Download - Volksbank AG

Download - Volksbank AG

Download - Volksbank AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

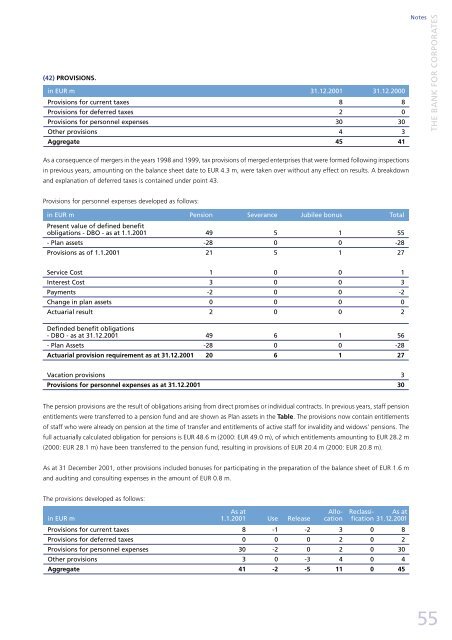

(42) PROVISIONS.<br />

in EUR m 31.12.2001 31.12.2000<br />

Provisions for current taxes 8 8<br />

Provisions for deferred taxes 2 0<br />

Provisions for personnel expenses 30 30<br />

Other provisions 4 3<br />

Aggregate 45 41<br />

As a consequence of mergers in the years 1998 and 1999, tax provisions of merged enterprises that were formed following inspections<br />

in previous years, amounting on the balance sheet date to EUR 4.3 m, were taken over without any effect on results. A breakdown<br />

and explanation of deferred taxes is contained under point 43.<br />

Provisions for personnel expenses developed as follows:<br />

in EUR m Pension Severance Jubilee bonus Total<br />

Present value of defined benefit<br />

obligations - DBO - as at 1.1.2001 49 5 1 55<br />

- Plan assets -28 0 0 -28<br />

Provisions as of 1.1.2001 21 5 1 27<br />

Service Cost 1 0 0 1<br />

Interest Cost 3 0 0 3<br />

Payments -2 0 0 -2<br />

Change in plan assets 0 0 0 0<br />

Actuarial result 2 0 0 2<br />

Definded benefit obligations<br />

- DBO - as at 31.12.2001 49 6 1 56<br />

- Plan Assets -28 0 0 -28<br />

Actuarial provision requirement as at 31.12.2001 20 6 1 27<br />

Vacation provisions 3<br />

Provisions for personnel expenses as at 31.12.2001 30<br />

The pension provisions are the result of obligations arising from direct promises or individual contracts. In previous years, staff pension<br />

entitlements were transferred to a pension fund and are shown as Plan assets in the Table. The provisions now contain entitlements<br />

of staff who were already on pension at the time of transfer and entitlements of active staff for invalidity and widows’ pensions. The<br />

full actuarially calculated obligation for pensions is EUR 48.6 m (2000: EUR 49.0 m), of which entitlements amounting to EUR 28.2 m<br />

(2000: EUR 28.1 m) have been transferred to the pension fund, resulting in provisions of EUR 20.4 m (2000: EUR 20.8 m).<br />

As at 31 December 2001, other provisions included bonuses for participating in the preparation of the balance sheet of EUR 1.6 m<br />

and auditing and consulting expenses in the amount of EUR 0.8 m.<br />

The provisions developed as follows:<br />

As at Allo- Reclassi- As at<br />

in EUR m 1.1.2001 Use Release cation fication 31.12.2001<br />

Provisions for current taxes 8 -1 -2 3 0 8<br />

Provisions for deferred taxes 0 0 0 2 0 2<br />

Provisions for personnel expenses 30 -2 0 2 0 30<br />

Other provisions 3 0 -3 4 0 4<br />

Aggregate 41 -2 -5 11 0 45<br />

Notes<br />

THE BANK FOR CORPORATES<br />

55