Securitas AB Annual Report 2005

Securitas AB Annual Report 2005

Securitas AB Annual Report 2005

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

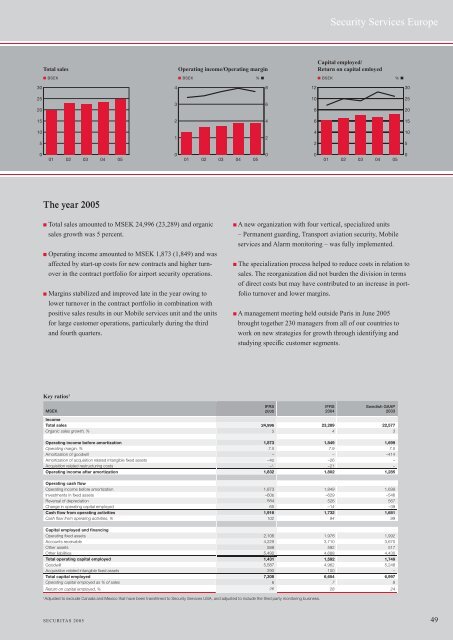

Total sales<br />

■ BSEK<br />

01 02 03 04 05<br />

The year <strong>2005</strong><br />

■ Total sales amounted to MSEK 24,996 (23,289) and organic<br />

sales growth was 5 percent.<br />

■ Operating income amounted to MSEK 1,873 (1,849) and was<br />

affected by start-up costs for new contracts and higher turnover<br />

in the contract portfolio for airport security operations.<br />

■ Margins stabilized and improved late in the year owing to<br />

lower turnover in the contract portfolio in combination with<br />

positive sales results in our Mobile services unit and the units<br />

for large customer operations, particularly during the third<br />

and fourth quarters.<br />

Key ratios 1<br />

MSEK<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Operating income/Operating margin<br />

■ BSEK % ■<br />

01 02 03 04 05<br />

Security Services Europe<br />

■ A new organization with four vertical, specialized units<br />

– Permanent guarding, Transport aviation security, Mobile<br />

services and Alarm monitoring – was fully implemented.<br />

■ The specialization process helped to reduce costs in relation to<br />

sales. The reorganization did not burden the division in terms<br />

of direct costs but may have contributed to an increase in portfolio<br />

turnover and lower margins.<br />

■ A management meeting held outside Paris in June <strong>2005</strong><br />

brought together 230 managers from all of our countries to<br />

work on new strategies for growth through identifying and<br />

studying specifi c customer segments.<br />

IFRS<br />

<strong>2005</strong><br />

IFRS<br />

2004<br />

Swedish GAAP<br />

2003<br />

Income<br />

Total sales 24,996<br />

23,289 22,577<br />

Organic sales growth, % 5<br />

4 3<br />

Operating income before amortization 1,873<br />

1,849 1,699<br />

Operating margin, % 7.5<br />

7.9 7.5<br />

Amortization of goodwill –<br />

– –414<br />

Amortization of acquisition related intangible fi xed assets –40<br />

–26 –<br />

Acquisition related restructuring costs –1<br />

–21 –<br />

Operating income after amortization 1,832<br />

1,802 1,285<br />

Operating cash fl ow<br />

Operating income before amortization 1,873<br />

1,849 1,699<br />

Investments in fi xed assets –606<br />

–629 –546<br />

Reversal of depreciation 584<br />

526 567<br />

Change in operating capital employed 65<br />

–14 –39<br />

Cash fl ow from operating activities 1,916<br />

1,732 1,681<br />

Cash fl ow from operating activities, % 102<br />

94 99<br />

Capital employed and fi nancing<br />

Operating fi xed assets 2,106<br />

1,978 1,992<br />

Accounts receivable 4,229<br />

3,710 3,670<br />

Other assets 588<br />

592 517<br />

Other liabilities 5,492<br />

4,688 4,430<br />

Total operating capital employed 1,431<br />

1,592 1,749<br />

Goodwill 5,587<br />

4,962 5,248<br />

Acquisition related intangible fi xed assets 290<br />

100 –<br />

Total capital employed 7,308<br />

6,654 6,997<br />

Operating capital employed as % of sales 6<br />

7 8<br />

Return on capital employed, % 26<br />

28 24<br />

1 Adjusted to exclude Canada and Mexico that have been transferred to Security Services USA, and adjusted to include the third party monitoring business.<br />

8<br />

6<br />

4<br />

2<br />

0<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Capital employed/<br />

Return on capital emloyed<br />

■ BSEK % ■<br />

01 02 03 04 05<br />

SECURITAS <strong>2005</strong> 49<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0