Download - Volksbank AG

Download - Volksbank AG

Download - Volksbank AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

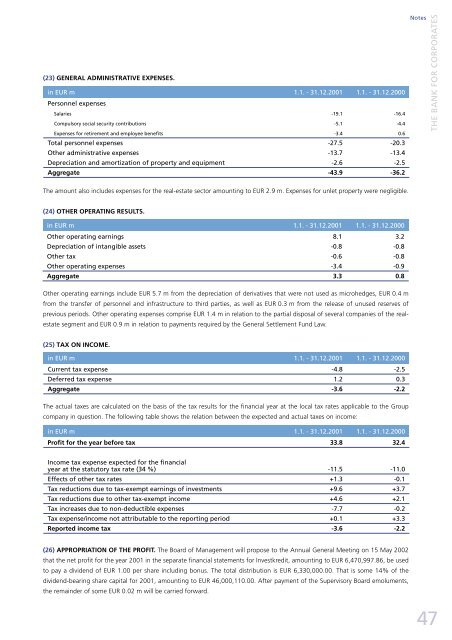

(23) GENERAL ADMINISTRATIVE EXPENSES.<br />

in EUR m 1.1. - 31.12.2001 1.1. - 31.12.2000<br />

Personnel expenses<br />

Salaries -19.1 -16.4<br />

Compulsory social security contributions -5.1 -4.4<br />

Expenses for retirement and employee benefits -3.4 0.6<br />

Total personnel expenses -27.5 -20.3<br />

Other administrative expenses -13.7 -13.4<br />

Depreciation and amortization of property and equipment -2.6 -2.5<br />

Aggregate -43.9 -36.2<br />

The amount also includes expenses for the real-estate sector amounting to EUR 2.9 m. Expenses for unlet property were negligible.<br />

(24) OTHER OPERATING RESULTS.<br />

in EUR m 1.1. - 31.12.2001 1.1. - 31.12.2000<br />

Other operating earnings 8.1 3.2<br />

Depreciation of intangible assets -0.8 -0.8<br />

Other tax -0.6 -0.8<br />

Other operating expenses -3.4 -0.9<br />

Aggregate 3.3 0.8<br />

Other operating earnings include EUR 5.7 m from the depreciation of derivatives that were not used as microhedges, EUR 0.4 m<br />

from the transfer of personnel and infrastructure to third parties, as well as EUR 0.3 m from the release of unused reserves of<br />

previous periods. Other operating expenses comprise EUR 1.4 m in relation to the partial disposal of several companies of the realestate<br />

segment and EUR 0.9 m in relation to payments required by the General Settlement Fund Law.<br />

(25) TAX ON INCOME.<br />

in EUR m 1.1. - 31.12.2001 1.1. - 31.12.2000<br />

Current tax expense -4.8 -2.5<br />

Deferred tax expense 1.2 0.3<br />

Aggregate -3.6 -2.2<br />

The actual taxes are calculated on the basis of the tax results for the financial year at the local tax rates applicable to the Group<br />

company in question. The following table shows the relation between the expected and actual taxes on income:<br />

in EUR m 1.1. - 31.12.2001 1.1. - 31.12.2000<br />

Profit for the year before tax 33.8 32.4<br />

Income tax expense expected for the financial<br />

year at the statutory tax rate (34 %) -11.5 -11.0<br />

Effects of other tax rates +1.3 -0.1<br />

Tax reductions due to tax-exempt earnings of investments +9.6 +3.7<br />

Tax reductions due to other tax-exempt income +4.6 +2.1<br />

Tax increases due to non-deductible expenses -7.7 -0.2<br />

Tax expense/income not attributable to the reporting period +0.1 +3.3<br />

Reported income tax -3.6 -2.2<br />

(26) APPROPRIATION OF THE PROFIT. The Board of Management will propose to the Annual General Meeting on 15 May 2002<br />

that the net profit for the year 2001 in the separate financial statements for Investkredit, amounting to EUR 6,470,997.86, be used<br />

to pay a dividend of EUR 1.00 per share including bonus. The total distribution is EUR 6,330,000.00. That is some 14% of the<br />

dividend-bearing share capital for 2001, amounting to EUR 46,000,110.00. After payment of the Supervisory Board emoluments,<br />

the remainder of some EUR 0.02 m will be carried forward.<br />

Notes<br />

THE BANK FOR CORPORATES<br />

47