Download - Volksbank AG

Download - Volksbank AG

Download - Volksbank AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE BANK FOR CORPORATES<br />

14<br />

Management discussion<br />

Specialist banking group<br />

in Europe<br />

Success through<br />

specialisation<br />

Strategic partnerships<br />

with European<br />

specialist banks<br />

THE INVESTKREDIT GROUP. Together with its<br />

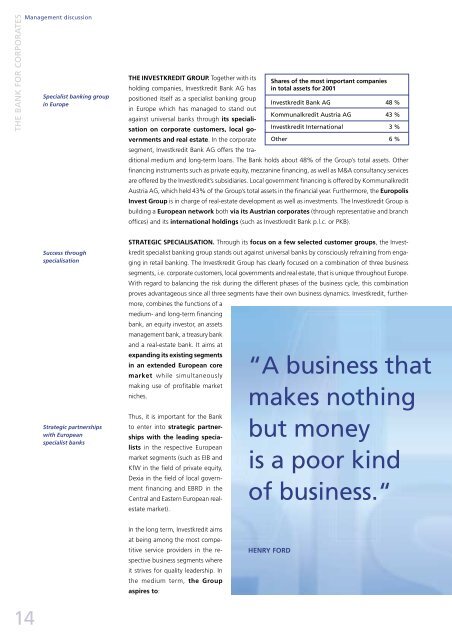

Shares of the most important companies<br />

holding companies, Investkredit Bank <strong>AG</strong> has in total assets for 2001<br />

positioned itself as a specialist banking group<br />

in Europe which has managed to stand out<br />

against universal banks through its speciali-<br />

Investkredit Bank <strong>AG</strong><br />

Kommunalkredit Austria <strong>AG</strong><br />

48 %<br />

43 %<br />

sation on corporate customers, local go-<br />

Investkredit International 3 %<br />

vernments and real estate. In the corporate<br />

segment, Investkredit Bank <strong>AG</strong> offers the tra-<br />

Other 6 %<br />

ditional medium and long-term loans. The Bank holds about 48% of the Group’s total assets. Other<br />

financing instruments such as private equity, mezzanine financing, as well as M&A consultancy services<br />

are offered by the Investkredit’s subsidiaries. Local government financing is offered by Kommunalkredit<br />

Austria <strong>AG</strong>, which held 43% of the Group’s total assets in the financial year. Furthermore, the Europolis<br />

Invest Group is in charge of real-estate development as well as investments. The Investkredit Group is<br />

building a European network both via its Austrian corporates (through representative and branch<br />

offices) and its international holdings (such as Investkredit Bank p.l.c. or PKB).<br />

STRATEGIC SPECIALISATION. Through its focus on a few selected customer groups, the Investkredit<br />

specialist banking group stands out against universal banks by consciously refraining from engaging<br />

in retail banking. The Investkredit Group has clearly focused on a combination of three business<br />

segments, i.e. corporate customers, local governments and real estate, that is unique throughout Europe.<br />

With regard to balancing the risk during the different phases of the business cycle, this combination<br />

proves advantageous since all three segments have their own business dynamics. Investkredit, furthermore,<br />

combines the functions of a<br />

medium- and long-term financing<br />

bank, an equity investor, an assets<br />

management bank, a treasury bank<br />

and a real-estate bank. It aims at<br />

expanding its existing segments<br />

in an extended European core<br />

market while simultaneously<br />

making use of profitable market<br />

niches.<br />

Thus, it is important for the Bank<br />

to enter into strategic partnerships<br />

with the leading specialists<br />

in the respective European<br />

market segments (such as EIB and<br />

KfW in the field of private equity,<br />

Dexia in the field of local government<br />

financing and EBRD in the<br />

Central and Eastern European realestate<br />

market).<br />

In the long term, Investkredit aims<br />

at being among the most competitive<br />

service providers in the respective<br />

business segments where<br />

it strives for quality leadership. In<br />

the medium term, the Group<br />

aspires to:<br />

“A business that<br />

makes nothing<br />

but money<br />

is a poor kind<br />

of business.“<br />

HENRY FORD