Download - Volksbank AG

Download - Volksbank AG

Download - Volksbank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Benefiting from<br />

advantages of<br />

Central and Eastern<br />

European growth<br />

market<br />

EBRD as strategic partner<br />

for real-estate projects<br />

in Central and<br />

Eastern Europe<br />

REAL ESTATE.<br />

BUSINESS APPROACH. One area in which the concept of internationalisation has been widely implemented<br />

is the real-estate segment which was considerably expanded in the last few years. This<br />

area which constitutes the ideal field of business for a bank specialising in long-term operations<br />

was turned into one of the Investkredit Group’s most important growth businesses owing to<br />

the efforts of Europolis Invest, a real-estate management company owned by Investkredit, which<br />

successfully combined its own real-estate developments with investments in fully rented top-class<br />

commercial real estate located in the capitals of the EU candidate countries.<br />

The Europolis Invest Group has specialised in three specific fields: real-estate investments, realestate<br />

project development and real-estate portfolio management. The Group’s business focus<br />

is on office properties and logistic properties. Since the central aim is to safeguard revenue in the long<br />

term, the main factors in project selection are the quality of the buildings, the creditworthiness of the<br />

tenants and the long-term contractual safeguarding of rentals. A profitable real-estate portfolio in<br />

Vienna – including properties such as the Akademiehof Karlsplatz – served as launching pad for the<br />

bank’s activities in the Central and Eastern European countries.<br />

The existing real-estate portfolio outside of Austria comprises two office projects in Budapest,<br />

called “City Gate“ and “Info Park Research Centre“, the “Hadovka Office Park“ and the “Technopark<br />

Pekarska“ project as well as the “River City Prague“ urban development project in Prague and the<br />

“Warsaw Towers“, “Saski Point“ and “Saski Crescent“ office buildings in Warsaw. The purchase of<br />

the “Alliance Logistic Centre“ in the vicinity of Warsaw was the bank’s first acquisition in the field of<br />

logistic properties.<br />

Construction work on the “Danube House“ building in the context of the River City Prague project<br />

was continued as planned in the year under review. The “Saski Point“ and “Alliance Logistic Centre“<br />

buildings were acquired in the course of the reporting period. The contracts on the purchase of the<br />

“Saski Crescent“ and “Technopark Pekarska“ projects were signed at the end of the year. The two<br />

latter projects allowed the bank to implement its concept of so-called “forward deals“ for the first<br />

time on a larger scale in the Central and Eastern European market. Forward deals are a mixture of<br />

classic real-estate investments and development projects, with the investment being already effected<br />

before the building is finished and let. Payment and purchase price depend on the completion of the<br />

construction work and the quality of the tenancy agreements.<br />

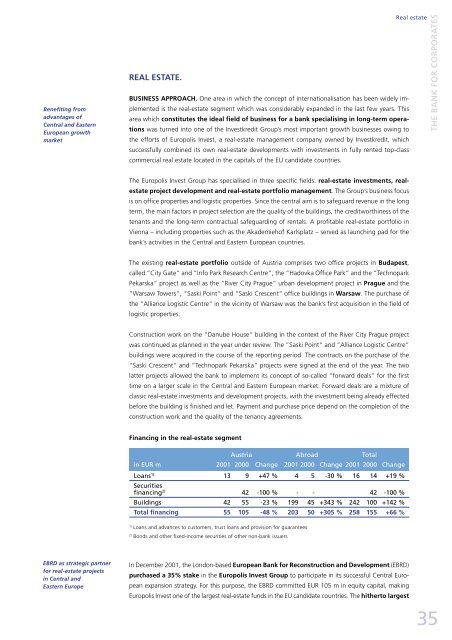

Financing in the real-estate segment<br />

Austria Abroad Total<br />

in EUR m 2001 2000 Change 2001 2000 Change 2001 2000 Change<br />

Loans1) Securities<br />

13 9 +47 % 4 5 -30 % 16 14 +19 %<br />

financing2) 42 -100 % - - 42 -100 %<br />

Buildings 42 55 -23 % 199 45 +343 % 242 100 +142 %<br />

Total financing 55 105 -48 % 203 50 +305 % 258 155 +66 %<br />

1) Loans and advances to customers, trust loans and provision for guarantees<br />

2) Bonds and other fixed-income securities of other non-bank issuers<br />

In December 2001, the London-based European Bank for Reconstruction and Development (EBRD)<br />

purchased a 35% stake in the Europolis Invest Group to participate in its successful Central European<br />

expansion strategy. For this purpose, the EBRD committed EUR 105 m in equity capital, making<br />

Europolis Invest one of the largest real-estate funds in the EU candidate countries. The hitherto largest<br />

Real estate<br />

THE BANK FOR CORPORATES<br />

35