Securitas AB Annual Report 2005

Securitas AB Annual Report 2005

Securitas AB Annual Report 2005

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The Group – Risk management<br />

Risk management – a responsibility for everyone<br />

Managing risks on behalf of customers and <strong>Securitas</strong> is the core of our business.<br />

Operational risks are managed through a decentralized approach according to<br />

a four-step model. A structured process of delegating responsibility for risk<br />

management stretches from branch managers upward in the organization to<br />

Group Management and the Board of Directors.<br />

Background<br />

<strong>Securitas</strong> is exposed to various types of risks in the dayto-day<br />

running of its business. These risks fall into two<br />

main categories, operational risks and fi nancial risks.<br />

Both can affect the fi nancial performance and position<br />

of the Group if not managed in a structured way. Operational<br />

risks are associated with running the operations<br />

and providing services to customers, for example, when<br />

services do not meet the required standards and result in<br />

property damages or losses or bodily injury. Financial<br />

risks arise because the Group has external fi nancing<br />

needs and operates in a number of foreign currencies.<br />

To allow the divisions, countries and regions to fully<br />

focus on their operations, fi nancial risk management<br />

is centralized as far as possible to the Group Treasury<br />

Centre. For a further description of the management of<br />

fi nancial risks, refer to Note 5 page on 85 in the Group’s<br />

notes and comments.<br />

Organization<br />

As they arise in the local business operations, operational<br />

risks must be managed with a decentralized approach.<br />

Customer contract management and loss prevention are<br />

essential activities in this regard. Every branch manager<br />

in <strong>Securitas</strong> has to evaluate and understand the risks associated<br />

with providing services. The Group’s divisional<br />

Presidents are responsible for all aspects of operations<br />

in their respective divisions, including operational risk<br />

management and risk control. Claims settlement is a<br />

Group responsibility, as is the purchase of certain strategic<br />

insurance programs.<br />

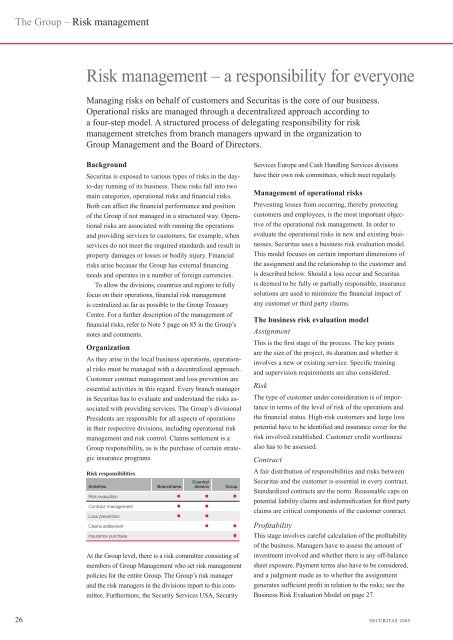

Risk responsibilities<br />

Activities Branch/area<br />

Country/<br />

division Group<br />

Risk evaluation ■ ■ ■<br />

Contract management ■ ■<br />

Loss prevention ■ ■<br />

Claims settlement ■ ■<br />

Insurance purchase<br />

At the Group level, there is a risk committee consisting of<br />

members of Group Management who set risk management<br />

policies for the entire Group. The Group’s risk manager<br />

and the risk managers in the divisions report to this committee.<br />

Furthermore, the Security Services USA, Security<br />

■<br />

Services Europe and Cash Handling Services divisions<br />

have their own risk committees, which meet regularly.<br />

Management of operational risks<br />

Preventing losses from occurring, thereby protecting<br />

customers and employees, is the most important objective<br />

of the operational risk management. In order to<br />

evaluate the operational risks in new and existing businesses,<br />

<strong>Securitas</strong> uses a business risk evaluation model.<br />

This model focuses on certain important dimensions of<br />

the assignment and the relationship to the customer and<br />

is described below. Should a loss occur and <strong>Securitas</strong><br />

is deemed to be fully or partially responsible, insurance<br />

solutions are used to minimize the fi nancial impact of<br />

any customer or third party claims.<br />

The business risk evaluation model<br />

Assignment<br />

This is the fi rst stage of the process. The key points<br />

are the size of the project, its duration and whether it<br />

involves a new or existing service. Specifi c training<br />

and supervision requirements are also considered.<br />

Risk<br />

The type of customer under consideration is of importance<br />

in terms of the level of risk of the operations and<br />

the fi nancial status. High-risk customers and large loss<br />

potential have to be identifi ed and insurance cover for the<br />

risk involved established. Customer credit worthiness<br />

also has to be assessed.<br />

Contract<br />

A fair distribution of responsibilities and risks between<br />

<strong>Securitas</strong> and the customer is essential in every contract.<br />

Standardized contracts are the norm. Reasonable caps on<br />

potential liability claims and indemnifi cation for third party<br />

claims are critical components of the customer contract.<br />

Profi tability<br />

This stage involves careful calculation of the profi tability<br />

of the business. Managers have to assess the amount of<br />

investment involved and whether there is any off-balance<br />

sheet exposure. Payment terms also have to be considered,<br />

and a judgment made as to whether the assignment<br />

generates suffi cient profi t in relation to the risks; see the<br />

Business Risk Evaluation Model on page 27.<br />

26 SECURITAS <strong>2005</strong>