Download - Volksbank AG

Download - Volksbank AG

Download - Volksbank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE BANK FOR CORPORATES<br />

28<br />

Corporates<br />

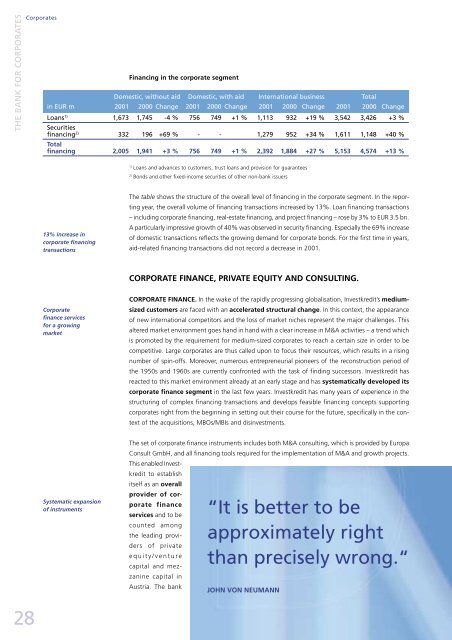

Financing in the corporate segment<br />

Domestic, without aid Domestic, with aid International business Total<br />

in EUR m 2001 2000 Change 2001 2000 Change 2001 2000 Change 2001 2000 Change<br />

Loans1) Securities<br />

1,673 1,745 -4 % 756 749 +1 % 1,113 932 +19 % 3,542 3,426 +3 %<br />

financing2) Total<br />

332 196 +69 % - - 1,279 952 +34 % 1,611 1,148 +40 %<br />

financing 2,005 1,941 +3 % 756 749 +1 % 2,392 1,884 +27 % 5,153 4,574 +13 %<br />

13% increase in<br />

corporate financing<br />

transactions<br />

Corporate<br />

finance services<br />

for a growing<br />

market<br />

1) Loans and advances to customers, trust loans and provision for guarantees<br />

2) Bonds and other fixed-income securities of other non-bank issuers<br />

The table shows the structure of the overall level of financing in the corporate segment. In the reporting<br />

year, the overall volume of financing transactions increased by 13%. Loan financing transactions<br />

– including corporate financing, real-estate financing, and project financing – rose by 3% to EUR 3.5 bn.<br />

A particularly impressive growth of 40% was observed in security financing. Especially the 69% increase<br />

of domestic transactions reflects the growing demand for corporate bonds. For the first time in years,<br />

aid-related financing transactions did not record a decrease in 2001.<br />

CORPORATE FINANCE, PRIVATE EQUITY AND CONSULTING.<br />

CORPORATE FINANCE. In the wake of the rapidly progressing globalisation, Investkredit’s mediumsized<br />

customers are faced with an accelerated structural change. In this context, the appearance<br />

of new international competitors and the loss of market niches represent the major challenges. This<br />

altered market environment goes hand in hand with a clear increase in M&A activities – a trend which<br />

is promoted by the requirement for medium-sized corporates to reach a certain size in order to be<br />

competitive. Large corporates are thus called upon to focus their resources, which results in a rising<br />

number of spin-offs. Moreover, numerous entrepreneurial pioneers of the reconstruction period of<br />

the 1950s and 1960s are currently confronted with the task of finding successors. Investkredit has<br />

reacted to this market environment already at an early stage and has systematically developed its<br />

corporate finance segment in the last few years. Investkredit has many years of experience in the<br />

structuring of complex financing transactions and develops feasible financing concepts supporting<br />

corporates right from the beginning in setting out their course for the future, specifically in the context<br />

of the acquisitions, MBOs/MBIs and disinvestments.<br />

The set of corporate finance instruments includes both M&A consulting, which is provided by Europa<br />

Consult GmbH, and all financing tools required for the implementation of M&A and growth projects.<br />

This enabled Investkredit<br />

to establish<br />

itself as an overall<br />

Systematic expansion<br />

of instruments<br />

provider of corporate<br />

finance<br />

services and to be “It is better to be<br />

counted among<br />

the leading provi- approximately right<br />

ders of private<br />

equity/venture<br />

capital and mezzanine<br />

capital in<br />

than precisely wrong.“<br />

Austria. The bank<br />

JOHN VON NEUMANN