Download - Volksbank AG

Download - Volksbank AG

Download - Volksbank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

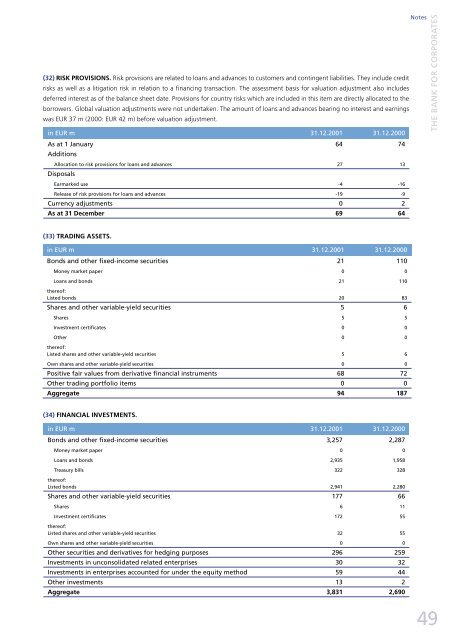

(32) RISK PROVISIONS. Risk provisions are related to loans and advances to customers and contingent liabilities. They include credit<br />

risks as well as a litigation risk in relation to a financing transaction. The assessment basis for valuation adjustment also includes<br />

deferred interest as of the balance sheet date. Provisions for country risks which are included in this item are directly allocated to the<br />

borrowers. Global valuation adjustments were not undertaken. The amount of loans and advances bearing no interest and earnings<br />

was EUR 37 m (2000: EUR 42 m) before valuation adjustment.<br />

in EUR m 31.12.2001 31.12.2000<br />

As at 1 January<br />

Additions<br />

64 74<br />

Allocation to risk provisions for loans and advances 27 13<br />

Disposals<br />

Earmarked use -4 -16<br />

Release of risk provisions for loans and advances -19 -9<br />

Currency adjustments 0 2<br />

As at 31 December 69 64<br />

(33) TRADING ASSETS.<br />

in EUR m 31.12.2001 31.12.2000<br />

Bonds and other fixed-income securities 21 110<br />

Money market paper 0 0<br />

Loans and bonds<br />

thereof:<br />

21 110<br />

Listed bonds 20 83<br />

Shares and other variable-yield securities 5 6<br />

Shares 5 5<br />

Investment certificates 0 0<br />

Other<br />

thereof:<br />

0 0<br />

Listed shares and other variable-yield securities 5 6<br />

Own shares and other variable-yield securities 0 0<br />

Positive fair values from derivative financial instruments 68 72<br />

Other trading portfolio items 0 0<br />

Aggregate 94 187<br />

(34) FINANCIAL INVESTMENTS.<br />

in EUR m 31.12.2001 31.12.2000<br />

Bonds and other fixed-income securities 3,257 2,287<br />

Money market paper 0 0<br />

Loans and bonds 2,935 1,958<br />

Treasury bills<br />

thereof:<br />

322 328<br />

Listed bonds 2,941 2,280<br />

Shares and other variable-yield securities 177 66<br />

Shares 6 11<br />

Investment certificates<br />

thereof:<br />

172 55<br />

Listed shares and other variable-yield securities 32 55<br />

Own shares and other variable-yield securities 0 0<br />

Other securities and derivatives for hedging purposes 296 259<br />

Investments in unconsolidated related enterprises 30 32<br />

Investments in enterprises accounted for under the equity method 59 44<br />

Other investments 13 2<br />

Aggregate 3,831 2,690<br />

Notes<br />

THE BANK FOR CORPORATES<br />

49