Download - Volksbank AG

Download - Volksbank AG

Download - Volksbank AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE BANK FOR CORPORATES<br />

Notes<br />

56<br />

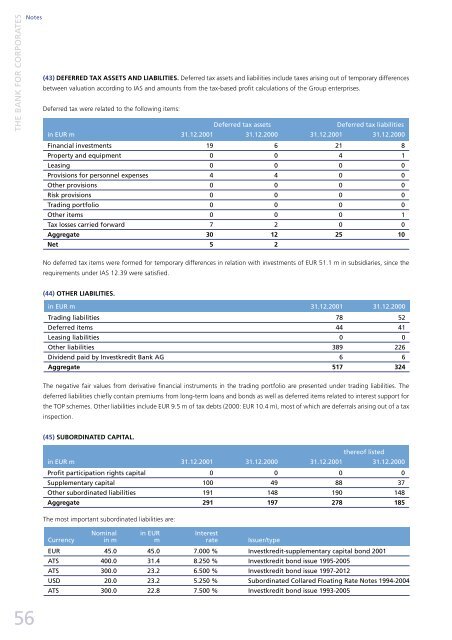

(43) DEFERRED TAX ASSETS AND LIABILITIES. Deferred tax assets and liabilities include taxes arising out of temporary differences<br />

between valuation according to IAS and amounts from the tax-based profit calculations of the Group enterprises.<br />

Deferred tax were related to the following items:<br />

Deferred tax assets Deferred tax liabilities<br />

in EUR m 31.12.2001 31.12.2000 31.12.2001 31.12.2000<br />

Financial investments 19 6 21 8<br />

Property and equipment 0 0 4 1<br />

Leasing 0 0 0 0<br />

Provisions for personnel expenses 4 4 0 0<br />

Other provisions 0 0 0 0<br />

Risk provisions 0 0 0 0<br />

Trading portfolio 0 0 0 0<br />

Other items 0 0 0 1<br />

Tax losses carried forward 7 2 0 0<br />

Aggregate 30 12 25 10<br />

Net 5 2<br />

No deferred tax items were formed for temporary differences in relation with investments of EUR 51.1 m in subsidiaries, since the<br />

requirements under IAS 12.39 were satisfied.<br />

(44) OTHER LIABILITIES.<br />

in EUR m 31.12.2001 31.12.2000<br />

Trading liabilities 78 52<br />

Deferred items 44 41<br />

Leasing liabilities 0 0<br />

Other liabilities 389 226<br />

Dividend paid by Investkredit Bank <strong>AG</strong> 6 6<br />

Aggregate 517 324<br />

The negative fair values from derivative financial instruments in the trading portfolio are presented under trading liabilities. The<br />

deferred liabilities chiefly contain premiums from long-term loans and bonds as well as deferred items related to interest support for<br />

the TOP schemes. Other liabilities include EUR 9.5 m of tax debts (2000: EUR 10.4 m), most of which are deferrals arising out of a tax<br />

inspection.<br />

(45) SUBORDINATED CAPITAL.<br />

in EUR m 31.12.2001 31.12.2000 31.12.2001<br />

thereof listed<br />

31.12.2000<br />

Profit participation rights capital 0 0 0 0<br />

Supplementary capital 100 49 88 37<br />

Other subordinated liabilities 191 148 190 148<br />

Aggregate 291 197 278 185<br />

The most important subordinated liabilities are:<br />

Nominal in EUR Interest<br />

Currency in m m rate Issuer/type<br />

EUR 45.0 45.0 7.000 % Investkredit-supplementary capital bond 2001<br />

ATS 400.0 31.4 8.250 % Investkredit bond issue 1995-2005<br />

ATS 300.0 23.2 6.500 % Investkredit bond issue 1997-2012<br />

USD 20.0 23.2 5.250 % Subordinated Collared Floating Rate Notes 1994-2004<br />

ATS 300.0 22.8 7.500 % Investkredit bond issue 1993-2005