Download - Volksbank AG

Download - Volksbank AG

Download - Volksbank AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Deal structuring<br />

in the context of<br />

project financing<br />

transactions<br />

Credit rating and<br />

collateralisation<br />

determine loan terms<br />

Prudent loan<br />

management<br />

The trend towards large-volume financing transactions with industrial corporates was continued in<br />

the reporting year. Against the background of portfolio control by banks, the syndicated financing<br />

business has grown in significance. In the future, Investkredit will extend its function in underwriting<br />

partnerships, as shown today in the strong increase investment volumes.<br />

2001 saw an increase in the level of project financing transactions. Starting out from the establishment<br />

of independent companies these types of loans are serviced out of the relevant project’s sources<br />

of earnings. The bank’s tasks in relation to structuring such deals range from the legal planning of the<br />

transaction to economic feasibility studies and ongoing project controlling. These models are mainly<br />

applied to real-estate transactions and public-private partnerships.<br />

The arrangement of loan terms depends on specific credit ratings and the provision of security.<br />

While liquidity is agreed on a long-term basis, the interest rate adjustment is in many cases related to<br />

covenants, i.e. the credit margin is developing according to the relevant corporate’s rating. The settlement<br />

of margins is thus linked to the dynamism of the corporate’s economic development. In many<br />

cases the corporates have anticipated the interest rate cuts of the European Central Bank and have<br />

taken out variable-interest loans. In contrast, towards the end of the year, an increased interest in<br />

fixed-rate loans was seen.<br />

The cyclical downturn in the second half of 2001 has also contributed to the fact that Investkredit<br />

paid special attention to its loan management. In individual cases it became necessary to increase<br />

collaterals. The importance of a contractual safeguarding of liquidity is pointed out in detail when<br />

talking to our customers. In accordance with the accounting and valuation principles, the required<br />

level of individual value adjustments has increased along the cyclical curve.<br />

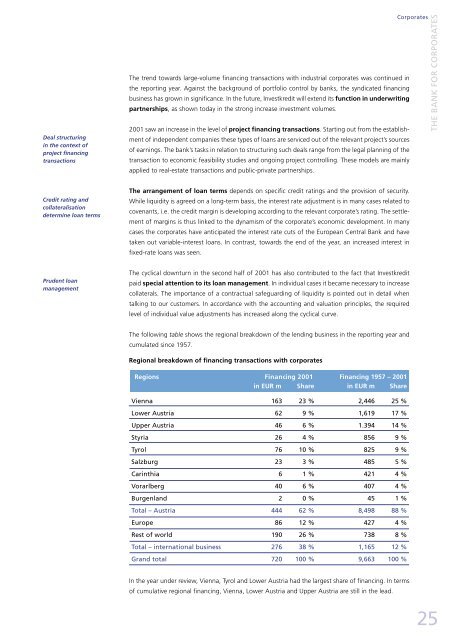

The following table shows the regional breakdown of the lending business in the reporting year and<br />

cumulated since 1957.<br />

Regional breakdown of financing transactions with corporates<br />

Regions Financing 2001 Financing 1957 – 2001<br />

in EUR m Share in EUR m Share<br />

Vienna 163 23 % 2,446 25 %<br />

Lower Austria 62 9 % 1,619 17 %<br />

Upper Austria 46 6 % 1.394 14 %<br />

Styria 26 4 % 856 9 %<br />

Tyrol 76 10 % 825 9 %<br />

Salzburg 23 3 % 485 5 %<br />

Carinthia 6 1 % 421 4 %<br />

Vorarlberg 40 6 % 407 4 %<br />

Burgenland 2 0 % 45 1 %<br />

Total – Austria 444 62 % 8,498 88 %<br />

Europe 86 12 % 427 4 %<br />

Rest of world 190 26 % 738 8 %<br />

Total – international business 276 38 % 1,165 12 %<br />

Grand total 720 100 % 9,663 100 %<br />

In the year under review, Vienna, Tyrol and Lower Austria had the largest share of financing. In terms<br />

of cumulative regional financing, Vienna, Lower Austria and Upper Austria are still in the lead.<br />

Corporates<br />

THE BANK FOR CORPORATES<br />

25