You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

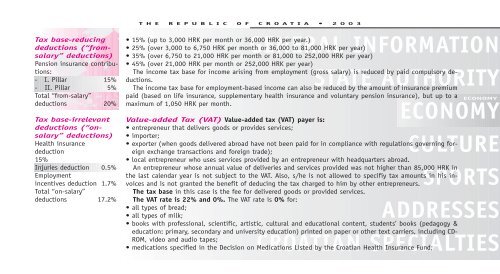

Tax base-reducing<br />

deductions (“fromsalary”<br />

deductions)<br />

Pension insurance contributions:<br />

- I. Pillar 15%<br />

- II. Pillar 5%<br />

Total “from-salary”<br />

deductions 20%<br />

Tax base-irrelevant<br />

deductions (“onsalary”<br />

deductions)<br />

Health insurance<br />

deduction<br />

15%<br />

Injuries deduction 0.5%<br />

Employment<br />

incentives deduction 1.7%<br />

Total “on-salary”<br />

deductions 17.2%<br />

THE REPUBLIC OF CROATIA • 2003<br />

GENERAL INFORMATION<br />

STATE AUTHORITY<br />

• 15% (up to 3,000 HRK per month or 36,000 HRK per year.)<br />

• 25% (over 3,000 to 6,750 HRK per month or 36,000 to 81,000 HRK per year)<br />

• 35% (over 6,750 to 21,000 HRK per month or 81,000 to 252,000 HRK per year)<br />

• 45% (over 21,000 HRK per month or 252,000 HRK per year)<br />

The income tax base for income arising from employment (gross salary) is reduced by paid compulsory deductions.<br />

The income tax base for employment-based income can also be reduced by the amount of insurance premium<br />

paid (based on life insurance, supplementary health insurance and voluntary pension insurance), but up to a<br />

maximum of 1,050 HRK per month.<br />

ECONOMY<br />

Value-added Tax (VAT) Value-added tax (VAT) payer is:<br />

• entrepreneur that delivers goods or provides services;<br />

• importer;<br />

• exporter (when goods delivered abroad have not been paid for in compliance with regulations governing for-<br />

eign exchange transactions and foreign trade);<br />

CULTURE<br />

SPORTS<br />

ADDRESSES<br />

CROATIAN SPECIALTIES<br />

• local entrepreneur who uses services provided by an entrepreneur with headquarters abroad.<br />

An entrepreneur whose annual value of deliveries and services provided was not higher than 85,000 HRK in<br />

the last calendar year is not subject to the VAT. Also, s/he is not allowed to specifiy tax amounts in his invoices<br />

and is not granted the benefit of deducing the tax charged to him by other entrepreneurs.<br />

The tax base in this case is the fee for delivered goods or provided services.<br />

The VAT rate is 22% and 0%. The VAT rate is 0% for:<br />

• all types of bread;<br />

• all types of milk;<br />

• books with professional, scientific, artistic, cultural and educational content, students’ books (pedagogy &<br />

education: primary, secondary and university education) printed on paper or other text carriers, including CD-<br />

ROM, video and audio tapes;<br />

• medications specified in the Decision on Medications Listed by the Croatian Health Insurance Fund;