Download - Volksbank AG

Download - Volksbank AG

Download - Volksbank AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE BANK FOR CORPORATES<br />

18<br />

Management discussion<br />

Earnings per share<br />

reduced by higher taxes<br />

and minority interests<br />

Dynamic growth<br />

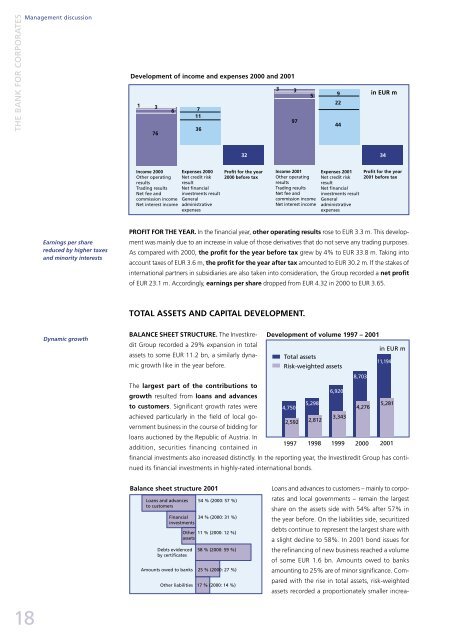

Development of income and expenses 2000 and 2001<br />

1<br />

3<br />

76<br />

6<br />

Income 2000<br />

Other operating<br />

results<br />

Trading results<br />

Net fee and<br />

commission income<br />

Net interest income<br />

7<br />

11<br />

36<br />

Expenses 2000<br />

Net credit risk<br />

result<br />

Net financial<br />

investments result<br />

General<br />

administrative<br />

expenses<br />

32<br />

Profit for the year<br />

2000 before tax<br />

3<br />

3<br />

97<br />

5<br />

Income 2001<br />

Other operating<br />

results<br />

Trading results<br />

Net fee and<br />

commission income<br />

Net interest income<br />

9<br />

22<br />

44<br />

Expenses 2001<br />

Net credit risk<br />

result<br />

Net financial<br />

investments result<br />

General<br />

administrative<br />

expenses<br />

Development of volume 1997 – 2001<br />

Total assets<br />

Risk-weighted assets<br />

8,703<br />

in EUR m<br />

34<br />

Profit for the year<br />

2001 before tax<br />

PROFIT FOR THE YEAR. In the financial year, other operating results rose to EUR 3.3 m. This development<br />

was mainly due to an increase in value of those derivatives that do not serve any trading purposes.<br />

As compared with 2000, the profit for the year before tax grew by 4% to EUR 33.8 m. Taking into<br />

account taxes of EUR 3.6 m, the profit for the year after tax amounted to EUR 30.2 m. If the stakes of<br />

international partners in subsidiaries are also taken into consideration, the Group recorded a net profit<br />

of EUR 23.1 m. Accordingly, earnings per share dropped from EUR 4.32 in 2000 to EUR 3.65.<br />

TOTAL ASSETS AND CAPITAL DEVELOPMENT.<br />

BALANCE SHEET STRUCTURE. The Investkredit<br />

Group recorded a 29% expansion in total<br />

assets to some EUR 11.2 bn, a similarly dynamic<br />

growth like in the year before.<br />

in EUR m<br />

The largest part of the contributions to<br />

growth resulted from loans and advances<br />

6,920<br />

to customers. Significant growth rates were 4,750<br />

5,298<br />

4,276<br />

5,281<br />

achieved particularly in the field of local government<br />

business in the course of bidding for<br />

2,592<br />

2,812<br />

3,343<br />

loans auctioned by the Republic of Austria. In<br />

addition, securities financing contained in<br />

1997 1998 1999 2000 2001<br />

financial investments also increased distinctly. In the reporting year, the Investkredit Group has continued<br />

its financial investments in highly-rated international bonds.<br />

Balance sheet structure 2001<br />

Loans and advances 54 % (2000: 57 %)<br />

to customers<br />

Financial 34 % (2000: 31 %)<br />

investments<br />

Other 11 % (2000: 12 %)<br />

assets<br />

Debts evidenced 58 % (2000: 59 %)<br />

by certificates<br />

Amounts owed to banks 25 % (2000: 27 %)<br />

Other liabilities 17 % (2000: 14 %)<br />

11,194<br />

Loans and advances to customers – mainly to corporates<br />

and local governments – remain the largest<br />

share on the assets side with 54% after 57% in<br />

the year before. On the liabilities side, securitized<br />

debts continue to represent the largest share with<br />

a slight decline to 58%. In 2001 bond issues for<br />

the refinancing of new business reached a volume<br />

of some EUR 1.6 bn. Amounts owed to banks<br />

amounting to 25% are of minor significance. Compared<br />

with the rise in total assets, risk-weighted<br />

assets recorded a proportionately smaller increa-