Download - Volksbank AG

Download - Volksbank AG

Download - Volksbank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

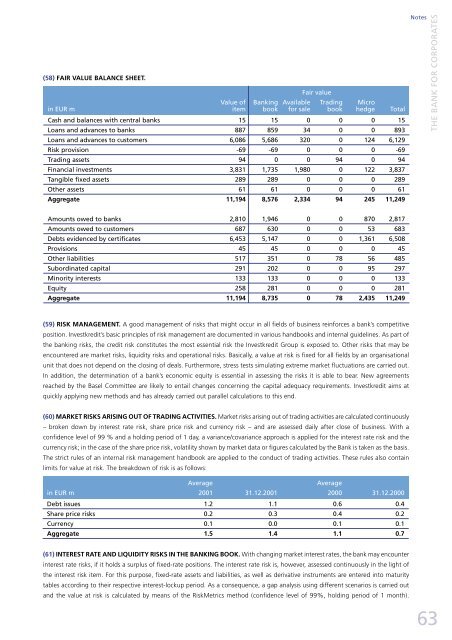

(58) FAIR VALUE BALANCE SHEET.<br />

Fair value<br />

Value of Banking Available Trading Micro<br />

in EUR m item book for sale book hedge Total<br />

Cash and balances with central banks 15 15 0 0 0 15<br />

Loans and advances to banks 887 859 34 0 0 893<br />

Loans and advances to customers 6,086 5,686 320 0 124 6,129<br />

Risk provision -69 -69 0 0 0 -69<br />

Trading assets 94 0 0 94 0 94<br />

Financial investments 3,831 1,735 1,980 0 122 3,837<br />

Tangible fixed assets 289 289 0 0 0 289<br />

Other assets 61 61 0 0 0 61<br />

Aggregate 11,194 8,576 2,334 94 245 11,249<br />

Amounts owed to banks 2,810 1,946 0 0 870 2,817<br />

Amounts owed to customers 687 630 0 0 53 683<br />

Debts evidenced by certificates 6,453 5,147 0 0 1,361 6,508<br />

Provisions 45 45 0 0 0 45<br />

Other liabilities 517 351 0 78 56 485<br />

Subordinated capital 291 202 0 0 95 297<br />

Minority interests 133 133 0 0 0 133<br />

Equity 258 281 0 0 0 281<br />

Aggregate 11,194 8,735 0 78 2,435 11,249<br />

(59) RISK MAN<strong>AG</strong>EMENT. A good management of risks that might occur in all fields of business reinforces a bank’s competitive<br />

position. Investkredit’s basic principles of risk management are documented in various handbooks and internal guidelines. As part of<br />

the banking risks, the credit risk constitutes the most essential risk the Investkredit Group is exposed to. Other risks that may be<br />

encountered are market risks, liquidity risks and operational risks. Basically, a value at risk is fixed for all fields by an organisational<br />

unit that does not depend on the closing of deals. Furthermore, stress tests simulating extreme market fluctuations are carried out.<br />

In addition, the determination of a bank’s economic equity is essential in assessing the risks it is able to bear. New agreements<br />

reached by the Basel Committee are likely to entail changes concerning the capital adequacy requirements. Investkredit aims at<br />

quickly applying new methods and has already carried out parallel calculations to this end.<br />

(60) MARKET RISKS ARISING OUT OF TRADING ACTIVITIES. Market risks arising out of trading activities are calculated continuously<br />

– broken down by interest rate risk, share price risk and currency risk – and are assessed daily after close of business. With a<br />

confidence level of 99 % and a holding period of 1 day, a variance/covariance approach is applied for the interest rate risk and the<br />

currency risk; in the case of the share price risk, volatility shown by market data or figures calculated by the Bank is taken as the basis.<br />

The strict rules of an internal risk management handbook are applied to the conduct of trading activities. These rules also contain<br />

limits for value at risk. The breakdown of risk is as follows:<br />

Average Average<br />

in EUR m 2001 31.12.2001 2000 31.12.2000<br />

Debt issues 1.2 1.1 0.6 0.4<br />

Share price risks 0.2 0.3 0.4 0.2<br />

Currency 0.1 0.0 0.1 0.1<br />

Aggregate 1.5 1.4 1.1 0.7<br />

(61) INTEREST RATE AND LIQUIDITY RISKS IN THE BANKING BOOK. With changing market interest rates, the bank may encounter<br />

interest rate risks, if it holds a surplus of fixed-rate positions. The interest rate risk is, however, assessed continuously in the light of<br />

the interest risk item. For this purpose, fixed-rate assets and liabilities, as well as derivative instruments are entered into maturity<br />

tables according to their respective interest-lockup period. As a consequence, a gap analysis using different scenarios is carried out<br />

and the value at risk is calculated by means of the RiskMetrics method (confidence level of 99%, holding period of 1 month).<br />

Notes<br />

THE BANK FOR CORPORATES<br />

63