Download - Volksbank AG

Download - Volksbank AG

Download - Volksbank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE BANK FOR CORPORATES<br />

34<br />

Local governments<br />

Two new equity<br />

investments<br />

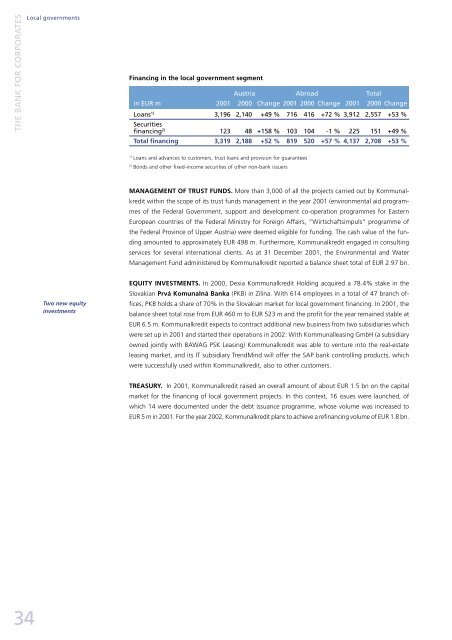

Financing in the local government segment<br />

Austria Abroad Total<br />

in EUR m 2001 2000 Change 2001 2000 Change 2001 2000 Change<br />

Loans1) Securities<br />

3,196 2,140 +49 % 716 416 +72 % 3,912 2,557 +53 %<br />

financing2) 123 48 +158 % 103 104 -1 % 225 151 +49 %<br />

Total financing 3,319 2,188 +52 % 819 520 +57 % 4,137 2,708 +53 %<br />

1) Loans and advances to customers, trust loans and provision for guarantees<br />

2) Bonds and other fixed-income securities of other non-bank issuers<br />

MAN<strong>AG</strong>EMENT OF TRUST FUNDS. More than 3,000 of all the projects carried out by Kommunalkredit<br />

within the scope of its trust funds management in the year 2001 (environmental aid programmes<br />

of the Federal Government, support and development co-operation programmes for Eastern<br />

European countries of the Federal Ministry for Foreign Affairs, “Wirtschaftsimpuls“ programme of<br />

the Federal Province of Upper Austria) were deemed eligible for funding. The cash value of the funding<br />

amounted to approximately EUR 498 m. Furthermore, Kommunalkredit engaged in consulting<br />

services for several international clients. As at 31 December 2001, the Environmental and Water<br />

Management Fund administered by Kommunalkredit reported a balance sheet total of EUR 2.97 bn.<br />

EQUITY INVESTMENTS. In 2000, Dexia Kommunalkredit Holding acquired a 78.4% stake in the<br />

Slovakian Prvá Komunalná Banka (PKB) in Zilina. With 614 employees in a total of 47 branch offices,<br />

PKB holds a share of 70% in the Slovakian market for local government financing. In 2001, the<br />

balance sheet total rose from EUR 460 m to EUR 523 m and the profit for the year remained stable at<br />

EUR 6.5 m. Kommunalkredit expects to contract additional new business from two subsidiaries which<br />

were set up in 2001 and started their operations in 2002: With Kommunalleasing GmbH (a subsidiary<br />

owned jointly with BAW<strong>AG</strong> PSK Leasing) Kommunalkredit was able to venture into the real-estate<br />

leasing market, and its IT subsidiary TrendMind will offer the SAP bank controlling products, which<br />

were successfully used within Kommunalkredit, also to other customers.<br />

TREASURY. In 2001, Kommunalkredit raised an overall amount of about EUR 1.5 bn on the capital<br />

market for the financing of local government projects. In this context, 16 issues were launched, of<br />

which 14 were documented under the debt issuance programme, whose volume was increased to<br />

EUR 5 m in 2001. For the year 2002, Kommunalkredit plans to achieve a refinancing volume of EUR 1.8 bn.