You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

THE REPUBLIC OF CROATIA • 2003<br />

GENERAL INFORMATION<br />

STATE AUTHORITY<br />

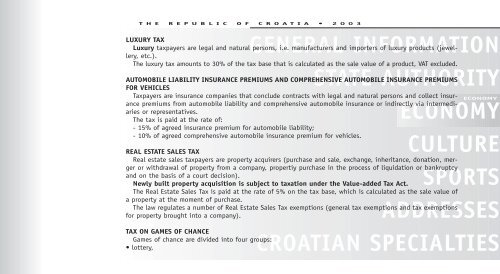

LUXURY TAX<br />

Luxury taxpayers are legal and natural persons, i.e. manufacturers and importers of luxury products (jewellery,<br />

etc.).<br />

The luxury tax amounts to 30% of the tax base that is calculated as the sale value of a product, VAT excluded.<br />

AUTOMOBILE LIABILITY INSURANCE PREMIUMS AND COMPREHENSIVE AUTOMOBILE INSURANCE PREMIUMS<br />

FOR VEHICLES<br />

Taxpayers are insurance companies that conclude contracts with legal and natural persons and collect insurance<br />

premiums from automobile liability and comprehensive automobile insurance or indirectly via intermediaries<br />

or representatives.<br />

The tax is paid at the rate of:<br />

- 15% of agreed insurance premium for automobile liability;<br />

- 10% of agreed comprehensive automobile insurance premium for vehicles.<br />

ECONOMY<br />

CULTURE<br />

SPORTS<br />

ADDRESSES<br />

CROATIAN SPECIALTIES<br />

REAL ESTATE SALES TAX<br />

Real estate sales taxpayers are property acquirers (purchase and sale, exchange, inheritance, donation, merger<br />

or withdrawal of property from a company, propertiy purchase in the process of liquidation or bankruptcy<br />

and on the basis of a court decision).<br />

Newly built property acquisition is subject to taxation under the Value-added Tax Act.<br />

The Real Estate Sales Tax is paid at the rate of 5% on the tax base, which is calculated as the sale value of<br />

a property at the moment of purchase.<br />

The law regulates a number of Real Estate Sales Tax exemptions (general tax exemptions and tax exemptions<br />

for property brought into a company).<br />

TAX ON GAMES OF CHANCE<br />

Games of chance are divided into four groups:<br />

• lottery,