Securitas AB Annual Report 2005

Securitas AB Annual Report 2005

Securitas AB Annual Report 2005

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

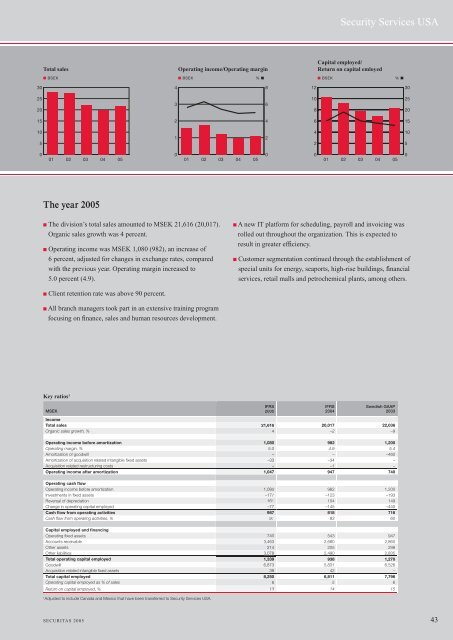

Total sales<br />

■ BSEK<br />

01 02 03 04 05<br />

The year <strong>2005</strong><br />

■ The division’s total sales amounted to MSEK 21,616 (20,017).<br />

Organic sales growth was 4 percent.<br />

■ Operating income was MSEK 1,080 (982), an increase of<br />

6 percent, adjusted for changes in exchange rates, compared<br />

with the previous year. Operating margin increased to<br />

5.0 percent (4.9).<br />

■ Client retention rate was above 90 percent.<br />

■ All branch managers took part in an extensive training program<br />

focusing on fi nance, sales and human resources development.<br />

Key ratios 1<br />

4<br />

3<br />

2<br />

1<br />

0<br />

Operating income/Operating margin<br />

■ BSEK % ■<br />

01 02 03 04 05<br />

8<br />

6<br />

4<br />

2<br />

0<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Security Services USA<br />

Capital employed/<br />

Return on capital emloyed<br />

■ BSEK % ■<br />

01 02 03 04 05<br />

■ A new IT platform for scheduling, payroll and invoicing was<br />

rolled out throughout the organization. This is expected to<br />

result in greater effi ciency.<br />

■ Customer segmentation continued through the establishment of<br />

special units for energy, seaports, high-rise buildings, fi nancial<br />

services, retail malls and petrochemical plants, among others.<br />

IFRS<br />

IFRS<br />

Swedish GAAP<br />

MSEK<br />

Income<br />

<strong>2005</strong><br />

2004<br />

2003<br />

Total sales 21,616<br />

20,017 22,036<br />

Organic sales growth, % 4<br />

–2 –9<br />

Operating income before amortization 1,080<br />

982 1,200<br />

Operating margin, % 5.0<br />

4.9 5.4<br />

Amortization of goodwill –<br />

– –460<br />

Amortization of acquisition related intangible fi xed assets –33<br />

–34 –<br />

Acquisition related restructuring costs –<br />

–1 –<br />

Operating income after amortization 1,047<br />

947 740<br />

Operating cash fl ow<br />

Operating income before amortization 1,080<br />

982 1,200<br />

Investments in fi xed assets –177<br />

–123 –193<br />

Reversal of depreciation 161<br />

104 149<br />

Change in operating capital employed –77<br />

–145 –440<br />

Cash fl ow from operating activities 987 987<br />

818 716<br />

Cash fl ow from operating activities, % 91<br />

83 60<br />

Capital employed and fi nancing<br />

Operating fi xed assets 740<br />

543 947<br />

Accounts receivable 3,463<br />

2,680 2,860<br />

Other assets 214<br />

205 298<br />

Other liabilities 3,078<br />

2,490 2,835<br />

Total operating capital employed 1,339<br />

938 1,270<br />

Goodwill 6,873<br />

5,831 6,526<br />

Acquisition related intangible fi xed assets 38<br />

42 –<br />

Total capital employed 8,250<br />

6,811 7,796<br />

Operating capital employed as % of sales 6<br />

5 6<br />

Return on capital employed, % 13<br />

14 15<br />

1 Adjusted to include Canada and Mexico that have been transferred to Security Services USA.<br />

SECURITAS <strong>2005</strong> 43<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0