Download - Volksbank AG

Download - Volksbank AG

Download - Volksbank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Expenses related to all subordinated liabilities in the financial year amounted to EUR 14.7 m (2000: EUR 11.9 m). Claims of creditors<br />

to the repayment of these liabilities are subordinated in relation with other creditors and, in the event of bankruptcy or liquidation,<br />

may be paid back only after all non-subordinated creditors have been satisfied.<br />

(46) EQUITY. The share capital of EUR 46,000,110.00 is divided into 6,330,000 non par value shares. In the financial year, a share<br />

split-up of 1:10 was carried out. The shares are issued to bearer. With the approval of the Supervisory Board, the Board of Management<br />

is empowered to increase the share capital up to 23 May 2006 by issuing a maximum of 42,280 new non par value shares<br />

issued to bearer, in one or more operations and by at most EUR 3,072,487.60. During the financial year, Investkredit traded in its own<br />

shares for market-making reasons. As at 31 December 2001, Investkredit held 1,843 of its own shares in the carrying amount of<br />

EUR 0.1 m. Due to the minor significance, they were not deducted from equity but presented under Financial investments. The<br />

maximum number of own shares held in the financial year was 301,350.<br />

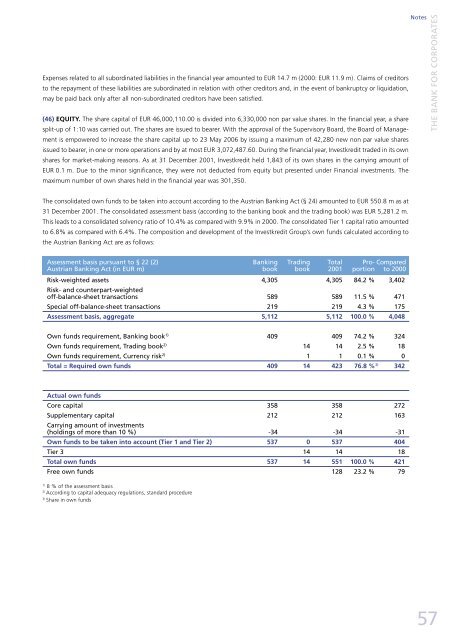

The consolidated own funds to be taken into account according to the Austrian Banking Act (§ 24) amounted to EUR 550.8 m as at<br />

31 December 2001. The consolidated assessment basis (according to the banking book and the trading book) was EUR 5,281.2 m.<br />

This leads to a consolidated solvency ratio of 10.4% as compared with 9.9% in 2000. The consolidated Tier 1 capital ratio amounted<br />

to 6.8% as compared with 6.4%. The composition and development of the Investkredit Group’s own funds calculated according to<br />

the Austrian Banking Act are as follows:<br />

Assessment basis pursuant to § 22 (2) Banking Trading Total Pro- Compared<br />

Austrian Banking Act (in EUR m) book book 2001 portion to 2000<br />

Risk-weighted assets<br />

Risk- and counterpart-weighted<br />

4,305 4,305 84.2 % 3,402<br />

off-balance-sheet transactions 589 589 11.5 % 471<br />

Special off-balance-sheet transactions 219 219 4.3 % 175<br />

Assessment basis, aggregate 5,112 5,112 100.0 % 4,048<br />

Own funds requirement, Banking book1) 409 409 74.2 % 324<br />

Own funds requirement, Trading book2) 14 14 2.5 % 18<br />

Own funds requirement, Currency risk2) 1 1 0.1 % 0<br />

Total = Required own funds 409 14 423 76.8 % 3) 342<br />

Actual own funds<br />

Core capital 358 358 272<br />

Supplementary capital<br />

Carrying amount of investments<br />

212 212 163<br />

(holdings of more than 10 %) -34 -34 -31<br />

Own funds to be taken into account (Tier 1 and Tier 2) 537 0 537 404<br />

Tier 3 14 14 18<br />

Total own funds 537 14 551 100.0 % 421<br />

Free own funds 128 23.2 % 79<br />

1) 8 % of the assessment basis<br />

2) According to capital adequacy regulations, standard procedure<br />

3) Share in own funds<br />

Notes<br />

THE BANK FOR CORPORATES<br />

57