Download - Volksbank AG

Download - Volksbank AG

Download - Volksbank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE BANK FOR CORPORATES<br />

24<br />

Corporates<br />

Dealing with<br />

corporates’ concerns<br />

New publications<br />

Workshops organised<br />

in the year under review<br />

Financing:<br />

facts & figures<br />

Investkredit as a<br />

financier for industry<br />

vative power and management help to ascertain the customer’s credit standing. The discussion of<br />

corporates’ self-assessment and their external assessment lends a new quality to customer relations.<br />

The spectrum of issues handled by Investkredit’s customer service officers is becoming more and more<br />

sophisticated. Long-term, open partnerships with customers provide the basis to discuss forwardlooking<br />

issues of corporate financing from a variety of perspectives at an early stage.<br />

Investkredit’s specialised publications, which support the know-how management of customers<br />

and employees alike, clearly illustrate the preparations made to address corporates’ concerns. In the<br />

year under review, Investkredit published the following financial information brochures:<br />

Interest-rate and currency management instruments – a financial information brochure provided<br />

by the Bank for Corporates<br />

The future of corporate financing in the euro area<br />

Securities financing for corporates – a vademecum for the bond market<br />

The business administration, management and technology experts as well as the lawyers at Investkredit<br />

are currently devising financing solutions which go beyond the bank’s day-to-day business. The structuring<br />

of financing is of major importance for the implementation of business projects. In this respect,<br />

clear responsibilities within the bank and fast decision-making procedures are among the factors<br />

underlying the success of Investkredit.<br />

In the year under review, various suggestions and ideas of our customers stimulated Investkredit to<br />

organise INVEST Workshops on the following topics:<br />

“Aid schemes for corporates in Upper Austria and Salzburg. Innovation – co-operation –<br />

projects“<br />

“Loans with treasury elements“<br />

“Change in ownership – a strategic approach for corporates“<br />

“Corporate pension schemes“<br />

“The future of corporate financing in the euro area. Markets – instruments – recommendations“<br />

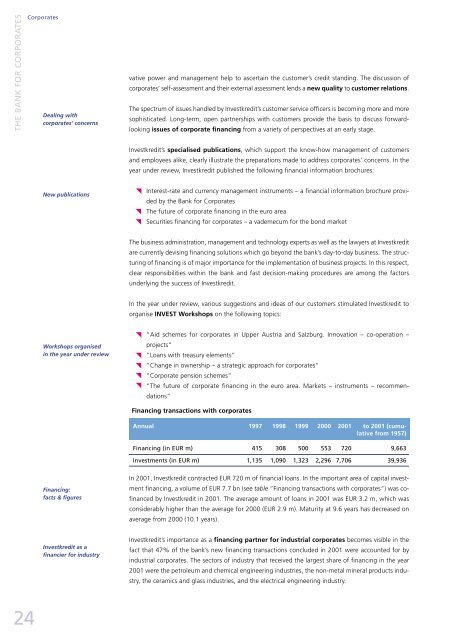

Financing transactions with corporates<br />

Annual 1997 1998 1999 2000 2001 to 2001 (cumulative<br />

from 1957)<br />

Financing (in EUR m) 415 308 500 553 720 9,663<br />

Investments (in EUR m) 1,135 1,090 1,323 2,296 7,706 39,936<br />

In 2001, Investkredit contracted EUR 720 m of financial loans. In the important area of capital investment<br />

financing, a volume of EUR 7.7 bn (see table “Financing transactions with corporates“) was cofinanced<br />

by Investkredit in 2001. The average amount of loans in 2001 was EUR 3.2 m, which was<br />

considerably higher than the average for 2000 (EUR 2.9 m). Maturity at 9.6 years has decreased on<br />

average from 2000 (10.1 years).<br />

Investkredit’s importance as a financing partner for industrial corporates becomes visible in the<br />

fact that 47% of the bank’s new financing transactions concluded in 2001 were accounted for by<br />

industrial corporates. The sectors of industry that received the largest share of financing in the year<br />

2001 were the petroleum and chemical engineering industries, the non-metal mineral products industry,<br />

the ceramics and glass industries, and the electrical engineering industry.