Download - Volksbank AG

Download - Volksbank AG

Download - Volksbank AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

INVESTKREDIT SHARES.<br />

Investkredit shares<br />

listed on the<br />

prime market of<br />

Wiener Börse<br />

Banks and industrial<br />

enterprises are<br />

major shareholders<br />

Difficult times for<br />

capital markets<br />

Investkredit shares<br />

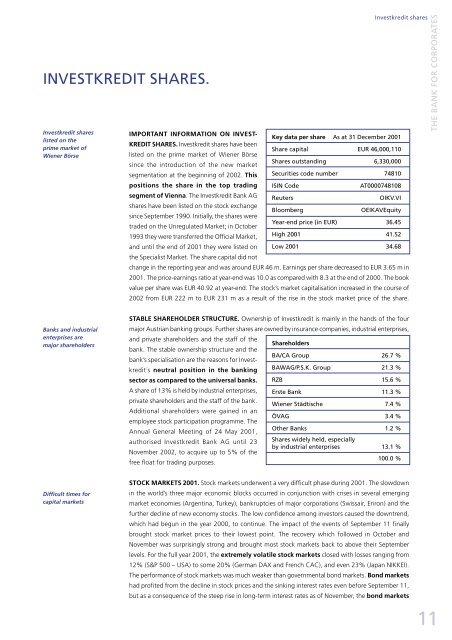

IMPORTANT INFORMATION ON INVEST-<br />

Key data per share As at 31 December 2001<br />

KREDIT SHARES. Investkredit shares have been<br />

listed on the prime market of Wiener Börse<br />

Share capital EUR 46,000,110<br />

since the introduction of the new market<br />

Shares outstanding 6,330,000<br />

segmentation at the beginning of 2002. This Securities code number 74810<br />

positions the share in the top trading ISIN Code AT0000748108<br />

segment of Vienna. The Investkredit Bank <strong>AG</strong> Reuters OIKV.VI<br />

shares have been listed on the stock exchange<br />

since September 1990. Initially, the shares were<br />

traded on the Unregulated Market; in October<br />

Bloomberg<br />

Year-end price (in EUR)<br />

OEIKAVEquity<br />

36.45<br />

1993 they were transferred the Official Market, High 2001 41.52<br />

and until the end of 2001 they were listed on<br />

the Specialist Market. The share capital did not<br />

Low 2001 34.68<br />

change in the reporting year and was around EUR 46 m. Earnings per share decreased to EUR 3.65 m in<br />

2001. The price-earnings ratio at year-end was 10.0 as compared with 8.3 at the end of 2000. The book<br />

value per share was EUR 40.92 at year-end. The stock’s market capitalisation increased in the course of<br />

2002 from EUR 222 m to EUR 231 m as a result of the rise in the stock market price of the share.<br />

STABLE SHAREHOLDER STRUCTURE. Ownership of Investkredit is mainly in the hands of the four<br />

major Austrian banking groups. Further shares are owned by insurance companies, industrial enterprises,<br />

and private shareholders and the staff of the<br />

bank. The stable ownership structure and the<br />

bank’s specialisation are the reasons for Invest-<br />

Shareholders<br />

BA/CA Group 26.7 %<br />

kredit´s neutral position in the banking BAW<strong>AG</strong>/P.S.K. Group 21.3 %<br />

sector as compared to the universal banks. RZB 15.6 %<br />

A share of 13% is held by industrial enterprises, Erste Bank 11.3 %<br />

private shareholders and the staff of the bank.<br />

Wiener Städtische 7.4 %<br />

Additional shareholders were gained in an<br />

employee stock participation programme. The<br />

ÖV<strong>AG</strong> 3.4 %<br />

Annual General Meeting of 24 May 2001,<br />

Other Banks 1.2 %<br />

authorised Investkredit Bank <strong>AG</strong> until 23<br />

November 2002, to acquire up to 5% of the<br />

Shares widely held, especially<br />

by industrial enterprises 13.1 %<br />

free float for trading purposes.<br />

100.0 %<br />

STOCK MARKETS 2001. Stock markets underwent a very difficult phase during 2001. The slowdown<br />

in the world’s three major economic blocks occurred in conjunction with crises in several emerging<br />

market economies (Argentina, Turkey), bankruptcies of major corporations (Swissair, Enron) and the<br />

further decline of new economy stocks. The low confidence among investors caused the downtrend,<br />

which had begun in the year 2000, to continue. The impact of the events of September 11 finally<br />

brought stock market prices to their lowest point. The recovery which followed in October and<br />

November was surprisingly strong and brought most stock markets back to above their September<br />

levels. For the full year 2001, the extremely volatile stock markets closed with losses ranging from<br />

12% (S&P 500 – USA) to some 20% (German DAX and French CAC), and even 23% (Japan NIKKEI).<br />

The performance of stock markets was much weaker than governmental bond markets. Bond markets<br />

had profited from the decline in stock prices and the sinking interest rates even before September 11,<br />

but as a consequence of the steep rise in long-term interest rates as of November, the bond markets<br />

THE BANK FOR CORPORATES<br />

11