- Page 2 and 3:

___________________________________

- Page 4 and 5:

Notices This is the first edition o

- Page 6 and 7:

About CALI eLangdell Press The Cent

- Page 8 and 9:

Unit 19: Conditions ...............

- Page 10 and 11:

___________________________________

- Page 12 and 13:

hired Corleone family thugs 4 or an

- Page 14 and 15:

described herein, and agrees to fre

- Page 16 and 17:

6. MARY BETH WHITEHEAD, Surrogate,

- Page 18 and 19:

Surrogate and WILLIAM STERN, Natura

- Page 20 and 21:

10. Consider paragraph 5. Should th

- Page 22 and 23:

The two court opinions that follow

- Page 24 and 25:

Venue Venue is a concept of place

- Page 26 and 27:

Their first child, Ryan, was born o

- Page 28 and 29:

Subsequent to entering into the sur

- Page 30 and 31:

The sixth and final argument sugges

- Page 32 and 33:

It is argued by amicus that the $ 1

- Page 34 and 35:

no stated public policy on surrogac

- Page 36 and 37:

IN RE BABY M Supreme Court of New J

- Page 38 and 39:

adoption; the sole purpose of the c

- Page 40 and 41:

The surrogacy contract violates the

- Page 42 and 43:

Problems Donald Donor is a single,

- Page 44 and 45:

An Introduction to CONTRACT FORMATI

- Page 46 and 47:

particular obligation? In Europe, i

- Page 48 and 49:

The evidence is undisputed that pla

- Page 50 and 51:

After some negotiation a price of $

- Page 52 and 53:

The answer of A.H. Zehmer admitted

- Page 54 and 55:

no, that is beer and liquor talking

- Page 56 and 57:

on the Zehmers as well as on himsel

- Page 58 and 59:

offer and of the reward and its sub

- Page 60 and 61:

your professor. You will come acros

- Page 62 and 63:

car title you’re holding there. I

- Page 64 and 65:

In the modern world, the question o

- Page 66 and 67:

pair of sunglasses. The drumroll th

- Page 68 and 69:

This letter was apparently sent onw

- Page 70 and 71:

Because these cases generally invol

- Page 72 and 73:

teenager’s schoolmates gape in ad

- Page 74 and 75:

Review Question 3. Note how Judge W

- Page 76 and 77:

cash in ten days,” it must be dee

- Page 78 and 79:

“Before a contract can be complet

- Page 80 and 81:

for the purpose of doing the work a

- Page 82 and 83:

accidentally being bound to unwante

- Page 84 and 85:

___________________________________

- Page 86 and 87:

Here, we have a counter-offer. The

- Page 88 and 89:

parties.” Metropolitan Sports Fac

- Page 90 and 91:

court. See Minn. R. Civ. App. P. 10

- Page 92 and 93:

Thus, it clearly appears that the d

- Page 94 and 95:

with distribution. The parties ulti

- Page 96 and 97:

all essential terms. See, e.g., Sit

- Page 98 and 99:

Enclosed, we beg to hand you contra

- Page 100 and 101:

to call for an acceptance particula

- Page 102 and 103:

than identify himself, Dealer says,

- Page 104 and 105:

offer.” More often, they nod, sha

- Page 106 and 107:

The next attack will be my end, I a

- Page 108 and 109:

from all the facts and circumstance

- Page 110 and 111:

Notice to the agent, within the sco

- Page 112 and 113:

2. Written approval by United State

- Page 114 and 115:

contrary in the offer, the acceptan

- Page 116 and 117:

HOBBS v. MASSASOIT WHIP CO. Supreme

- Page 118 and 119:

stranger may impose a duty upon ano

- Page 120 and 121:

contract in this case come into exi

- Page 122 and 123:

___________________________________

- Page 124 and 125:

An Introduction to CONSIDERATION Th

- Page 126 and 127:

and you are free to change your min

- Page 128 and 129:

Ridge Runner that she lacked the pr

- Page 130 and 131:

We conclude that the territory enco

- Page 132 and 133:

He further answered, that it was gi

- Page 134 and 135:

This action was brought upon an all

- Page 136 and 137:

consideration does in fact benefit

- Page 138 and 139:

Review Question 5. The promisors in

- Page 140 and 141:

The distinction between such a cond

- Page 142 and 143:

Vincent refuses. Fritz eventually s

- Page 144 and 145:

enefit was money received, the subs

- Page 146 and 147:

they stopped work in a body, and de

- Page 148 and 149:

supervise this building. Under the

- Page 150 and 151:

The day before trial the plaintiffs

- Page 152 and 153:

General rules of law established fo

- Page 154 and 155:

For the foregoing reasons we are al

- Page 156 and 157:

WEBB v. McGOWIN Court of Appeals of

- Page 158 and 159:

100 P. 631 (Kan. 1909); Edson v. Po

- Page 160 and 161:

McGowin’s adult child, would that

- Page 162 and 163:

efuses, saying, “We had a deal.

- Page 164 and 165:

Giles had no right to use it. But t

- Page 166 and 167:

BLICESTER: That’s crazy. JUDGE: N

- Page 168 and 169:

A. She took the piece of paper and

- Page 170 and 171:

According to the undisputed proof,

- Page 172 and 173:

We recognize that upon different fa

- Page 174 and 175:

was discussed with compensation to

- Page 176 and 177:

CONRAD v. FIELDS Court of Appeals o

- Page 178 and 179:

her job at Qwest and enroll in law

- Page 180 and 181:

Seth Wyman’s estranged son Levi i

- Page 182 and 183:

An Introduction to ALTERNATIVE REGI

- Page 184 and 185:

consistency. Some provisions have p

- Page 186 and 187:

TOUSLEY-BIXLER CONSTRUCTION CO. v.

- Page 188 and 189:

of goods within this Article whethe

- Page 190 and 191:

differently from other contracts? F

- Page 192 and 193:

nine units was delivered and paid f

- Page 194 and 195:

think they have struck a deal.” Q

- Page 196 and 197:

more sense for contract formation t

- Page 198 and 199:

COMMERCIAL CODE § 2-206:12 (3D ED.

- Page 200 and 201:

face of which appears the notation,

- Page 202 and 203:

Problem 10.3 On June 1, the sales d

- Page 204 and 205:

except for personal use. If, howeve

- Page 206 and 207:

[T]he plain reading of the statute

- Page 208 and 209:

not lubricated in any way. Without

- Page 210 and 211:

we also note that Best Bolt’s vic

- Page 212 and 213:

(c) are fit for the ordinary purpos

- Page 214 and 215:

This purchase order represents the

- Page 216 and 217:

provision would cause no “surpris

- Page 218 and 219:

FLENDER CORPORATION v. TIPPINS INTE

- Page 220 and 221:

well that the reservations each par

- Page 222 and 223:

The alternate approach, recognized

- Page 224 and 225:

(a) Is Ivy League University a “m

- Page 226 and 227:

and ratified a treaty called the Un

- Page 228 and 229:

(2) The fact that the parties have

- Page 230 and 231: e. Manufacturer in Texas contracts

- Page 232 and 233: an authorized distributor of Defend

- Page 234 and 235: undisputed that each of these alleg

- Page 236 and 237: Treaty Text Note. Read Articles 18,

- Page 238 and 239: *4 (S.D. Ohio Mar. 26, 2009); see a

- Page 240 and 241: perform a substantial part of his o

- Page 242 and 243: shall be settled by binding arbitra

- Page 244 and 245: An Introduction to CONTRACT DEFENSE

- Page 246 and 247: ___________________________________

- Page 248 and 249: which extended even to being able t

- Page 250 and 251: Dickerson, 72 Ala. 318 (1882). In t

- Page 252 and 253: loss from the transaction, includin

- Page 254 and 255: this definition. Whether other area

- Page 256 and 257: ORTELERE v. TEACHERS’ RETIREMENT

- Page 258 and 259: medicine, this physician “judged

- Page 260 and 261: The avoidance of duties under an ag

- Page 262 and 263: 7. What is my total service credit?

- Page 264 and 265: Review Question 5. In McGovern v. C

- Page 266 and 267: will pay the full listed price of $

- Page 268 and 269: endeavoured to be upheld by Perjury

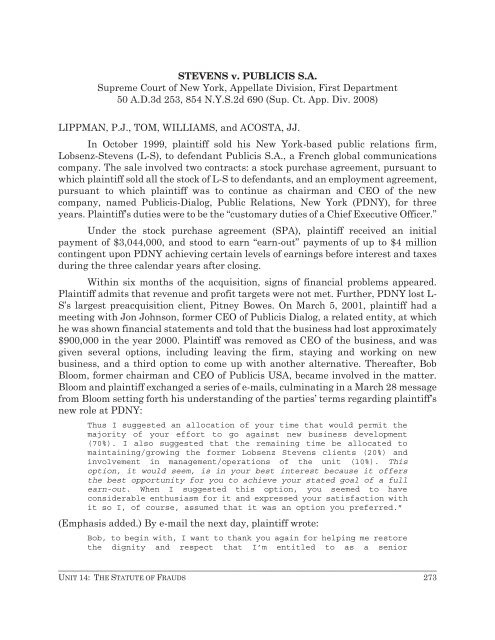

- Page 270 and 271: Y Contracts that cannot be performe

- Page 272 and 273: you think the consideration doctrin

- Page 274 and 275: NICKELS, J., dissenting. I disagree

- Page 276 and 277: contracts. What is the real purpose

- Page 278 and 279: At the ensuing trial, defendant den

- Page 282 and 283: professional. Things were really ge

- Page 284 and 285: GUENTHER v. AMER-TEX CONSTRUCTION C

- Page 286 and 287: (b) Subsection (a) of this section

- Page 288 and 289: Problem 14.3 Van der Rohe USA, Inc.

- Page 290 and 291: sold, the terms of the sale, the na

- Page 292 and 293: the judgment of a vulnerable party.

- Page 294 and 295: The first issue is whether the labe

- Page 296 and 297: some point or on some occasion it w

- Page 298 and 299: As a matter of law, based on the fa

- Page 300 and 301: or, more particularly, in cases suc

- Page 302 and 303: “deprived Loral of its free will.

- Page 304 and 305: As to mistake, the amended complain

- Page 306 and 307: In Weger v. Rocha, 32 P.2d 417 (Cal

- Page 308 and 309: I had brought back the topaz, and h

- Page 310 and 311: May 5, 1886, plaintiff went out to

- Page 312 and 313: arren cow is substantially a differ

- Page 314 and 315: prior to the sale was Buyer aware t

- Page 316 and 317: Against Public Policy. In many situ

- Page 318 and 319: HANKS v. POWDER RIDGE RESTAURANT CO

- Page 320 and 321: interest adversely, and identified

- Page 322 and 323: illogical, in these circumstances,

- Page 324 and 325: _____________________ Review Questi

- Page 326 and 327: construed against the employer). Th

- Page 328 and 329: acquired by virtue of effort and ex

- Page 330 and 331:

_____________________ Review Questi

- Page 332 and 333:

Mere inadequacy of consideration wi

- Page 334 and 335:

District of Columbia Court of Appea

- Page 336 and 337:

In determining reasonableness or fa

- Page 338 and 339:

Problems Problem 16.1 The Californi

- Page 340 and 341:

position to all of his patients (or

- Page 342 and 343:

An Introduction to TERMS AND INTERP

- Page 344 and 345:

___________________________________

- Page 346 and 347:

contract itself. Thus written docum

- Page 348 and 349:

consideration of the simultaneous a

- Page 350 and 351:

the contract on the basis of which

- Page 352 and 353:

The subject-matter of the written c

- Page 354 and 355:

understandings or agreements.” 3

- Page 356 and 357:

little time to compose it . . . . A

- Page 358 and 359:

expressed in the writing. KN Energy

- Page 360 and 361:

Article 8 UNITED NATIONS CONVENTION

- Page 362 and 363:

contracts or that parol evidence re

- Page 364 and 365:

percent (50%) protein, as tested on

- Page 366 and 367:

get the deal they intended, and the

- Page 368 and 369:

Cases and Materials W.W.W. ASSOCIAT

- Page 370 and 371:

do so because of some identified am

- Page 372 and 373:

The truth is that whatever virtue a

- Page 374 and 375:

Absent strong public policy conside

- Page 376 and 377:

FRIGALIMENT IMPORTING CO. v. B.N.S.

- Page 378 and 379:

persuasive if sustained by the reco

- Page 380 and 381:

and there is force in defendant’s

- Page 382 and 383:

RANDOM HOUSE, INC. v. ROSETTA BOOKS

- Page 384 and 385:

language of the grant was broad, en

- Page 386 and 387:

F.3d at 1095, would conclude that t

- Page 388 and 389:

When Hurricane Rubin strikes the lo

- Page 390 and 391:

the business. The contract was sile

- Page 392 and 393:

party argues ambiguity), the loan f

- Page 394 and 395:

accordance with the terms of this c

- Page 396 and 397:

of the advance payments, or the num

- Page 398 and 399:

imbibe alcoholic beverages and stil

- Page 400 and 401:

significant satisfied requirement o

- Page 402 and 403:

TOWN OF FAIRFIELD v. D’ADDARIO Su

- Page 404 and 405:

damages. The notice of Kant’s act

- Page 406 and 407:

who had turned down lucrative offer

- Page 408 and 409:

were to suggest some express provis

- Page 410 and 411:

notice of ninety days. The plaintif

- Page 412 and 413:

Review Question 2. What was Judge C

- Page 414 and 415:

exercising discretion under the con

- Page 416 and 417:

NANAKULI PAVING AND ROCK CO. v. SHE

- Page 418 and 419:

§ 490:1-102(2)(b). The drafters of

- Page 420 and 421:

trade existed in Hawaii in 1969 and

- Page 422 and 423:

1978) (unpublished opinion) (holdin

- Page 424 and 425:

Plaintiff does not contest its stat

- Page 426 and 427:

product. The concept of “merchant

- Page 428 and 429:

discovery by defendant of the defec

- Page 430 and 431:

Unfortunately, Plumber’s work doe

- Page 432 and 433:

An Introduction to PERFORMANCE AND

- Page 434 and 435:

___________________________________

- Page 436 and 437:

doctrine, so that close-enough perf

- Page 438 and 439:

the number of joists used in all th

- Page 440 and 441:

JACOB & YOUNGS, INC. v. KENT Court

- Page 442 and 443:

transgressor must accept the penalt

- Page 444 and 445:

was for requiring this kind of pipe

- Page 446 and 447:

The evidence is undisputed that the

- Page 448 and 449:

eing a new roof. We are not prepare

- Page 450 and 451:

This case is simple if the perfect

- Page 452 and 453:

yacht remained located at SIYS’ f

- Page 454 and 455:

happens by mere operation of law; s

- Page 456 and 457:

Problems Problem 21.1 Actor is a ve

- Page 458 and 459:

processor for the same price as the

- Page 460 and 461:

venue. Under Paradine v. Jane, this

- Page 462 and 463:

At trial, the court allowed IH’s

- Page 464 and 465:

In order for a supervening event to

- Page 466 and 467:

The court interpreted this passage

- Page 468 and 469:

economic circumstances sufficiently

- Page 470 and 471:

A cancellation order given by her o

- Page 472 and 473:

e entitled to judgment. They certai

- Page 474 and 475:

performance is excused when unfores

- Page 476 and 477:

caused to communications and transp

- Page 478 and 479:

Following the closing of the above-

- Page 480 and 481:

performance. 407 East 61st Garage,

- Page 482 and 483:

Canal, across the Mediterranean thr

- Page 484 and 485:

An Introduction to REMEDIES We now

- Page 486 and 487:

___________________________________

- Page 488 and 489:

multiplication and (very rarely) di

- Page 490 and 491:

It was also erroneous and misleadin

- Page 492 and 493:

and we turn to the question of whet

- Page 494 and 495:

testified that the total gas, oil,

- Page 496 and 497:

BRANDEIS MACHINERY & SUPPLY CO., LL

- Page 498 and 499:

PEEVYHOUSE v. GARLAND COAL & MINING

- Page 500 and 501:

explanation as to why a measure of

- Page 502 and 503:

work; however, where the contract p

- Page 504 and 505:

clear and unambiguous and the parti

- Page 506 and 507:

pool contractor to finish the pool

- Page 508 and 509:

___________________________________

- Page 510 and 511:

Nevertheless, the English courts he

- Page 512 and 513:

perform the work. As Lee failed to

- Page 514 and 515:

UNITED STATES ex rel. COASTAL STEEL

- Page 516 and 517:

emanded for those findings. When th

- Page 518 and 519:

the substance is that the plaintiff

- Page 520 and 521:

the agreement would continue on a m

- Page 522 and 523:

Review Question 7. Note the paralle

- Page 524 and 525:

product that would be fully functio

- Page 526 and 527:

car to the Country Music Museum for

- Page 528 and 529:

___________________________________

- Page 530 and 531:

Restatement (Second) of Contracts s

- Page 532 and 533:

Harrahs brings the instant action a

- Page 534 and 535:

contest payment for same if constru

- Page 536 and 537:

This is in accord with the earlier

- Page 538 and 539:

Defendant’s sole defense to this

- Page 540 and 541:

particular. Certainly, none of the

- Page 542 and 543:

sustained where, from the nature of

- Page 544 and 545:

ut will be happy to try to help in

- Page 546 and 547:

the full $7,500 price of admission

- Page 548 and 549:

Problem 25.2 Mina is a second-year

- Page 550 and 551:

___________________________________

- Page 552 and 553:

other types of specific performance

- Page 554 and 555:

imposed as the remedy for breach of

- Page 556 and 557:

certainty, then S&M should be compe

- Page 558 and 559:

There is simply no requirement in t

- Page 560 and 561:

“other proper circumstances” th

- Page 562 and 563:

fence plaintiff erected to discoura

- Page 564 and 565:

y no means certain, at the time of

- Page 566 and 567:

cannot use that method of self-help

- Page 568 and 569:

contract price of $533,000) that La

- Page 570 and 571:

teacher resigned at the beginning,

- Page 572 and 573:

eaching its lease with Perez by the

- Page 574 and 575:

___________________________________

- Page 576 and 577:

An Introduction to CONTRACT NONPART

- Page 578 and 579:

___________________________________

- Page 580 and 581:

fraud, mistake, and illegality. If

- Page 582 and 583:

may be the diversity of opinion els

- Page 584 and 585:

given him by the will for a particu

- Page 586 and 587:

since Lawrence v. Fox in a desire t

- Page 588 and 589:

workers’ compensation benefits),

- Page 590 and 591:

to divide a lawyer’s loyalty betw

- Page 592 and 593:

Review Question 9. Lawyers do many

- Page 594 and 595:

Problems Problem 27.1 Hank and Hild

- Page 596 and 597:

___________________________________

- Page 598 and 599:

interested in jumping into such a b

- Page 600 and 601:

limitations barred the claims. She

- Page 602 and 603:

assigned their claim to recover the

- Page 604 and 605:

application to this contract as it

- Page 606 and 607:

A breach of contract has been defin

- Page 608 and 609:

moved to Arizona and had no further

- Page 610 and 611:

It is evident from the express lang

- Page 612 and 613:

contracted to assume, and the assig

- Page 614:

March 1 for the conveyance of Purpl