Download - Volksbank AG

Download - Volksbank AG

Download - Volksbank AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Management style<br />

allows for quick<br />

decisions<br />

Investkredit as<br />

quality leader<br />

among Austrian<br />

banks (TOP 2000)<br />

Difficult market<br />

environment due to<br />

simultaneous<br />

economic contraction<br />

in Europe, the USA<br />

and Japan<br />

Management discussion<br />

consistently seek appropriate combinations of risk and income profiles<br />

broaden and deepen customer relations by providing continuity, know-how and innovative<br />

approaches<br />

reach a sustainable increase in return on equity approaching the 15% mark<br />

further reduce the cost-income ratio to less than 40% by 2004.<br />

REALISATION OF STRATEGY. Investkredit’s management team meets on a monthly basis to discuss<br />

the ways and means for a proper realisation of strategy. In addition, an elaborate internal reporting<br />

system allows for fine-tuning existing measures, as well as for quickly adjusting strategy to<br />

changed market conditions. Open and transparent disclosure and reporting practice is one of the key<br />

principles of the Bank’s management style. Department heads meet with the members of the Board<br />

on a daily basis, thus enabling it to reach important business decisions within one day.<br />

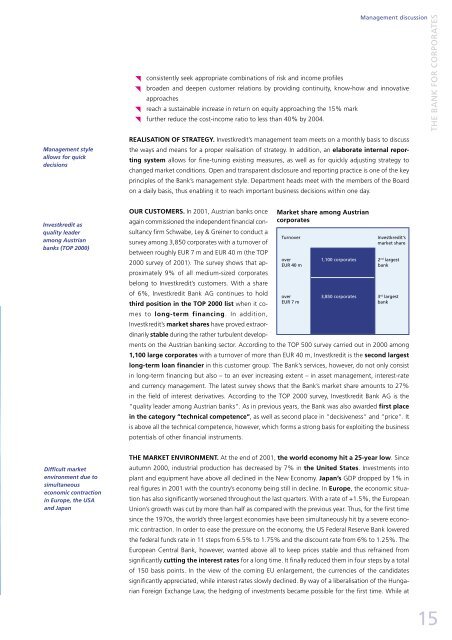

Market share among Austrian<br />

corporates<br />

Turnover<br />

Investkredit‘s<br />

market share<br />

over<br />

EUR 40 m<br />

2<br />

over<br />

EUR 7 m<br />

nd largest<br />

bank<br />

3rd OUR CUSTOMERS. In 2001, Austrian banks once<br />

again commissioned the independent financial consultancy<br />

firm Schwabe, Ley & Greiner to conduct a<br />

survey among 3,850 corporates with a turnover of<br />

between roughly EUR 7 m and EUR 40 m (the TOP<br />

2000 survey of 2001). The survey shows that approximately<br />

9% of all medium-sized corporates<br />

belong to Investkredit’s customers. With a share<br />

1,100 corporates<br />

of 6%, Investkredit Bank <strong>AG</strong> continues to hold<br />

3,850 corporates<br />

largest<br />

third position in the TOP 2000 list when it comes<br />

to long-term financing. In addition,<br />

Investkredit’s market shares have proved extraordinarily<br />

stable during the rather turbulent develop-<br />

bank<br />

ments on the Austrian banking sector. According to the TOP 500 survey carried out in 2000 among<br />

1,100 large corporates with a turnover of more than EUR 40 m, Investkredit is the second largest<br />

long-term loan financier in this customer group. The Bank’s services, however, do not only consist<br />

in long-term financing but also – to an ever increasing extent – in asset management, interest-rate<br />

and currency management. The latest survey shows that the Bank’s market share amounts to 27%<br />

in the field of interest derivatives. According to the TOP 2000 survey, Investkredit Bank <strong>AG</strong> is the<br />

“quality leader among Austrian banks“. As in previous years, the Bank was also awarded first place<br />

in the category “technical competence“, as well as second place in “decisiveness“ and “price“. It<br />

is above all the technical competence, however, which forms a strong basis for exploiting the business<br />

potentials of other financial instruments.<br />

THE MARKET ENVIRONMENT. At the end of 2001, the world economy hit a 25-year low. Since<br />

autumn 2000, industrial production has decreased by 7% in the United States. Investments into<br />

plant and equipment have above all declined in the New Economy. Japan’s GDP dropped by 1% in<br />

real figures in 2001 with the country’s economy being still in decline. In Europe, the economic situation<br />

has also significantly worsened throughout the last quarters. With a rate of +1.5%, the European<br />

Union’s growth was cut by more than half as compared with the previous year. Thus, for the first time<br />

since the 1970s, the world’s three largest economies have been simultaneously hit by a severe economic<br />

contraction. In order to ease the pressure on the economy, the US Federal Reserve Bank lowered<br />

the federal funds rate in 11 steps from 6.5% to 1.75% and the discount rate from 6% to 1.25%. The<br />

European Central Bank, however, wanted above all to keep prices stable and thus refrained from<br />

significantly cutting the interest rates for a long time. It finally reduced them in four steps by a total<br />

of 150 basis points. In the view of the coming EU enlargement, the currencies of the candidates<br />

significantly appreciated, while interest rates slowly declined. By way of a liberalisation of the Hungarian<br />

Foreign Exchange Law, the hedging of investments became possible for the first time. While at<br />

THE BANK FOR CORPORATES<br />

15