividends on preferred shares<br />

(Note 19) 7,500,000 7,500,000 7,500,000<br />

(a) Net income attributable to common<br />

shareholders of the Parent<br />

Company 9,344,920,983 7,634,597,536 11,673,655,539<br />

(b) Weighted average number<br />

of common shares outstanding 18,738,128,770 18,749,742,466 18,750,000,000<br />

Basic/diluted earnings per share (a/b) ₱0.499 ₱0.407 ₱0.623<br />

The Parent Company does not have any dilutive potential common shares as at<br />

December 31, <strong>2016</strong> and 2015.<br />

30. Share-Based Payment<br />

On January 23, 2009, the BOD of the Parent Company approved the Employee Stock Grant Plan<br />

(ESGP). The ESGP is an integral part of the Parent Company’s total rewards program for its<br />

officers and employees and is intended to provide an opportunity for participants to have real and<br />

personal direct interest in the Parent Company.<br />

On December 1, 2009, the Nomination and Compensation Committee (the Committee) granted<br />

7,000,000 shares representing the Parent Company common shares authorized under the ESGP<br />

which were transferred to the BDO Trust. These shares were part of the 93,000,000 common<br />

shares issued to the BDO Trust and recorded under “Common shares in employee trust account”.<br />

BDO Trust will administer the issuance of the common shares to the employee grantees under the<br />

Parent Company’s ESGP (see Note 19).<br />

The stock grants are given in lieu of cash incentives and bonuses. The grant of shares under the<br />

ESGP does not require an exercise price to be paid by the awardees. The granted shares will vest<br />

over a three-year period as follows: 20% after the first anniversary of the grant date; 30% after the<br />

second anniversary of the grant date; and the remaining 50% after the third anniversary of the<br />

grant date. Awardees that resign or are terminated will lose any right to unvested shares. There<br />

are no cash settlement alternatives.<br />

The ESGP covers officers and employees of the Parent Company or other individuals whom the<br />

Committee may decide to include. The Committee shall maintain the sole discretion over the<br />

selection of individuals to whom awards may be granted for any given calendar year.<br />

263